Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

ANSWER

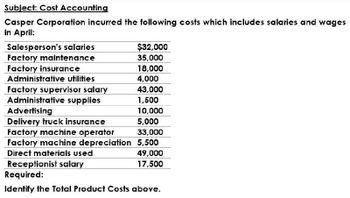

Transcribed Image Text:Subject: Cost Accounting

Casper Corporation incurred the following costs which includes salaries and wages

in April:

Salesperson's salaries

$32,000

Factory maintenance

35,000

Factory insurance

18,000

Administrative utilities

4,000

Factory supervisor salary

43,000

Administrative supplies

1,500

Advertising

10,000

Delivery truck insurance

5,000

Factory machine operator

33,000

Factory machine depreciation 5,500

Direct materials used

Receptionist salary

49,000

17,500

Required:

Identify the Total Product Costs above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Metlock Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information $13,300 10.870 3,340 Manufacturing overhead 42,120 69,440 118,480 7,000 Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising Office supplies used Determine the total amount of manufacturing overhead.. $59,480 39,820 2.150 1,130 1,720 12.900 2,260 suarrow_forwardAsteroid Industries accumulated the following cost information for the year: Salesperson salaries Indirect materials Indirect labor Factory depreciation Direct labor $ 16,600 4,600 9,100 13,400 37,600 Using the above information, total factory overhead costs equal:arrow_forwardQuestion: Jasper Corporation incurred the following costs which includes salaries and wages in April: Salesperson's salaries $32,000 Factory maintenance 25,000 Factory insurance 10,000 Administrative utilities 4,000 Factory supervisor salary 30,000 Administrative supplies 1,500 Advertising 10,000 Delivery truck insurance 5,000 Factory machine operator 22,000 Factory machine depreciation 5,500 Direct materials used 30,000 Receptionist salary 17,500 Required: Identify the Total Product Costs above.arrow_forward

- Claire Corporation's trial balance includes the following expenses: Raw materials used in production Raw materials purchased General manager salary Sales manager salary Direct labor incurred General liability insurance premium Factory rent Office lease Factory utilities Depreciation on factory equipment Assuming that this list represents all expenses for the year, what amount should Claire report as a period (non-product) expense? Select one: $5,500 6,500 50,000 30,000 130,000 a. $101,000 b. $107,500 c. $83,000 d. $74,000 3,000 24,000 18,000 12,000 14,000arrow_forwardSubject :- Accountingarrow_forward[The following information applies to the questions displayed below.] Watercraft's predetermined overhead rate is 200% of direct labor. Information on the company's production activities during May follows. a. Purchased raw materials on credit, $240,000. b. Materials requisitions record use of the following materials for the month. $ 49,000 32,500 20, 200 22,800 6,600 131,100 19,500 $ 150,600 Job 136 Job 137 Job 138 Job 139 Job 140 Total direct materials Indirect materials Total materials requisitions c. Time tickets record use of the following labor for the month. These wages were paid in cash. Job 136 $12,100 Job 137 10, 700 Job 138 37,700 39,200 3,400 103,100 25,000 $ 128, 100 Job 139 Job 140 Total direct labor Indirect labor Total labor costarrow_forward

- ABC Company accumulated the following cost information for the year: Salesperson salaries Indirect materials Indirect labor Factory depreciation Direct labor Multiple Choice Using the above information, what are the total factory overhead costs? O $12,900. $78,800. $53,200. $ 16,100 4,100 8,600 $17,000. 12,900 37,100arrow_forwardKindly help me with accounting questionsarrow_forwardAnswerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning