Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hand written solutions are strictly prohibited

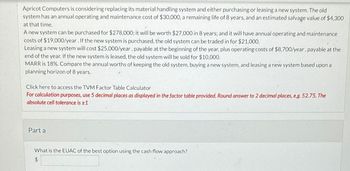

Transcribed Image Text:Apricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old

system has an annual operating and maintenance cost of $30,000, a remaining life of 8 years, and an estimated salvage value of $4,300

at that time.

A new system can be purchased for $278,000; it will be worth $27,000 in 8 years; and it will have annual operating and maintenance

costs of $19,000/year. If the new system is purchased, the old system can be traded in for $21,000.

Leasing a new system will cost $25,000/year, payable at the beginning of the year, plus operating costs of $8,700/year, payable at the

end of the year. If the new system is leased, the old system will be sold for $10,000.

MARR is 18%. Compare the annual worths of keeping the old system, buying a new system, and leasing a new system based upon a

planning horizon of 8 years.

Click here to access the TVM Factor Table Calculator

For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 52.75. The

absolute cell tolerance is ±1

Part a

What is the EUAC of the best option using the cash flow approach?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm uses the straight-line depreciation method with a zero salvage value and has a (marginal) income tax rate of 40 percent. The firms cost of capital is 12 percent. Compute the IRR and the NPV. Should the firm accept or reject the project?arrow_forwardWhat life cycle cost concept begins raising concerns by year 5 with any electric vehicle (EV)? If that issue affected resale value at year 5, would that affect perceived value-in-use? How exactly?arrow_forwardMetropolitan Hospital has estimated its average monthly bed needs as N=1,000+9X where X=timeperiod(months);January2002=0 N=monthlybedneeds Assume that no new hospital additions are expected in the area in the foreseeable future. The following monthly seasonal adjustment factors have been estimated, using data from the past five years: Forecast Metropolitans bed demand for January, April, July, November, and December 2007. If the following actual and forecast values for June bed demands have been recorded, what seasonal adjustment factor would you recommend be used in making future June forecasts?arrow_forward

- Plot the logarithm of arrivals for each transportation mode against time, all on the same graph. Which now appears to be growing the fastest?arrow_forwardThe Questor Corporation has experienced the following sales pattern over a 10-year period: Compute the equation of a trend line (similar to Equation 5.4) for these sales data to forecast sales for the next year. (Let 2004=0,2005=1, etc., for the time variable.) What does this equation forecast for sales in the year 2014? Use a first-order exponential smoothing model with a w of 0.9 to forecast sales for the year 2014.arrow_forwardLogarithms are especially useful for comparing series with two divergent scales since 10 percent growth always looks the same, regardless of the starting level. When absolute levels matter, the raw data are more appropriate, but when growth rates are whats important, log scales are better.arrow_forward

- What is deflation?arrow_forwardA firm experienced the demand shown in the following table. *Unkown future value to be forecast Fill in the table by preparing forecasts based on a five-year moving average, a three-year moving average, and exponential smoothing (with a w=0.9 and a w=0.3). Note The exponential smoothing forecasts may be begun by assuming Y t+1=Yt. Using the forecasts from 2005 through 2009, compare the accuracy of each of the forecasting methods based on the RMSE criterion. Which forecast would you have used for 2010? Why?arrow_forwardInvestors sometimes fear that a high-risk investment is especially likely to have low returns. Is this fear true? Does a high risk mean the return must be low?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc