FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Help with T-accounts?

Cascade Company has four employees. All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31.

The accounts kept by Cascade include the following:

| Account Number |

Title |

Balance on June 1 |

| 101 | Cash | $67,600 |

| 211 | Employee Federal Income Tax Payable | 3,560 |

| 212 | Social Security Tax Payable | 5,119 |

| 213 | Medicare Tax Payable | 1,195 |

| 218 | Savings Bond Deductions Payable | 1,275 |

| 221 | FUTA Tax Payable | 568 |

| 222 | SUTA Tax Payable | 3,834 |

| 511 | Wages and Salaries Expense | 0 |

| 530 | Payroll Taxes Expense | 0 |

The following transactions relating to payrolls and payroll taxes occurred during June and July:

| June 15 | Paid $9,874 covering the following May taxes: | ||

| Social Security tax | $5,119 | ||

| Medicare tax | 1,195 | ||

| Employee federal income tax withheld | 3,560 | ||

| Total | $9,874 | ||

| 30 | June payroll: | ||

| Total wages and salaries expense | $46,000 | ||

| Less amounts withheld: | |||

| Social Security tax | $2,852 | ||

| Medicare tax | 667 | ||

| Employee federal income tax | 3,910 | ||

| Savings bond deductions | 1,275 | 8,704 | |

| Net amount paid | $37,296 | ||

| 30 | Purchased savings bonds for employees, $2,550 | ||

| 30 | Employer payroll taxes expenses for June were: | ||

| Social Security | $2,852 | ||

| Medicare | 667 | ||

| FUTA | 92 | ||

| SUTA | 621 | ||

| Total | $4,232 | ||

| July 15 | Paid $10,948 covering the following June taxes: | ||

| Social Security tax | $5,704 | ||

| Medicare tax | 1,334 | ||

| Employee federal income tax withheld | 3,910 | ||

| Total | $10,948 | ||

| 31 | Paid SUTA tax for the quarter, $4,455 | ||

| 31 | Paid FUTA tax, $660 |

Transcribed Image Text:Cash

101

Employee Federal Income Tax Payable

211

dropdown

Social Security Tax Payable

212

Medicare Tax Payable

213

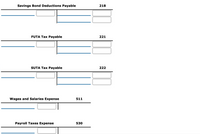

Transcribed Image Text:Savings Bond Deductions Payable

218

FUTA Tax Payable

221

SUTA Tax Payable

222

Wages and Salaries Expense

511

Payroll Taxes Expense

530

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Step by step solutionarrow_forwardnaruarrow_forwardPayroll Accounts and Year-End Entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable — 212 Social Security Tax Payable $17,898 213 Medicare Tax Payable 4,710 214 Employees Federal Income Tax Payable 29,045 215 Employees State Income Tax Payable 28,260 216 State Unemployment Tax Payable 2,983 217 Federal Unemployment Tax Payable 942 218 U.S. Saving Bond Deductions Payable 7,000 219 Medical Insurance Payable 54,600 411 Operations Salaries Expense 1,901,000 511 Officers Salaries Expense 1,240,000 512 Office Salaries Expense 316,000 519 Payroll Tax Expense 270,040 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $7,000 to Jay Bank to purchase U.S. savings bonds for employees. Dec. 2 Issued Check No. 411 to Jay Bank for $51,653 in payment of $17,898 of social security…arrow_forward

- Journalize the following data taken from the payroll register of CopyMasters as of April 15, 20—. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. Regular earnings $ 5,715.00 Overtime earnings 790.00 Deductions: Federal income tax 625.00 Social Security tax 403.31 Medicare tax 94.32 Pension plan 80.00 Health insurance premiums 270.00 United Way contributions 100.00 Journalize the following data taken from the payroll register of CopyMasters as of April 15, 20—. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. Page: DATE ACCOUNT TITLE DOC. NO. POST. REF. DEBIT CREDIT 1 20-- Apr. 15 Wages and salaries expense 1 2 Employee federal income tax payable 625 2 3 Social Security tax payable 403.31 3 4 Medicare tax payable 94.32 4 5…arrow_forwardAccountingarrow_forwardThe following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: On page 10 of the journal: Dec. Salary distribution: Officers Operations Office Deductions: Social security tax Medicare tax 2 Issued Check No. 410 for $3,400 to Jay Bank to purchase U.S. savings bonds for employees. Issued Check No. 411 to Jay Bank for $27,012 in payment of $9,280 of social security tax, $2,302 of Medicare tax, and $15,430 of employees' federal income tax due. 2 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Federal income tax withhold 13 State income tax withheld Savings bond deductions 13 13 Net amount 16 19 On page 11 of the journal: Officers Medical insurance deductions 3,700 29,464 $45,736 Operations Office Salary distribution: Deductions: Social security tax Medicare tax 27 27 $42,400 Dec. 27 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Net amount 27…arrow_forward

- Journalizing Payroll Transactions 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. 2. Record the journal entry for the payroll, crediting Cash for the net pay. When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. On December 31, the payroll register of Hamstreet Associates indicated the following information: Wages and Salaries Expense $7,900 Employee Federal Income Tax Payable 900 United Way Contributions Payable 190 Earnings subject to Social Security tax 7,200 Payroll Withholdings 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. Social Security Tax $fill in the blank 6752ad03b03cf89_1 Medicare Tax $fill in the blank 6752ad03b03cf89_2 General Journal 2. Record the journal entry for the payroll,…arrow_forwardXYZ Company is processing payroll for the week ending January 9th. Employee earnings total $5,000. Federal income tax withheld from employee paychecks totaled $1,100. The social security tax rate is 6%, the Medicare tax rate is 1.5%, the state unemployment tax rate is 5.4% and the federal unemployment tax rate is .8%. a) Journalize the payroll entry for the week. DATE Debit Credit X/X b) Journalize the payroll tax entry for the week. DATE Debit Credit X/Xarrow_forward2. Below is the payroll register for Akai company's September 30, 2024, weekly payroll: Deductions Gross Employee Federal Income Marital Tax Status Earnings Withheld Social State Tax Withheld Security Medicare Tax Withheld Tax Medical Insurance Withheld Dental Insurance Withheld Withheld Net Pay a. Akai, J. Single $1,200.00 $168.00 $96.00 $74.40 $17.40 $80.00 $20.00 $744.20 b. Green, W. Single 840.00 117.60 67.20 52.08 12.18 80.00 20.00 490.94 c. Hernandez, L. Married 1,280.00 128.00 102.40 79.36 18.56 125.00 30.00 796.68 d. Vang, G. Married 1,100.00 110.00 88.00 68.20 15.95 125.00 30.00 662.85 e. Hurst, A. Married 680.00 68.00 54.40 42.16 9.86 125.00 30.00 350.58 Totals $5,100.00 $591.60 $408.00 $316.20 $73.95 $535.00 $130.00 $3,045.25 A. Based on the information in the September 30, 2024, payroll register, and the list of general ledger accounts below, record the payroll journal entry below DATE 20-- Sept. 30 GENERAL JOURNAL PAGE DESCRIPTION DOC. NO. POST. REF. DEBIT CREDIT General…arrow_forward

- On the printed "Worksheet" page, journalize the transactions the information from the "Transactions" page.arrow_forwardFeb. 26 The company paid cash to Lyn Addie for eight days’ work at $125 per day. Mar. 25 The company sold merchandise with a $2,002 cost for $2,800 on credit to Wildcat Services, invoice dated March 25. Required 1. Assume that Lyn Addie is an unmarried employee. Her $1,000 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $159. Compute her net pay for the eight days’ work paid on February 26. Round amounts to the nearest cent. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). Round amounts to the nearest cent. 4. Record the entry(ies) for the merchandise sold on March 25 if a 4% sales tax rate…arrow_forwardThe following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable 212 Social Security Tax Payable 213 Medicare Tax Payable 214 Employees Federal Income Tax Payable 215 Employees State Income Tax Payable 216 State Unemployment Tax Payable 217 Federal Unemployment Tax Payable 218 Retirement Savings Deductions Payable $ 9,273 $ 3,400 219 Medical Insurance Payable 411 Operations Salaries Expense 511 Officers Salaries Expense 512 Office Salaries Expense 519 Payroll Tax Expense 27,000 2,318 15,455 950,000 13,909 600,000 1,400 150,000 500 137,951 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2. Issued Check No. 410 for $3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for $27,046, in payment of $9,273 of social secu- rity tax, $2,318 of Medicare tax, and $15,455 of employees' federal…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education