EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

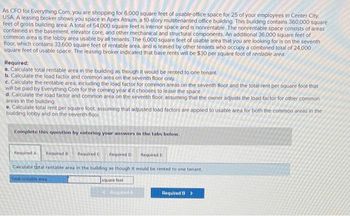

Transcribed Image Text:As CFO for Everything.Com, you are shopping for 6,000 square feet of usable office space for 25 of your employees in Center City,

USA. A leasing broker shows you space in Apex Atrium, a 10-story multitenanted office building. This building contains 360,000 square

feet of gross building area. A total of 54,000 square feet is interior space and is nonrentable. The nonrentable space consists of areas

contained in the basement, elevator core, and other mechanical and structural components. An additional 36,000 square feet of

common area is the lobby area usable by all tenants. The 6,000 square feet of usable area that you are looking for is on the seventh

floor, which contains 33,600 square feet of rentable area, and is leased by other tenants who occupy a combined total of 24,000

square feet of usable space. The leasing broker indicated that base rents will be $30 per square foot of rentable area

Required:

a. Calculate total rentable area in the building as though it would be rented to one tenant

b. Calculate the load factor and common area on the seventh floor only.

c. Calculate the rentable area, including the load factor for common areas on the seventh floor and the total rent per square foot that

will be paid by Everything Com for the coming year if it chooses to lease the space

d. Calculate the load factor and common area on the seventh floor, assuming that the owner adjusts the load factor for other common

areas in the building

e. Calculate total rent per square foot, assuming that adjusted load factors are applied to usable area for both the common areas in the

building lobby and on the seventh floor.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C Required D

Required E

Calculate total rentable area in the building as though it would be rented to one tenant.

Total rentable area

square feet

Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- s CFO for Everything.Com, you are shopping for 6,800 square feet of usable office space for 25 of your employees in Center City, USA. A leasing broker shows you space in Apex Atrium, a 10-story multitenanted office building. This building contains 408,000 square feet of gross building area. A total of 61,200 square feet is interior space and is nonrentable. The nonrentable space consists of areas contained in the basement, elevator core, and other mechanical and structural components. An additional 40,800 square feet of common area is the lobby area usable by all tenants. The 6,800 square feet of usable area that you are looking for is on the seventh floor, which contains 38,080 square feet of rentable area, and is leased by other tenants who occupy a combined total of 27,200 square feet of usable space. The leasing broker indicated that base rents will be $30 per square foot of rentable area. Required: a. Calculate total rentable area in the building as though it would be rented to…arrow_forwardA company rents a building with a total of 80,000 square feet, which are evenly divided between two floors. The total monthly rent for the building is $75,000. The company allocates $50,000 of total rent expense to the first floor and $25,000 of total rent expense to the second floor. How much of the monthly rental expense should be allocated to a department that occupies 16,000 square feet on the first floor?arrow_forwardRefer to the following paragraph for answering the next 2 questions (i.e., Q2-3). A small warehouse has 100,000 square feet of capacity. The manager at the warehouse is in the process of signing contracts for storage space with customers. The contract has an upfront monthly fee of $200 per customer and then a fee of $3 per square foot based on actual usage. The warehouse guarantees the contracted amount even if it has to arrange for extra space at a price of $6 per square foot. The manager believes that customers are unlikely to use the full contracted amount at all times. Thus, he is thinking of signing contracts that exceed 100,000 square feet. He forecasts that unused space will be normally distributed, with a mean of 20,000 square feet and a standard deviation of 10,000 square feet. Q2. What is the TOTAL size of the contracts he should sign? 120,000 O140,000 160,000 180,000arrow_forward

- Better Finance (previously Bill Float), based in San Francisco, California, provides leasing and credit solutions to consumers and smal businesses. If Better Finance wants to distribute $41,000 worth of overhead by sales. $ 4,960, 900 4, 960, 800 New customer sales (NCS) Current customer new sales (CCNS) Current customer loan extension sales (CCLES) 2,480, 000 $12, 400, 000 Calculate the overhead expense for each department. Overhead expense New customer sales Current customer new sales Current customer loan extension salesarrow_forwardHarmon’s has several departments that occupy all floors of a two-story building that includes a basement floor. Harmon rented this building under a long-term lease negotiated when rental rates were low. The departmental accounting system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded in this account for the current period follow. Building rent . $400,000 Lighting expense . 25,000 Cleaning expense 40,000 Total occupancy cost . $465,000 The building has 7,500 square feet on each of the upper two floors but only 5,000 square feet in the basement. In prior periods, the accounting manager merely divided the $465,000 occupancy cost by 20,000 square feet to find an average cost of $23.25 per square foot and then charged each department a building occupancy cost equal to this rate times the number of square feet that it occupies. Jordan Style manages a department that occupies 2,000 square feet of basement floor space. In…arrow_forwardNeed help please not use aiarrow_forward

- A retailer pays $150,000 rent each year for its two-story building. Space in this building is occupied by five departments as shown here. Department Jewelry Cosmetics Department Housewares Tools Shoes First Floor Jewelry Department Cosmetics Department Totals The company allocates $97,500 of total rent expense to the first floor and $52,500 to the second floor. It then allocates rent expense for each floor to the departments on that floor based on square feet occupied. Determine the rent expense to be allocated to each department. Second Floor Housewares Department Square feet occupied 1,610 (first-floor) 2,990 (first-floor) Tools Department Shoes Department Totals Square feet occupied 2,070 (second-floor) 828 (second-floor 1,702 (second-floor) Square Feet 1.610 INN 2,990 14,600 Square Feet (1 2,070 828 1,702 14.600 Percent of Total % % HIIH 0% Percent of Total LLL % % % 0 % 201 Cost Allocated $ Cost Allocated 51 2012 277arrow_forwardA retailer pays $140,000 rent each year for its two-story building. Space in this building is occupied by five departments as shown here. Department Jewelry Cosmetics Department Housewares Tools Shoes First Floor Jewelry Department Cosmetics Department Totals The company allocates $84,000 of total rent expense to the first floor and $56,000 to the second floor. It then allocates rent expense for each floor to the departments on that floor based on square feet occupied. Determine the rent expense to be allocated to each department. Second Floor Housewares Department Square feet occupied 1,610 (first-floor) 2,990 (first-floor) Tools Department Shoes Department Totals Square feet occupied 1,932 (second-floor) 690 (second-floor) 1,978 (second-floor) Square Feet Square Feet 0 0 Percent of Total % % 0% Percent of Total % % 0 % Cost Allocated $ Cost Allocated $ 0 0arrow_forwardAmerican Investor Group is opening an office in Portland, Oregon. Fixed monthly costs are office rent ($8,800), depreciation on office furniture ($1,800), utilities ($2,500), special telephone lines ($1,500), a connection with an online brokerage service ($2,400), and the salary of a financial planner ($4,000). Variable costs include payments to the financial planner (9% of revenue), advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone lines and computerized brokerage service (6% of revenue). Read the requirements. Requirement 1. Use the contribution margin ratio approach to compute American's breakeven revenue in dollars. If the average trade leads to $750 in revenue for American, how many trades must be made to break even? Begin by showing the formula and then entering the amounts to calculate the required sales dollars for American to break even. (Abbreviation used: CM = contribution margin.) Fixed costs Target profit ) + CM ratio =…arrow_forward

- WV Construction has two divisions: Remodeling and New Home Construction. Each division has an on-site supervisor who is paid a salary of $82,000 annually and one salaried estimator who is paid $46,000 annually. The corporate office has two office administrative assistants who are paid salaries of $50,000 and $37,000 annually. The president's salary is $153,000. How much of these salaries are common fixed expenses?arrow_forwardwV Construction has two divisions: Remodeling and New Home Construction. Each division has an on-site supervisor who is paid a salary of $98,000 annually and one salaried estimator who is paid $54,000 annually. The corporate office has two office administrative assistants who are paid salaries of $58,000 and $41,000 annually. The president's salary is $165,000. How much of these salaries are common fixed expenses? Multiple Cholce $165,000 $264,000 399,000 $348,000 11:2 92 F AQI 61 9/24 pe here to search DELLarrow_forwardB-You is a consulting firm that works with managers to improve their interpersonal skills. Recently, a representative of a high-tech research firm approached B-You's owner with an offer to contract for one year with B-You to improve the interpersonal skills of a newly hired manager. B-You reported the following costs and revenues during the past year. B-YOU Annual Income Statement Sales revenue $ 234,300 Costs Labor 111,000 Equipment lease 16,000 Rent 13,500 Supplies 10,300 Officers' salaries 70,000 Other costs 7,000 Total costs $ 227,800 Operating profit (loss) $ 6,500 If B-You decides to take the contract to help the manager, it will hire a full-time consultant at $84,000. Equipment lease will increase by 5 percent. Supplies will increase by an estimated 10 percent and other costs by 15 percent. The existing building has space for the new consultant. No new offices will be necessary for this work. Problem 1-44 (Algo) Part a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College