FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

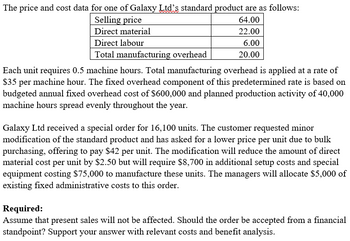

Transcribed Image Text:The price and cost data for one of Galaxy Ltd's standard product are as follows:

Selling price

64.00

22.00

Direct material

Direct labour

6.00

Total manufacturing overhead

20.00

Each unit requires 0.5 machine hours. Total manufacturing overhead is applied at a rate of

$35 per machine hour. The fixed overhead component of this predetermined rate is based on

budgeted annual fixed overhead cost of $600,000 and planned production activity of 40,000

machine hours spread evenly throughout the year.

Galaxy Ltd received a special order for 16,100 units. The customer requested minor

modification of the standard product and has asked for a lower price per unit due to bulk

purchasing, offering to pay $42 per unit. The modification will reduce the amount of direct

material cost per unit by $2.50 but will require $8,700 in additional setup costs and special

equipment costing $75,000 to manufacture these units. The managers will allocate $5,000 of

existing fixed administrative costs to this order.

Required:

Assume that present sales will not be affected. Should the order be accepted from a financial

standpoint? Support your answer with relevant costs and benefit analysis.

Expert Solution

arrow_forward

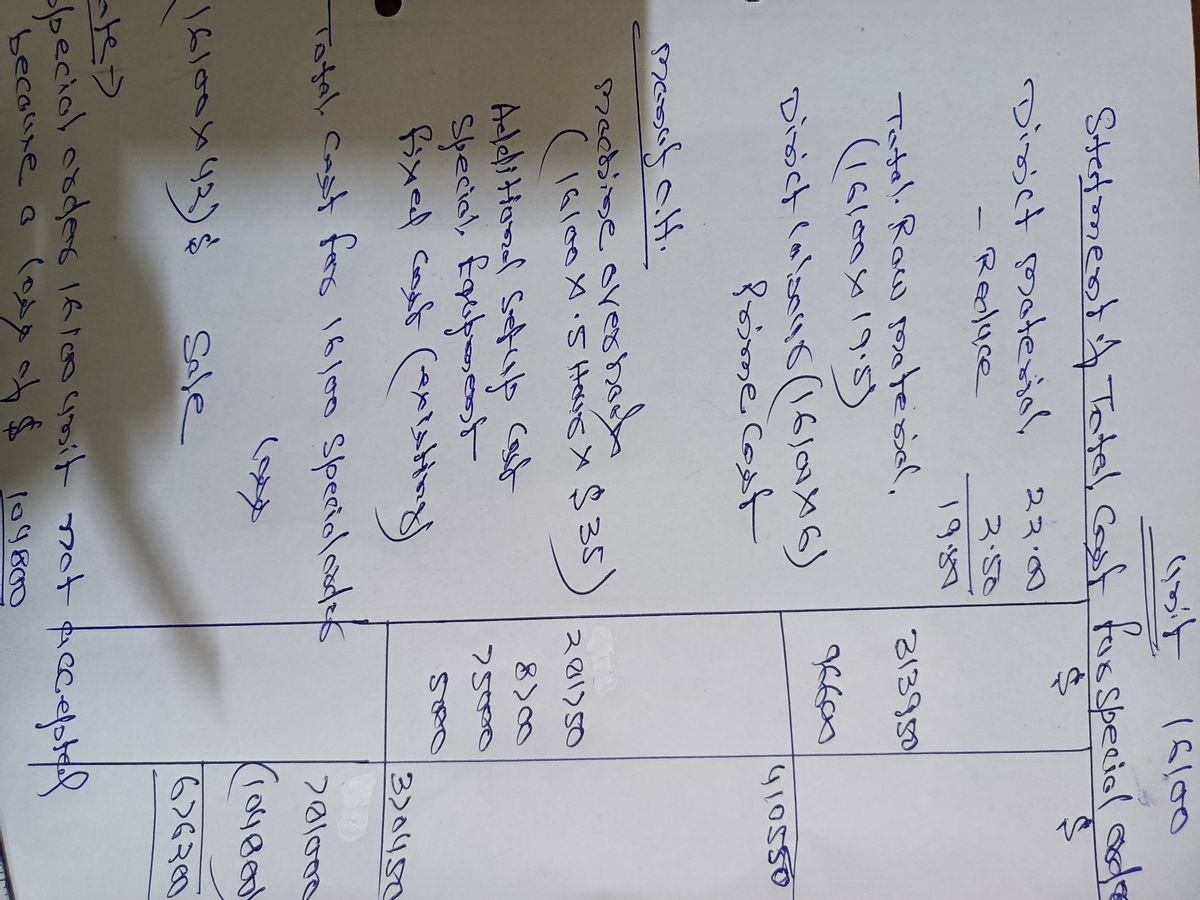

Step 1

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discuss the limitations of cost volume profit analysis for planning and decision making. Nb: please do answer this question in three paragraphs.arrow_forwardWhen making decisions, managers should consider a. revenues that differ between alternatives. b. costs that do not differ between alternatives. c. only variable costs. d. sunk costs in their decisions.arrow_forwardIn incremental analysis, only relevant costs are considered when making a decision among alternatives. Explain what relevant costs are. Would these include only variable costs? Explain.arrow_forward

- Identify two ways in which a contribution margin income statement differs in format from a traditional income statement. Which is more useful for decision making and why?arrow_forwardWhich of the following is not an application of cost-volume-profit analysis? Setting prices for products and services. Performing strategic “what-if” analyses. Deciding whether to cut a product line. Determining the short-term cost or profit implications of many decisions. Deciding whether to make or buy a given product or service.arrow_forward“In CVP analysis, gross margin is a less-useful concept than contribution margin.” Do you agree? Explain briefly?arrow_forward

- Conceptually, how would you evaluate a quantity discount offerfrom a supplier?arrow_forwardif we produce goods over the capacity, should we consider the fixed marketing cost and variable marketing cost when making the decision to accept or reject a special offer?arrow_forwardProfitability changes may be simply calculated by using what kind of tool: sales price/volume/variable costs/fixed costs.arrow_forward

- (b) Contrast and compare the WACC and the APV methods and critically evaluate strengths and weaknesses of the two methods. What are the underlying assumptions of the two methods? Refer to the existing literature when discussing and evaluating these assumptions. (c) Practitioners sometimes consider the financial distress costs in their APV applications. What are these costs? Why are they relevant? Briefly describe the empirical evidence on distress costs, including studies on their magnitude relative to firm value.arrow_forwardTo make predictions about costs and income, you must first classify costs by their behavior. True Falsearrow_forwardCan someone help by providing an example of revenues and costs that would be impacted by outsourcing decision using ration analysis?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education