FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

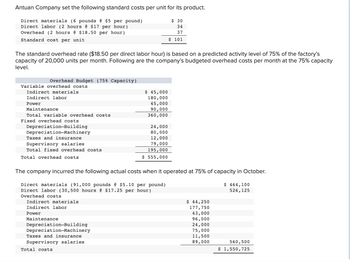

Transcribed Image Text:Antuan Company set the following standard costs per unit for its product.

Direct materials (6 pounds @ $5 per pound)

$ 30

Direct labor (2 hours @ $17 per hour)

34

Overhead (2 hours @ $18.50 per hour)

37

Standard cost per unit

$ 101

The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's

capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity

level.

Overhead Budget (75% Capacity)

Variable overhead costs

$ 45,000

Indirect materials

Indirect labor

180,000

Power

45,000

Maintenance

90,000

costs

360,000

Total var ble ove

Fixed overhead costs.

24,000

80,000

Depreciation-Building

Depreciation-Machinery

Taxes and insurance

Supervisory salaries.

12,000

79,000

Total fixed overhead costs

195,000

Total overhead costs

$ 555,000

The company incurred the following actual costs when it operated at 75% of capacity in October.

Direct materials (91,000 pounds @ $5.10 per pound)

$ 464,100

526, 125

Direct labor (30,500 hours @ $17.25 per hour)

Overhead costs

Indirect materials.

$ 44,250

Indirect labor

177,750

Power

43,000

Maintenance

96,000

24,000

Depreciation-Building

Depreciation-Machinery

75,000

11,500

Taxes and insurance

Supervisory salaries.

89,000

560,500

Total costs

$ 1,550,725

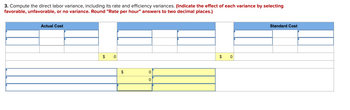

Transcribed Image Text:3. Compute the direct labor variance, including its rate and efficiency variances. (Indicate the effect of each variance by selecting

favorable, unfavorable, or no variance. Round "Rate per hour" answers to two decimal places.)

Standard Cost

Actual Cost

$

0

$

0

0

0

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information applies to the questions displayed below.]Antuan Company set the following standard costs per unit for its product. Direct materials (5.0 pounds @ $6.00 per pound) $ 30.00 Direct labor (1.9 hours @ $11.00 per hour) 20.90 Overhead (1.9 hours @ $18.50 per hour) 35.15 Standard cost per unit $ 86.05 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 30,000 Indirect labor 75,000 Power 30,000 Maintenance 30,000 Total variable overhead costs 165,000 Fixed overhead costs Depreciation—Building 24,000 Depreciation—Machinery 70,000 Taxes and insurance 18,000 Supervisory salaries 250,250 Total fixed overhead costs 362,250 Total overhead costs $ 527,250 The…arrow_forwardThe following are standard costs related to a product of Jacobs, SRL: Inputs: Unit of Input Units per item Price or rate Direct Materials: square feet 80 $22/square foot Direct Labor: direct labor hours 24 $38/direct labor hour Variable Overhead: direct labor hours $49/direct labor hour The company applies variable overhead on the basis of direct labor hours. In April, the following results were reported: Actual output: 506 items Raw Materials used: 45,684 square feet Raw Material purchased: 42,335 square feet Actual direct labor hours: 14,168 hours Actual cost of raw materials purchased: $973,705 Actual direct labor cost: $609,224 Actual variable overhead cost: $665,896 The direct material purchases variance is computed when the materials are purchased. Determine each of the following variances and whether they are favorable or unfavorable: Part 1: Direct Material quantity variance: 114,488 Unfavorable 114,488 Favorable 83,145 Favorable 83, 145…arrow_forwardLucia Company has set the following standard cost per unit for direct materials and direct labor. Direct materials (14 pounds @ $3 per pound) Direct labor (2 hours @ $14 per hour) $ 42 28 During May the company incurred the following actual costs to produce 8.100 units. Direct materials (115,780 pounds @ $2.80 per pound) Direct labor (19,700 hours @ $14.10 per hour) $ 323,968 277,770 AR = Actual Rate SR = Standard Rate AQ = Actual Quantity SQ AP Standard Quantity Actual Price SP=Standard Price AH = Actual Hours SH Standard Hours (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the direct materials price and quantity variances. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.arrow_forward

- Camila Company has set the following standard cost per unit for direct materials and direct labor. Direct materials (14 pounds @ $5 per pound) Direct labor (3 hours @ $15 per hour) During June the company incurred the following actual costs to produce 8,300 units. Direct materials (119,100 pounds @ $4.70 per pound) Direct labor (28,600 hours @ $15.20 per hour) AR = Actual Rate SR = Standard Rate AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price $70 45 $ 559,770 434,720arrow_forwardAntuan Company set the following standard costs per unit for its product. Direct materials (6 pounds @ $5 per pound) $ 30 Direct labor (2 hours @ $17 per hour) 34 Overhead (2 hours @ $18.50 per hour). 37 Standard cost per unit $ 101 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials. $ 45,000 Indirect labor 180,000 Power 45,000 Maintenance 90,000 360,000 Total variable overhead costs Fixed overhead costs 24,000 Depreciation-Building Depreciation-Machinery 80,000 Taxes and insurance 12,000 Supervisory salaries. 79,000 Total fixed overhead costs 195,000 Total overhead costs $ 555,000 The company incurred the following actual costs when it operated at 75% of capacity in October. Direct materials (91,000 pounds @ $5.10 per…arrow_forwardMartinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost Per Unit Direct materials $ 6.00 Direct labor $ 3.50 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 3.00 Fixed administrative expense $ 2.00 Sales commissions $ 1.00 Variable administrative expense $ 0.50 Foundational 1-6 (Static) 6. If 12,500 units are produced and sold, what is the total amount of variable costs related to the units produced and sold?arrow_forward

- Rhodes Corporation manufactures a product with the following standard costs: Direct materials (20 yards @ $1.85 per yard) $ 37.00 Direct labor (4 hours @ $12.00 per hour) 48.00 Variable factory overhead (4 hours @ $5.40 per hour) 21.60 Fixed factory overhead (4 hours @ $3.60 per hour) 14.40 Total standard cost per unit of output $121.00 Standards are based on normal monthly production involving 2,000 direct labor hours (500 units of output).The following information pertains to the month of July: Direct materials purchased (16,000 yards @ $1.80 per yard) $28,800 Direct materials used (9,400 yards) Direct labor (1,880 hours @ $12.20 per hour) 22,936 Actual factory overhead 16,850 Actual production in July: 460 units Using the information above, compute the following variances for the month of July, indicating whether each variance is favorable or unfavorable: Materials purchase price variance…arrow_forwardKubin Company’s relevant range of production is 20,000 to 23,000 units. When it produces and sells 21,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 8.00 Direct labor $ 5.00 Variable manufacturing overhead $ 2.50 Fixed manufacturing overhead $ 6.00 Fixed selling expense $ 4.50 Fixed administrative expense $ 3.50 Sales commissions $ 2.00 Variable administrative expense $ 1.50 Exercise 1-7 (Algo) Direct and Indirect Costs [LO1-1] Required: 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 21,500 units? b. What is the total indirect manufacturing cost incurred to make 21,500 units? 2. Assume the cost object is the Manufacturing Department and that its total output is 21,500 units. a. How much total manufacturing cost is directly traceable to the Manufacturing Department? b. How much total manufacturing cost is an indirect cost that cannot be…arrow_forwardThe standard factory overhead rate is $10 per direct labor hour ($8 for variable factory overhead and $2 for fixed factory overhead) based on 100% of normal capacity of 30,000 direct labor hours. The standard cost and the actual cost of factory overhead for the production of 5,000 units during May were as follows: Standard hours at 100% of normal capacity 30,000 Standard hours for actual production 25,000 Standard total FOH cost (25,000 hours $10 per hour) $250,000 Actual Variable FOH costs $202,500 Actual Fixed FOH costs $60,000 Required: Calculate Variable FOH Controllable variance. Calculate Fixed FOH Volume variance. Calculate the total FOH variance.arrow_forward

- Trico Company set the following standard unit costs for its single product. Direct materials (30 lbs. @ $4 per lb.) $120 Direct labor (5 hrs. @ $14 per hr.) 70 Factory overhead—variable (5 hrs. @ $8 per hr.) 40 Factory overhead—fixed (5 hrs. @ $10 per hr.) 60 Total standard cost $280 The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 60,000 units per quarter. The following flexible budget information is available. Operating Level Operating Level Operating Level 70% 80% 90% Production in units 42,000 48,000 54,000 Standard direct labor hours 210,000 240,000 270,000 Budgeted overhead: Fixed factory OH $2,400,000 $2,400,000 $2,400,000 Variable factory OH $1,68,000 $1,920,000 $2.160,000 During the current quarter, the company operated at 90% of capacity and produced 54,000 units of product; actual direct…arrow_forwardMartinez Company’s relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 5.50 Direct labor $ 3.00 Variable manufacturing overhead $ 1.50 Fixed manufacturing overhead $ 4.00 Fixed selling expense $ 2.50 Fixed administrative expense $ 2.00 Sales commissions $ 1.00 Variable administrative expense $ 0.50 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 10,000 units? (Do not round intermediate calculations.)arrow_forwardBullseye Company manufactures dartboards. Its standard cost information follows: Standard Price (Rate) Standard Quantity 2.50 sq. ft. 1 hrs. $2.90 per sq. ft. $11.00 per hr. $ 0.40 per hr. Direct materials (cork board) Direct labor Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($68,250+ 195,000 units) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost Required 1 Required 2 Required 3. 1 hrs. Complete this question by entering your answers in the tabs below. Direct Materials Price Variance Direct Materials Quantity Variance Direct Materials Spending Variance Required: 1. Calculate the direct materials price, quantity, and total spending variances for Bullseye. 2. Calculate the direct labor rate, efficiency, and total spending variances for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education