FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

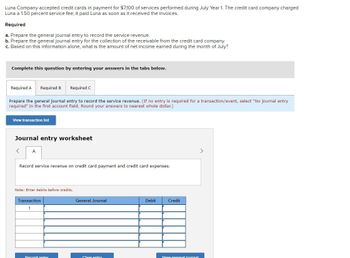

Transcribed Image Text:Luna Company accepted credit cards in payment for $7,100 of services performed during July Year 1. The credit card company charged

Luna a 1.50 percent service fee; it paid Luna as soon as it received the invoices.

Required

a. Prepare the general journal entry to record the service revenue.

b. Prepare the general journal entry for the collection of the receivable from the credit card company.

c. Based on this information alone, what is the amount of net income earned during the month of July?

Complete this question by entering your answers in the tabs below.

Required A Required B

Required C

Prepare the general journal entry to record the service revenue. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field. Round your answers to nearest whole dollar.)

View transaction list

Journal entry worksheet

<

A

Record service revenue on credit card payment and credit card expenses.

Note: Enter debits before credits.

Transaction

1

General Journal

Debit

Credit

Record entry

Clear entry

View general inurnal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide Answerarrow_forwardCero company collected an account receivable from a customer whose account has been written off in the previous year. The net effect of the entry made by Ceroarrow_forwardThe following information is available for Market, Incorporated and Supply, Incorporated at December 31. Accounts Market, Incorporated Supply, Incorporated Accounts receivable $59,800 $77,800 Allowance for doubtful accounts 2,548 2,956 Sales revenue 616,960 907,100 Required What is the accounts receivable turnover for each of the companies? What is the average days to collect the receivables? Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each company? What is the accounts receivable turnover for each of the companies? (Round your answers to 1 decimal place.) Company Accounts Receivable Turnover Market times Supply times What is the average days to collect the receivables? (Use 365 days in a year. Do not round intermediate calculations. Round your answers to the nearest whole number.)…arrow_forward

- A small retailer allows customers to use two different credit cards in charging purchases. The CC Bank Card assesses a 4.6% service charge for credit card sales. The VIZA Card assesses a 3.8% charge on sales for using its card. This retailer also has its own store credit card. As of Feb 28 month-end, the retailer earned $65 in net interest revenue on its own card. Prepare journal entries to record the following selected credit card transactions. Feb. 2 Sold merchandise for $3,000 (that had cost $1800) and accepted the customer’s CC Bank Card. Feb. 6 Sold merchandise for $2200 (that had cost $1500) and accepted the customer’s VIZA Card. Feb 28 Recognized the $65 interest revenue earned on its store credit card for January.arrow_forwardRecord the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forward9. Which of the following is recorded upon receipt of a payment on April 7, 2021, by a customer who pays a $900 invoice dated March 3, 2021, with terms 2/10, n/60? A. Debit Sales Discounts $18. B. Credit Purchase Discounts $18. C. Credit Accounts Receivable $882. D. Debit Cash $900.arrow_forward

- 1. On September 1, 2021, Lily Company had an initial accounts receivable control account balance of $72,000. The subsidiary ledger contains 3 accounts: Jasmine Company, balance $25,200; Sunflower Company, balance $14,400; and Orchid Company. The following were information regarding Lily Company's accounts receivable during September. Purchases Payments Returns Jasmine Company $57,500 $50,000 $2,000 Sunflower Company $82,000 $32,800 $ - Orchid Company $43,700 $52,000 $ - Instructions: What was the September 1 balance in the Orchid Company subsidiary account? b. What was the September 30 balance in the control account? c. Compute the balance in the subsidiary accounts at the end of the month! d. Which September transaction would not be recorded in the four common types of the special journal?arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education