FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

The

| Common stock, $10 par value, authorized 1,043,000 shares, 321,000 shares issued and outstanding | $3,210,000 | |

| Paid-in capital in excess of par—common stock | 562,000 | |

| 624,000 |

During the current year, the following transactions occurred.

| 1. | The company issued to the stockholders 109,000 rights. Ten rights are needed to buy one share of stock at $30. The rights were void after 30 days. The market price of the stock at this time was $32 per share. | |

| 2. | The company sold to the public a $204,000, 10% bond issue at 104. The company also issued with each $100 bond one detachable stock purchase warrant, which provided for the purchase of common stock at $28 per share. Shortly after issuance, similar bonds without warrants were selling at 96 and the warrants at $8. | |

| 3. | All but 5,450 of the rights issued in (1) were exercised in 30 days. | |

| 4. | At the end of the year, 80% of the warrants in (2) had been exercised, and the remaining were outstanding and in good standing. | |

| 5. | During the current year, the company granted stock options for 10,800 shares of common stock to company executives. The company, using a fair value option-pricing model, determines that each option is worth $10. The option price is $28. The options were to expire at year-end and were considered compensation for the current year. | |

| 6. | All but 1,080 shares related to the stock-option plan were exercised by year-end. The expiration resulted because one of the executives failed to fulfill an obligation related to the employment contract. |

Transcribed Image Text:No. Account Titles and Explanation

Debit

Credit

1.

No Erery

No Erery

2.

Cash

212160

Dlacount on Bond Payable

Bordi Payable

20000

Pald-n Capital-Sock Warranta

16320

3.

Cash

Commen Seack

Paldin Capital in Eces of Par- Common Seock

207100

4.

Pald-in Captal-Sock Warranta

13056

Cash

4596

Common Sock

16320

Pald-in Capital in bcess of Par- Common Stock

42432

5.

Compenation Eperee

108000

Pald-in Capial-Sock Oprions

108000

6. For oetions eercised

Cah

2720

Pald-n Capltal-Shock Opelone

97200

Common Sock

97200

Pald-in Capltal in Ecess of Par- Common Stock

272140

Eor entions leand

Pald-in Caphal-Sock Opelone

10800

Compensatlon bperse

10800

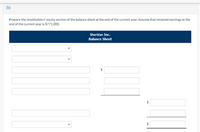

Transcribed Image Text:(b)

Prepare the stockholders' equity section of the balance sheet at the end of the current year. Assume that retained earnings at the

end of the current year is $771,000.

Sheridan Inc.

Balance Sheet

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected accounts appear in the ledger of Upscale Construction Inc. at the beginning of the current year: Preferred 1% Stock, $50 par (100,000 shares authorized, 81,900 shares issued) $4,095,000 Paid-In Capital in Excess of Par—Preferred Stock 155,610 Common Stock, $3 par (5,000,000 shares authorized, 1,780,000 shares issued) 5,340,000 Paid-In Capital in Excess of Par—Common Stock 1,602,000 Retained Earnings 35,256,000 During the year, the corporation completed a number of transactions affecting the stockholders’ equity. They are summarized as follows: Jan. 5 Issued 493,300 shares of common stock at $7, receiving cash. Feb. 10 Issued 8,800 shares of preferred 1% stock at $60. Mar. 19 Purchased 46,700 shares of treasury common for $7 per share. May 16 Sold 18,400 shares of treasury common for $9 per share. Aug. 25 Sold 4,900 shares of treasury common for $6 per share. Dec. 6 Declared cash dividends of $0.50 per share on preferred stock…arrow_forwardThe following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current fiscal year: Preferred 1% Stock, $50 par (100,000 shares authorized, 83,900 shares issued)$4,195,000 Paid-In Capital in Excess of Par—Preferred Stock184,580 Common Stock, $3 par (5,000,000 shares authorized, 2,120,000 shares issued)6,360,000 Paid-In Capital in Excess of Par—Common Stock1,590,000 Retained Earnings31,692,000 During the year, the corporation completed a number of transactions affecting the stockholders’ equity. They are summarized as follows: Journalize the entries to record the transactions. Should equal 18 lines. Jan. 5 Issued 467,700 shares of common stock at $9, receiving cash. Feb. 10 Issued 10,700 shares of preferred 1% stock at $62. Mar. 19 Purchased 53,000 shares of treasury stock for $6 per share. May 16 Sold 20,000 shares of treasury stock for $8 per share. Aug. 25 Sold 5,200 shares of treasury stock for $5 per share. Dec. 6 Declared cash…arrow_forwardInstructions The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 2% Stock, $100 par (100,000 shares authorized, 80,000 shares issued) Paid-In Capital in Excess of Par-Preferred Stock Common Stock, $5 par (5,000,000 shares authorized, 4,000,000 shares issued) Paid-In Capital in Excess of Par-Common Stock Retained Earnings $8,000,000 440,000 20,000,000 2,280,000 115,400,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 220,000 shares of common stock at $14, receiving cash. b. Issued 12,000 shares of preferred 2% stock at $110. c. Purchased 160,000 shares of treasury common for $10 per share. d. Sold 105,000 shares of treasury common for $16 per share. e. Sold 40,000 shares of treasury common for $8 per share. f. Declared cash dividends of $2.00 per share on preferred stock and $0.08 per share on common stock. g.…arrow_forward

- Kohler Corporation reports the following components of stockholders’ equity at December 31 of the prior year. Common stock—$15 par value, 100,000 shares authorized, 40,000 shares issued and outstanding $ 600,000 Paid-in capital in excess of par value, common stock 70,000 Retained earnings 400,000 Total stockholders' equity $ 1,070,000 During the current year, the following transactions affected its stockholders’ equity accounts. January 2 Purchased 5,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $4 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,500 of its treasury shares at $24 cash per share. August 22 Sold 2,500 of its treasury shares at $16 cash per share. September 5 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend…arrow_forwardThe stockholders' equity section of Jun Company's balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 20% stock dividend. The stock's per share market value on April 2 is $15 (prior to the dividend). Common stock-$5 par value, 415,000 shares authorized, 220,000 shares issued and outstanding Paid-in capital in excess of par value, common stock. Retained earnings Total stockholders' equity Prepare the stockholders' equity section immediately after the stock dividend is distributed. Total paid-in capital Total stockholders' equity JUN COMPANY Stockholders' Equity April 2 (after stock dividend) $ 0 $ 1,100,000 530,000 853,000 $ 2,483,000 0 4arrow_forwardThe stockholders’ equity section of Bramble Corp.’s balance sheet at December 31 is presented here. BRAMBLE CORP.Balance Sheet (partial) Stockholders’ equity Paid-in capital Preferred stock, cumulative, 12,500 shares authorized, 7,500 shares issued and outstanding $ 787,500 Common stock, no par, 735,000 shares authorized, 565,000 shares issued 2,260,000 Total paid-in capital 3,047,500 Retained earnings 1,158,000 Total paid-in capital and retained earnings 4,205,500 Less: Treasury stock (6,900 common shares) 36,800 Total stockholders’ equity $4,168,700 From a review of the stockholders’ equity section, answer the following questions.(a) How many shares of common stock are outstanding? Common stock outstanding enter a number of shares shares (b) Assuming there is a stated value, what is the stated value of the common stock? The stated value of the common stock…arrow_forward

- Following is the stockholders' equity section as of June 30. Common stock-$20 par value, 200,000 shares authorized, 80,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity On July 1, the directors declare a 5% stock dividend distributable on July 31 to the July 18 stockholders of record. The stock's market value is $50 per share on July 1 before the stock dividend. 1. Prepare entries to record both the dividend declaration and its distribution. 2. Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Enter answers in the tabs below. Required 1 Required 2 $ 1,600,000 400,000 750,000 $ 2,750,000 Prepare the stockholders' equity section after the stock dividend is distributed. (Assume no other changes to equity.) Stockholders' Equity Section of the Balance Sheet July 31 Retained earnings Common stock Paid-in capital in excess of par value, common…arrow_forwardShown below is information relating to the stockholders' equity of Perry Corporation as of December 31, Year 1: 5.5% cumulative preferred stock, $100 par value; authorized, ?? shares; issued and outstanding, ?? shares Common stock, $10 par value; authorized, 360,000 shares; issued and outstanding, 140,000 shares Additional paid-in capital: Common stock Retained earnings (Deficit) Dividends in arrears What was the original issue price per share of common stock?arrow_forwardThe stockholders’ equity section of Creighton Company’s balance sheet is shown as follows: CREIGHTON COMPANY As of December 31, Year 3 Stockholders’ equity Preferred stock, $10 stated value, 7% cumulative,300 shares authorized, 50 issued and outstanding $ 500 Common stock, $10 par value, 250 shares authorized,100 issued and outstanding 1,000 Common stock, class B, $20 par value, 400 sharesauthorized, 150 issued and outstanding 3,000 Common stock, no par, 150 shares authorized,100 issued and outstanding 2,200 Paid-in capital in excess of stated value—preferred 600 Paid-in capital in excess of par value—common 1,200 Paid-in capital in excess of par value—class B common 750 Retained earnings 7,000 Total stockholders’ equity $ 16,250 Requireda. Assuming the preferred stock was originally issued for cash, determine the amount of cash collected when the stock was issued.b. Based on the class B common stock alone,…arrow_forward

- The stockholders’ equity section of Jun Company’s balance sheet as of April 1 follows. On April 2, Jun declares and distributes a 15% stock dividend. The stock’s per share market value on April 2 is $20 (prior to the dividend). Common stock—$5 par value, 405,000 sharesauthorized, 215,000 shares issued and outstanding $ 1,075,000 Paid-in capital in excess of par value, common stock 520,000 Retained earnings 848,000 Total stockholders' equity $ 2,443,000 Prepare the stockholders’ equity section immediately after the stock dividend is distributed.arrow_forwardA company with 118,808 authorized shares of $5 par common stock issued 31,951 shares at $16 per share. Subsequently, the company declared a 2% stock dividend on a date when the market price was $33 a share. What is the amount transferred from the retained earnings account to paid-in capital accounts as a result of the stock dividend? Oa. $17,893 Ob. $21,088 Oc. $3,195 Od. $78,413arrow_forwardA company reports the following components of stockholders’ equity at December 31 of the prior year. Common stock—$15 par value, 100,000 shares authorized, 60,000 shares issued and outstanding $ 900,000 Paid-in capital in excess of par value, common stock 60,000 Retained earnings 370,000 Total stockholders' equity $ 1,330,000 During the current year, the following transactions affected its stockholders’ equity accounts. January 2 Purchased 4,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $6 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,000 of its treasury shares at $24 cash per share. August 22 Sold 2,000 of its treasury shares at $16 cash per share. September 5 Directors declared a $6 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend declared on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education