Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

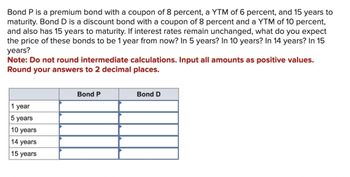

Transcribed Image Text:Bond P is a premium bond with a coupon of 8 percent, a YTM of 6 percent, and 15 years to

maturity. Bond D is a discount bond with a coupon of 8 percent and a YTM of 10 percent,

and also has 15 years to maturity. If interest rates remain unchanged, what do you expect

the price of these bonds to be 1 year from now? In 5 years? In 10 years? In 14 years? In 15

years?

Note: Do not round intermediate calculations. Input all amounts as positive values.

Round your answers to 2 decimal places.

1 year

5 years

10 years

14 years

15 years

Bond P

Bond D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What would be the value of the bond described in Part d if, just after it had been issued, the expected inflation rate rose by 3 percentage points, causing investors to require a 13% return? Would we now have a discount or a premium bond? What would happen to the bond’s value if inflation fell and rd declined to 7%? Would we now have a premium or a discount bond? What would happen to the value of the 10-year bond over time if the required rate of return remained at 13%? If it remained at 7%? (Hint: With a financial calculator, enter PMT, I/YR, FV, and N, and then change N to see what happens to the PV as the bond approaches maturity.)arrow_forwardSuppose a 10-year, 10% semiannual coupon bond with a par value of 1,000 is currently selling for 1,135.90, producing a nominal yield to maturity of 8%. However, the bond can be called after 5 years for a price of 1,050. (1) What is the bonds nominal yield to call (YTC)? (2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?arrow_forwardNikularrow_forward

- Bond X is a premium bond making annual payments. The bond pays a 9% coupon, has a YTM of 7%, and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 7% coupon, has a YTM of 9% and also has 13 years to maturity. If interest rates remain unchanged, what do you expect the price of these bonds to be one year from now? In three years? In eight years? In 12 years? In 13 years? (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) Time to maturity One year Three years Eight years 12 years 13 years Price of Bond X $ Price of Bond Y $ $ $ $arrow_forwardRaghubhaiarrow_forwardAssume a bond with a 10% annual rate has 8 years left to maturity when market rates are at 12%. Assume semi-annual payments. What is the price of the bond at 3 different points in time - today, in 1 year, and in 2 years. Is this a discount or premium bond, and what do you notice about the relationship between the price and maturity value (FV) over time?arrow_forward

- Bond P is a premium bond with a coupon rate of 8 percent. Bond D is a discount bond with a coupon rate of 3 percent and is currently selling at a discount. Both bonds make annual payments, have a YTM of 5 percent, and have eight years to maturity.1. What is the current yield for bond P and D?2. If interest rates remain unchanged, what is the expected capital gains yield over the next year for bond P and bond D?arrow_forwardSuppose you can observe that 1-year bond interest rate is 4%, 2-year bond interest rate is 8%, and 3-year bond interest rate is 10% at time t. It is also known that the term premium on a 2-year bond is 1% and the term premium on a 3-year bond is 1.5%. a) What are the market's expected 1-year bond interest rates for the next two years from time t? b) How to interpret those expected short-term interest rates? (what would be the "possible" economic meanings in the expected short- term interest rates?) Discuss as least two "candidates" to explain them.arrow_forwardBond A has an 8% annual coupon, Bond B has a 10% annual coupon, and Bond C has a 12% annual coupon. Each of the bonds has a maturity of 10 years and a yeild to maturity of 10%. If the market interest rates remain at 10% waht will happen to the bonds' prices one year from now? What will happen to the bonds' price if the market interest rates increase? Explain.arrow_forward

- Consider a bond with a duration of 8.8 years priced at $1,100. If market interest rates were to increase by 0.25%, what would be the predicted new bond price according to duration?arrow_forwardBond X is a premium bon making annual payments. The bond pays 8% coupon, has YTM of 6% and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 6% coupon, has an YTM of 8% and also has 13 years to maturity. The nominal value of both bonds is £1,000. What are the prices of these bonds today? If interest rates remain unchanged, what do you expect the prices of these bonds to be in one year? In three years? In eight years? In twelve, thirteen years? What is going on here? Illustrate your answers by graphing bond prices versus time to maturity.arrow_forwardThe YTM on a bond is the interest rate you earn on your investment if interest rates don't change. If you actually sell the bond before it matures, your realized return is known as the holding period yield (HPY). (Round the final answers to 2 decimal places.) a. Suppose that today you buy an 9.1% annual coupon bond for $1,170. The bond has 19 years to maturity. What rate of return do you expect to earn on your investment? Expected rate of return % b-1. Two years from now, the YTM on your bond has declined by 1%, and you decide to sell. What price will your bond sell for? (Omit $ sign in your response.) Bond price $ b-2. What is the HPY on your investment? HPYarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT