Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

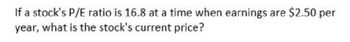

Transcribed Image Text:If a stock's P/E ratio is 16.8 at a time when earnings are $2.50 per

year,

what is the stock's current price?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If a company has a forward (forecasted) EPS of 5.242 and a forward PE of 76.495, what is the forecasted price of that stock? (forecasted)arrow_forwardWhat is the required return on preferred stock, rPS, if the stock has an annual dividend of $9 and a price of $100?arrow_forwardIf a company has a forward (forecasted) EPS of 0.757 and a forward (forecasted) PE of 86.995, what is the forecasted price of that stock? Yarrow_forward

- What are the arithmetic and geometric (Answer in that order.) average returns for a stock with annual returns of 9.4 percent, 8.2 percent, -8.3 percent, 4.1 percent, and 9.5 percent?arrow_forward1. A stock has had the following year-end prices and dividends: Year Price ($) Dividend ($) 94.17 92.21 1.05 96.1 1.2 96.3 1.57 94.16 1.66 96.46 1.69 What is the geometric average return for the stock? Answer as a percentage to two decimals (if you get -0.0435, you should answer -4.35).arrow_forwardHow do you calcuate the bechmark and historical return for the stock ARKK when the last price listed is $123.40 and the current value is $26,531.00.arrow_forward

- what are the two type parts of most stocks expected total return? if D1=$2.00, g= 6% and po $40.00, what are the stocks expected dividend yield, capital gains yield, and total expected return for the coming year?arrow_forwardWhat is the dividend yield if the annual dividend per share is $7.50 and the market price of a share of stock is $97?arrow_forwardA stock has had the following year-end prices and dividends: TIT Year Price Dividend $16.25 1 18.43 $ .15 2 19.43 .30 3 17.93 .33 4 20.27 .34 23.38 .40 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Arithmetic return |% Geometric returnarrow_forward

- A stock has a market price of $33.45 and pays a $.95 dividend. What is the dividend yield?arrow_forwardA stock has had the following year-end prices and dividends: Year Price 0 012345 1 $ 15.00 17.18 18.18 16.68 19.02 22.13 Dividend $ 0.15 0.38 0.40 0.42 0.48 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Arithmetic return Geometric return % %arrow_forwardA stock has had the following year-end prices and dividends: Year 0 1 2 3 4 5 Price $16.50 18.68 19.68 18.18 20.52 23.63 Dividend $ 0.15 0.35 0.37 0.38 0.45 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning