FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

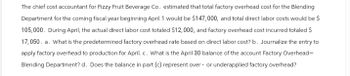

Transcribed Image Text:The chief cost accountant for Fizzy Fruit Beverage Co. estimated that total factory overhead cost for the Blending

Department for the coming fiscal year beginning April 1 would be $147,000, and total direct labor costs would be $

105,000. During April, the actual direct labor cost totaled $12,000, and factory overhead cost incurred totaled $

17,050. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to

apply factory overhead to production for April. c. What is the April 30 balance of the account Factory Overhead-

Blending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction to overhead accounting

VIEW Step 2: Calculation of predetermined overhead rate per direct labor cost

VIEW Step 3: Preparation of journal entry to apply factory overhead to production

VIEW Step 4: Determination of balance in the factory overhead account

VIEW Step 5: Analysis of application of overhead

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- aarrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $349,700 and direct labor hours would be 40,000. Actual manufacturing overhead costs incurred were $300,400, and actual direct labor hours were 52,900. What is the predetermined overhead rate per direct labor hour?arrow_forwardThe cost of goods manufactured for June was:arrow_forward

- The following account balances at the beginning of January were selected from the general ledger of Hammersley Manufacturing Company: Work in process inventory $0 Raw materials inventory $28,000 Finished goods inventory $40,000 Additional data: 1) Actual manufacturing overhead for January amounted to $62,000. 2) Total direct labor cost for January was $63,000. 3) The predetermined manufacturing overhead rate is based on direct labor cost. The budget for the year called for $250,000 of direct labor cost and $350,000 of manufacturing overhead costs. 4) The only job unfinished on January 31 was Job No. 151, for which total direct labor charges were $5,200 (800 direct labor hours) and total direct material charges were $14,000. 5) Cost of direct materials placed in production during January totaled $123,000. There were no indirect material requisitions during January. 6) January 31 balance in raw materials inventory was $35,000. 7) Finished goods inventory balance…arrow_forwardMarco Company shows the following costs for three jobs worked on in April. Balances on March 31 Direct materials used (in March) Direct labor used (in March) Overhead applied (March) Costs during April Direct materials used Direct labor used Overhead applied Status on April 30 Req 5A Job 306 $ 30,600 21,600 11,600 Additional Information a. Raw Materials Inventory has a March 31 balance of $81,600. b. Raw materials purchases in April are $504,000, and total factory payroll cost in April is Req 5B Raw materials Work in process Finished goods Total inventories 139,000 86,600 ? Finished (sold) $367,000. c. Actual overhead costs incurred in April are indirect materials, $51,000; indirect labor, $24,000; factory rent, $33,000; factory utilities, $20,000; and factory equipment depreciation, $52,000. d. Predetermined overhead rate is 50% of direct labor cost. e. Job 306 is sold for $639,000 cash in April. Job 307 $36,600 19,600 10,600 5-a. Compute gross profit for April. 5-b. Show how the…arrow_forwardHenderson Industries applies manufacturing overhead to its jobs based on a predetermined overhead rate, which is calculated using direct labor costs. The following data pertains to Henderson Industries' Work in Process inventory for the month of April: April 1 balance: $ 26,000 Debits during April: Direct Materials: $40,000 Direct Labor: $50,000 Manufacturing Overhead: $37, 500 Throughout April, the company's Work in Process inventory account received credits totaling $120, 500, representing the Cost of Goods Manufactured for the month. By April 30, only one job was still in process, having accumulated $9, 600 in applied overhead costs. The question is, what is the direct materials cost in this unfinished job? The options are: Group of answer choices $10, 600 $16, 700 $12, 800 $23, 400arrow_forward

- Make a general journal entryarrow_forwardVerizox Company uses a job order cost system with manufacturing overhead applied to products based on direct labor hours. At the beginning of the most recent year, the company estimated its manufacturing overhead cost at $182,400. Estimated direct labor cost was $446,500 for 19,000 hours. Actual costs for the most recent month are summarized here: Total Item Description Direct labor (1,900 hours) Cost $44,651 Indirect costs Indirect labor 2,460 3,440 3,370 4,750 Indirect materials Factory rent Factory supervision Factory depreciation Factory janitorial work Factory insurance General and administrative salaries 5,730 1,150 1,890 4,200 5,370 Selling expensesarrow_forwardFactory Overhead Rate, Entry for Applying Factory Overhead, and Factory Overhead Account Balance The cost accountant for Kenner Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $817,700, and total direct labor costs would be $629,000. During May, the actual direct labor cost totaled $54,000, and factory overhead cost incurred totaled $73,000. a. What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals.arrow_forward

- At the beginning of the year, Custom Mfg. established Its predetermined overhead rate by using the following cost predictions: overhead costs, $600,000, and direct materlals costs, $200,000. At year-end, the company's records show that actual overhead costs for the year are $1,499,100. Actual direct materials cost had been assigned to jobs as follows. Jobs completed and sold Jobs in finished goods inventory Jobs in work in process inventory $360, 000 82, 000 55,000 $497,000 Total actual direct materials cost 1. Determine the predetermined overhead rate. 2&3. Enter the overhead costs Incurred and the amounts applied to jobs during the year using the predetermined overhead rate and determine whether overhead is overapplied or underapplled. 4. Prepare the adjusting entry to allocate any over- or underapplled overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Req 4 Determine the predetermined overhead rate. Overhead Rate…arrow_forwardDuring May, Bergan Company incurred factory overhead costs as follows: indirect materials, $47,300; indirect labor, $84,300; utilities cost, $13,000; and factory depreciation, $51,800. Journalize the entry on May 30 to record the factory overhead incurred during May. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardCost data for Disksan Manufacturing Company for the month ended January 31 are as follows: Please see the attachments: a. Prepare a cost of goods manufactured statement for January.b. Determine the cost of goods sold for January.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education