FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

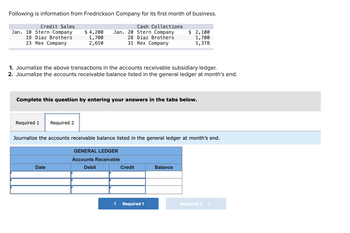

Transcribed Image Text:Following is information from Fredrickson Company for its first month of business.

Cash Collections

Jan. 20 Stern Company

28 Diaz Brothers

31 Rex Company

Credit Sales

Jan. 10 Stern Company

19 Diaz Brothers

23 Rex Company

$4,200

1,700

2,650

1. Journalize the above transactions in the accounts receivable subsidiary ledger.

2. Journalize the accounts receivable balance listed in the general ledger at month's end.

Required 1 Required 2

Complete this question by entering your answers in the tabs below.

Date

Journalize the accounts receivable balance listed in the general ledger at month's end.

GENERAL LEDGER

Accour Receivable

Debit

$ 2,100

1,700

1,378

Credit

< Required 1

Balance

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vail Company recorded the following transactions during November. Date General Journal November 5 Accounts Receivable-Ski Shop November 5 Sales November 10 Accounts Receivable-Welcome Incorporated 2,966 November 10 Sales November 13 Accounts Receivable-Zia Company November 13 Sales November 21 Sales Returns and Allowances November 21 Accounts Receivable-Zia Company November 30 Accounts Receivable-Ski Shop November 30 Sales Debit Credit 5,189 1,739 449 6,184 5,189 2,966 1,739 449 6,184 1. Post these entries to both the general ledger accounts and the accounts receivable ledger subsidiary ledger accounts. 2. Prepare a schedule of accounts receivable.arrow_forwardHarvest Company has the following December 31 General Ledger Account Balances after adjustments relating to Sales and Receivables: Sales $16,500 (of which 40% are credit sales still outstanding)Sales returns and Allowances $1,000Miscellaneous Receivables $1,212Allowance for Doubtful Accounts $1,502Long-term Receivables $9,014Advances to Shareholders and Directors $3,738 Notes Receivables $2,903 (Current Portion)Bad Debt Expense is estimated as 4% of credit sales. Required 1: Assuming no other transaction happened, what is the Bad Debt Expense reported on December 31st? Required 2: Assuming no other transaction happened, what is the adjusted net balance of all current Receivables at December 31st? Required 3: Assuming no other transaction happened, what is the adjusted net balance of Accounts Receivables at December 31st?arrow_forwardThe following information is available for Ellen's Fashions, Inc. for the current month. Book balance end of month $6,900 Outstanding checks 675 Deposits in transit 4,500 Service charges 105 Interest revenue 50 What is the adjusted book balance on the bank reconciliation? A. $6,845 B. $7,520 C. $10,570 D. $6745arrow_forward

- Zips Corp reports the following: Net Credit Sales 100,000 A/R Jan 1 10,000 ADA Jan 1 1,000 A/R Dec 31 15,000 ADA Dec 31 2,000 The average number of days until an account is collected is 36.5 O46 O40 O 30arrow_forwardThe following information is available for Ellen's Fashions, Inc. for the current month. Book balance end of month $6,900 Outstanding checks 675 Deposits in transit 4,500 Service charges 120 Interest revenue 35 What is the adjusted book balance on the bank reconciliation? A. $7,490 B. $6,745 C. $6,815 D. $10,570arrow_forwardThe following information is extracted from the books of Zone for the month of January: $ Credit purchases 100,258 Cash received from customers 110,568 Returns to suppliers 20,426 Irrecoverable debts written off 224 Receivable ledger balances 1 January 14,968 Payables ledger balances 1 January 54,010 Closing inventory 100,142 Credit sales 148,580 Returns from customers 2,508 Discounts allowed 1,824 Discounts received 864 Cash paid to suppliers 56,546 Required: Prepare the receivables ledger control account and the payables ledger control account for the month.arrow_forward

- XYZ Company has the following information: Beginning accounts receivable: $50,000 Ending accounts receivable: $60,000 Credit sales: $200,000 Cash collections: $180,000 Calculate the company's accounts receivable turnover ratio and average collection period.arrow_forwardMay 13: Paid the invoice of April 14. Date Description Debit Credit May 13 May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. Date Description Debit Credit May 17 June 2: Received a 60-day, 8% note for $180,000 on the Ryanair account. Date Description Debit Credit June 2arrow_forwardJournalizing Cash Receipts Enter the following transactions in a cash receipts journal: July 6 Daren Chesbrough made payment on account, $527. 10 Made cash sales for the week, $2,470. 14 Adam Casady made payment on account, $394. 15 Yue Zou made payment on account, $203. 17 Made cash sales for the week, $2,360.arrow_forward

- Hanshabenarrow_forwardhelparrow_forwardCurrent Attempt in Progress Manuel Company had cash sales of $86,800 (including taxes) for the month of June. Sales are subject to 8.50% sales tax. Prepare the entry to record the sales. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education