FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Question is attached in the screesnhot thanks for the hlep

l13pyl32yp42okp2ojhtihjlidgn

qgoiqyh90yh1391h3teq

g

lol

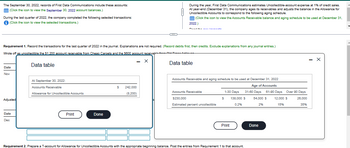

Transcribed Image Text:The September 30, 2022, records of First Data Communications include these accounts:

(Click the icon to view the September 30, 2022 account balances.)

During the last quarter of 2022, the company completed the following selected transactions:

i (Click the icon to view the selected transactions.)

Requirement 1. Record the transactions for the last quarter of 2022 in the journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.)

Wrote off as uncollectible the $1.200 account receivable from Cheap Carpets and the $600 account receivable Old Time

- X

Data table

Date

Nov

Adjusted

Date

Dec

Data table

At September 30, 2022:

Accounts Receivable

Allowance for Uncollectible Accounts

Print

Done

$

During the year, First Data Communications estimates Uncollectible-account expense at 1% of credit sales.

At year-end (December 31), the company ages its receivables and adjusts the balance in the Allowance for

Uncollectible Accounts to correspond to the following aging schedule.

(Click the icon to view the Accounts Receivable balance and aging schedule to be used at December 31,

2022)

MARLE

242,000

(8,200)

Accounts Receivable and aging schedule to be used at December 31, 2022

Age of Accounts

$

1-30 Days 31-60 Days 61-90 Days Over 90 Days

138,000 $ 54,000 $ 12,000 $ 26,000

0.2%

2%

15%

35%

Accounts Receivable

$230,000

Estimated percent uncollectible

Print

Requirement 2. Prepare a T-account for Allowance for Uncollectible Accounts with the appropriate beginning balance. Post the entries from Requirement 1 to that account.

Done

X

Transcribed Image Text:Requirement 1. Record the transactions for the last quarter of 2022 in the journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from any joumal entries.)

Wrote off as uncollectible the $1,200 account receivable from Cheap Carpets and the $600 account receivable from Old Timer Antiques.

Date

Nov

Date

Dec

30

Journal Entry

31

Less:

Accounts

Adjusted the Allowance for Uncollectible Accounts and recorded doubtful-account expense at year-end, based on the aging of receivables.

Journal Entry

Accounts

Debit

First Data Communications

Comparative Balance Sheet (partial)

December 31, 2022 and 2021

IL

Debit

2022

7

Requirement 2. Prepare a T-account for Allowance for Uncollectible Accounts with the appropriate beginning balance. Post the entries from Requirement 1 to that account.

Open the T-account by posting the beginning balance. Then post the entries to the Allowance for Uncollectible Accounts T-account and calculate the ending balance.

Allowance for Uncollectible Accounts

Credit

Requirement 3. Show how First Data Communications will report its accounts receivable in a comparative balance sheet for 2021 and 2022. (Use the three-line reporting format.) At December 31, 2021, the company's Accounts Receivable balance was $214,000, and the Allowance for Uncollectible Accounts stood at $4,400 credit balance. (Be sure to use the Accounts Receivable balan

December 31, 2022 given in the problem data.)

Credit

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assistarrow_forwardChatGi X Gincome X > DeepL X zto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mhe Questi X ssignment i Use the following information for the Quick Studies below. (Algo) [The following information applies to the questions displayed below.] On December 31, Hawkin's records show the following accounts. $ 5,900 1,000 3,600 14,800 Cash Accounts Receivable Supplies Equipment Accounts Payable Hawkin, Capital, December 1 Hawkin, Withdrawals Services Revenue Wages Expense Rent Expense Utilities Expense HAWKIN Statement of Owner's Equity For Month Ended December 31 Hawkin, Capital, December 1 Add: Investments by owner Hawkin, Capital, December 31 6,400 15,300 1,800 $ 16,400 8,000 1,900 1,100 QS 1-16 (Algo) Preparing a statement of owner's equity LO P2 Use the above information to prepare a statement of owner's equity for Hawkin for the month ended December 31. Hint: Owner investments are $0 for the period. 0 Copia d X 0 0 chat.op X Log…arrow_forwardWP BAB140 Lab#2 Ch3 W2022 NWP Assessment Player UI Appli x A Player O New Tab G Taccounts. - Google Search + A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=59c96111-f5ca-414f-9f35-58b827278d0d#/question/1 E Apps W MarketWatch: Stock.. e Business News Market News | Seek... O FINVIZ.com - Stock.. 7 CVNA 228.28 A +1. S Stocktwits - The lar. EE Google Translate E Earnings and Econo. AV Short Interest Stock. * U.S. News | Reuters WSJ market volume E Reading list >> BAB140 Lab#2 Ch3 W2022 Question 2 of 4 > 0/ 2.5 Accounts Payable Aug. 5 (c) 18 3,600 Aug. 29 5,900 Aug.31 1,700 Sept. 12 7,200 Sept. 23 5,800 Sept.30 (d) Sales Aug. 10 50,000 Aug. 12 500 15 44,000 Aug. 31 (e) Sept. 12 (f) Sept. 25 400 Sept. 30 98,100arrow_forward

- * 0O T # 3 la Uni X L Grades for Cristian Catala: 22s X WP Ch7quiz with TF5 WP NWP Assessment Player UI Ap X + tion.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Dafd8fa6a-bc9b-4f11-82e4-3c0d1d4a7063#/question/8 TF5 Question 9 of 10 -/1 Cullumber Consulting Company is headquartered in Atlanta and has branch offices in Nashville and Birmingham. Cullumber uses an activity-based costing system. The Atlanta office has its costs for Administration and Legal allocated to the two branch offices. Cullumber has provided the following information: Activity Cost Pool Cost Driver Costs Administration % of time devoted to branch $703000 Legal Hours spent on legal research $141000 Hours % of time spend devoted to branch on legal research Nashville 000 Birmingham How much of Atlanta's cost will be allocated to Nashville? (round to nearest dollar) O $632900 O $670862 O $672962 O $675200 Save for Later Attemnts: 0 of 1 used MacBook Pro G Search or type URL 000 +, 000 %23 %24 7. 8. 4. 9-…arrow_forward=U&launchmuri=nttps76253A pps76252rportal6252FITal poks Login -. Bb Module 5- Chap 1 &. H Office templates & t.. Il - Chapter 5 6 Sul Saved Help Save & Exit N FV $1 PV $1 FVA $1 PVA $1 FVAD $1 PVAD $1 1 1.03000 0.97087 1.0000 0.97087 1.0300 1.000Θ 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 1.09273 o.91514 3.0909 2.82861 3.1836 2.91347 1.12551 0.88849 1.15927 0.86261 1.19405 0.83748 4 4.1836 3.71710 4.3091 3.82861 5.3091 4.57971 5.4684 4.71710 6 6.4684 5.41719 6.6625 5.57971 1.22987 0.81309 7.6625 6.23028 7.8923 6.41719 8 1.26677 0.78941 8.8923 7.01969 9.1591 7.23028 1.30477 0.76642 10.1591 7.78611 10.4639 8.01969 10 1.34392 0.74409 11 1.38423 0.72242 11.4639 8.53020 11.8078 8.78611 12.8078 9.25262 13.1920 9.53020 14.6178 10.25262 16.0863 10.95400 12 1.42576 0.70138 14.1920 9.95400 13 1.46853 0.68095 15.6178 10.63496 17.5989 11.63496 17.0863 11.29607 18.5989 11.93794 19.1569 12.29607 20.1569 12.56110 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 20.7616 12.93794 Rosie's…arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forward

- I need typing clear urjent no chatgpt use i will give 5 upvotes full explanationarrow_forwardBlackboard Learn Bb 2193555 + i learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com/5f7ce11c673e5/2193555?X-Blackboard-Expiration=1648004400000&X-Blackboard-Signature=9lhjClppXf7wSeUqx.. E * O w WordCounter - Cou... y! Yahoo A Regions Bank | Che.. Welcome, Justin – B. * eBooks, Textbooks... O Jefferson State Co... Electronics, Cars, Fa. C Home | Chegg.com 2193555 1 / 1 100% + | PR 14-4B Entries for bonds payable and installment note transactions The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: оВJ. 3, 4 V 3. $61,644,484 Year 1 Еxcel July 1. Issued $55,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $62,817,040. Interest is payable semiannually on December 31 and June 30. General Ledger Oct. 1. Borrowed $450,000 by issuing a six-year, 8% installment note to Intexicon Bank. The note requires annual payments of $97,342, with the first payment occurring on…arrow_forwardⒸ O D O H < UB Unblockit - Proxies to acce X C Solved P11-1A Gão Limited X b Home | bartleby C (4) How to study fo... Dropbox- 1st B.tec... (10) Lil Jaico - Toma Dropbox - 1st B.tec... (10) Lil Would you like to make Opera GX your everyday browser? How do I do that? www.chegg.com/homework-help/questions-and-answers/journalize-transactions-b-post-equity-accounts-use-j5-posting-refrence-c-prepare-share-cap-q90903484 Jaico-Toma (17) Liverpool reacti... (1) How To Study fo... (6) HABITS of SUCC... AMARIA BB - Slow... Type here to search MARM O x + Chegg Books Jan. 10 Mar. 1 Apr. 1 May 1 Aug. 1 Sept. 1 Nov. 1 Study Career Find solutions for your homework business/accounting / accounting questions and answers/p11-1a gão limited was organized on january 1, 2017, it is... Question: P11-1A Gão Limited Was Organized On January 1, 2017. It Is Authorized To Issue 10,000 8%, HK$1,000 Par Value Preference Share... P11-1A Gão Limited was organized on January 1, 2017. It is authorized to issue 10,000…arrow_forward

- Fill in the missing amounts from the following T accounts.arrow_forwardI need answer typing clear urjent no chatgpt used i will give upvotes all answers plsarrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education