Concept explainers

Andretti Company has a single product called a Dak. The company normally produces and sells 86,000 Daks each year at a selling price of $62 per unit. The company’s unit costs at this level of activity are given below:

| Direct materials | $ 9.50 | |

|---|---|---|

| Direct labor | 9.00 | |

| Variable manufacturing |

3.20 | |

| Fixed manufacturing overhead | 5.00 | ($430,000 total) |

| Variable selling expenses | 4.70 | |

| Fixed selling expenses | 4.00 | ($344,000 total) |

| Total cost per unit | $ 35.40 |

A number of questions relating to the production and sale of Daks follow. Each question is independent.

Required:

1-a. Assume Andretti Company has sufficient capacity to produce 111,800 Daks each year without any increase in fixed

1-b. Would the additional investment be justified?

2. Assume Andretti Company has sufficient capacity to produce 111,800 Daks each year. A customer in a foreign market wants to purchase 25,800 Daks. If Andretti accepts this order, it would pay import duties on the Daks of $2.70 per unit and an additional $15,480 for permits and licenses. The only selling costs associated with the order would be $2.20 per unit shipping cost. What is the break-even price per unit on this order?

3. The company has 500 Daks on hand with some irregularities that make it impossible to sell them at the normal price through regular distribution channels. What unit cost figure is relevant for setting a minimum selling price to liquidate these units?

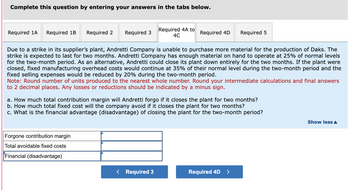

4. Due to a strike in its supplier’s plant, Andretti Company is unable to purchase more material for the production of Daks. The strike is expected to last for two months. Andretti Company has enough material on hand to operate at 25% of normal levels for the two-month period. As an alternative, Andretti could close its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period.

- How much total contribution margin will Andretti forgo if it closes the plant for two months?

- How much total fixed cost will the company avoid if it closes the plant for two months?

- What is the financial advantage (disadvantage) of closing the plant for the two-month period?

- Should Andretti close the plant for two months?

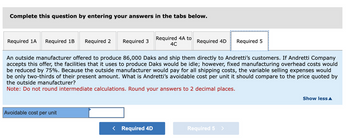

5. An outside manufacturer offered to produce 86,000 Daks and ship them directly to Andretti’s customers. If Andretti Company accepts this offer, the facilities that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 75%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two-thirds of their present amount. What is Andretti’s avoidable cost per unit it should compare to the price quoted by the outside manufacturer?

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 4 images

- Psaki Inc. manufactures and sells a single product called a Shiner. Operating at capacity, the company can produce and sell 22,000 Shiners per year. Costs associated with this level of production and sales are as follows: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense Total cost Unit Total $16.00 $ 352,000 9.00 198,000 4.00 88,000 10.00 220,000 4.00 88,000 132,000 6.00 $49.00 $1,078,000 The Shiners normally sell for $54 each. Fixed manufacturing overhead is constant at $220,000 per year within the range of 15,000 through 22,000 Shiners per year. Required: 1. Assume that, due to a recession, Psaki Company expects to sell only 15,000 Shiners through regular channels next year. A large retail chain has offered to purchase 7,000 Shiners if Psaki is willing to accept a price lower than the regular $54. There would be no sales commissions on this order; thus, variable selling expenses would be slashed…arrow_forwardAnswer all questions and properlyarrow_forwardThe following information relates to the unit product cost for a product manufactured by Nelson Industrial Company:Direct materials: $24 Direct Labor: 15 Variable overhead: 30 Fixed overhead: 18 Unit cost: 87 Line Item Description Cost Direct materials $24 Direct labor 15 Variable overhead 30 Fixed overhead 18 Unit cost $87 In addition, fixed selling costs are $500,000 per year, and variable selling costs are $12 per unit sold. Although production capacity is 600,000 units per year, the company expects to produce only 400,000 units next year. The product normally sells for $120 each. A customer has offered to buy 100,000 units for $90 each.If the firm produces the special order, the effect on income would be a(n): a. increase of $1.050,000. b. decrease of $900,000. c. decrease of $1,0500,000. d. increase of $900,000.arrow_forward

- Dinesh Bhaiarrow_forwardAndretti Company has a single product called a Dak. The company normally produces and sells 89,000 Daks each year at a selling price of $60 per unit. The company's unit costs at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 8.50 9.00 2.30 9.00 ($801,000 total) 3.70 2.50 ($222,500 total) $35.00 A number of questions relating to the production and sale of Daks follow. Each question is independent.arrow_forwardPolaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 30,000 Rets per year. Costs associated with this level of production and sales are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expense Fixed selling expense Unit $ 15 Total $ 450,000 8 240,000 3 90,000 9 270,000 4 120,000 6 180,000 $ 45 $ 1,350,000 Total cost The Rets normally sell for $50 each. Fixed manufacturing overhead is $270,000 per year within the range of 25,000 through 30,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 25,000 Rets through regular channels next year. A large retail chain has offered to purchase 5,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company…arrow_forward

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 86,400 units per year is: Direct materials Direct labor. Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $1.50 $ 2.00 $0.90 $ 5.15 $1.10 $ 1.00 The normal selling price is $20.00 per unit. The company's capacity is 102,000 units per year. An order has been received from a mail- order house for 1,300 units at a special price of $1700 per unit. This order would not affect regular sales or total fixed costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, sume the company's inventory includes 1,000 units that are inferior quality. The units must be sold through regular channels at a reduced price. The company does not expect the selling of these inferior…arrow_forwardAndretti Company has a single product called a Dak. The company normally produces and sells 86,000 Daks each year at a selling price of $62 per unit. The company’s unit costs at this level of activity are given below: Direct materials $ 9.50 Direct labor 9.00 Variable manufacturing overhead 3.20 Fixed manufacturing overhead 5.00 ($430,000 total) Variable selling expenses 4.70 Fixed selling expenses 4.00 ($344,000 total) Total cost per unit $ 35.40 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume Andretti Company has sufficient capacity to produce 111,800 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 30% above the present 86,000 units each year if it increased fixed selling expenses by $130,000. What is the financial advantage (disadvantage) of investing an additional $130,000 in fixed selling expenses? 1-b.…arrow_forwardDelta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 84,000 units per year is: Direct materials Direct labor Variable manufacturing overhead. Fixed manufacturing overhead Variable selling and administrative expense Fixed selling and administrative expense $ 2.50 $ 2.00 $ 0.80 $ 4.45 $ 1.20 $ 1.00 The normal selling price is $23.00 per unit. The company's capacity is 109,200 units per year. An order has been received from a mail-order house for 2,100 units at a special price of $20.00 per unit. This order would not affect regular sales or the company's total fixed costs. Required: 1. What is the financial advantage (disadvantage) of accepting the special order? 2. As a separate matter from the special order, assume the company's inventory includes 1,000 units of this product that were produced last year and that are inferior to the current model. The units must be sold through regular channels…arrow_forward

- Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company's normal activity level of 87,600 units per year is: Direct materials Direct labor Variable manufacturing overhead Fixed nanufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $2.40 5 3.00 5 0.80 $ 4.15 $ 1.70 $ 2.00 The normal selling price is $22.00 per unit. The company's capacity is 120,000 units per year. An order has been received from a mail- order house for 2,700 units at a special price of $19.00 per unit. This order would not affect regular sales or the company's total fixed costs. Required: 1. What is the financial advantege (disadvantage) of accepting the special order?arrow_forwardUrmilabenarrow_forwardPolaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell 36,000 Rets per year. Costs associated with this level of production and sales are given below: Unit Total Direct materials $ 20 $ 720,000 Direct labor 10 360,000 Variable manufacturing overhead 3 108,000 Fixed manufacturing overhead 9 324,000 Variable selling expense 2 72,000 Fixed selling expense 6 216,000 Total cost $ 50 $ 1,800,000 The Rets normally sell for $55 each. Fixed manufacturing overhead is $324,000 per year within the range of 31,000 through 36,000 Rets per year. Required: 1. Assume that due to a recession, Polaski Company expects to sell only 31,000 Rets through regular channels next year. A large retail chain has offered to purchase 5,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales commissions on this order; thus, variable selling expenses would be slashed by…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education