FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

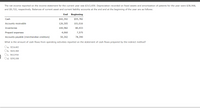

Transcribed Image Text:The net income reported on the income statement for the current year was $313,659. Depreciation recorded on fixed assets and amortization of patents for the year were $38,968,

and $9,722, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows:

End

Beginning

Cash

$42,392

$55,782

Accounts receivable

126,305

101,016

Inventories

100,582

80,433

Prepaid expenses

4,060

7,575

Accounts payable (merchandise creditors)

50,302

78,390

What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method?

Oa. $214,402

Ob. $432,360

Oc. $412,916

Od. $292,338

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please dont provide answer in an image format thank youarrow_forwardRequired information Exercise 12-12 (Algo) Indirect: Preparing statement of cash flows LO P2, P3, A1 [The following information applies to the questions displayed below.) The following financial statements and additional information are reported. IKIBAN INCORPORATED Comparative Balance Sheets At June 30 Assets Cash Accounts receivable, net Prepaid expenses Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable Total current liabilities Notes payable (long term) Total liabilities Equity Common stock, $5 par value Retained earnings Total liabilities and equity 2021 2020 $ 95,500 95,000 $ 64,000 83,800 71,000 116,500 6,400 9,400 280,700 260,900 144,000 (37,000) $ 387,700 $ 45,000 8,000 135,000 (19,000) $ 376,900 $ 60,000 19,000 7,800 5,400 58,400 86,800 50,000 80,000 108,400 166,800 260,000 180,000 19,300 30,100 $ 387,700 $ 376,900 Sales IKIBAN INCORPORATED Income Statement For…arrow_forwardCalculate cash balances based on the information provided in the chart below and show me how you did it Pro Forma Cash Flow Cash Received Cash from Operations Cash Sales $24,198 $100,099 $122,460 Cash from Receivables $46,108 $217,218 $342,905 Subtotal Cash from Operations $70,306 $317,317 $465,366 Additional Cash Received Sales Tax, VAT, HST/GST Received $0 $0 $0 New Current Borrowing $0 $0 $0 New Other Liabilities (interest-free) $0 $0 $0 New Long-term Liabilities $0 $40,000 $0 Sales of Other Current Assets $0 $0 $0 Sales of Long-term Assets $0 $0 $0 New Investment Received $0 $0 $0 Subtotal Cash Received $70,306 $357,317 $465,366 Expenditures Year 1 Year 2 Year 3 Expenditures from Operations Cash Spending $167,000 $225,200 $229,200 Bill Payments $75,294 $124,114 $152,785 Subtotal Spent on Operations $242,294 $349,314 $381,985 Additional Cash Spent Sales Tax,…arrow_forward

- Free cash flow Dillin Inc. reported the following on the company’s statement of cash flows in 20Y2 and 20Y1: Line Item Description 20Y2 20Y1 Net cash flows from operating activities $520,000 $485,000 Net cash flows used for investing activities (432,000) (394,000) Net cash flows used for financing activities (42,000) (58,800) Of the net cash flows used for investing activities, 60% was used for the purchase of property, plant, and equipment. a. Determine Dillin’s free cash flow for both years.arrow_forwardPB4. LO 16.3 Use the following information from Isthmus Company's financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018. Dec. 31, 2018 Dec. 31, 2017 Cash Account Receivable Inventory Accounts Payable Salaries Payable $295,000 45,300 92,200 23,000 1,700 $259,000 48,700 91,000 26,300 1,500 Additional information: Net income 45,200 33,300 Depreciation expensearrow_forwardNonearrow_forward

- Statement of Cash Flows—Indirect Method The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Assets Cash $303,530 $282,030 Accounts receivable (net) 109,960 101,290 Inventories 310,400 299,900 Investments 0 116,190 Land 159,210 0 Equipment 342,470 265,140 Accumulated depreciation—equipment (80,180) (71,500) Total assets $1,145,390 $993,050 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $207,320 $195,630 Accrued expenses payable (operating expenses) 20,620 25,820 Dividends payable 11,450 8,940 Common stock, $10 par 61,850 48,660 Paid-in capital in excess of par—common stock 232,510 135,050 Retained earnings 611,640 578,950 Total liabilities and stockholders’ equity $1,145,390 $993,050 Additional data obtained from an examination of the accounts in the ledger for…arrow_forwardStatement of Cash Flows The comparative balance sheet of Hirayama Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 Assets Cash $234 $18 Accounts receivable (net) 70 63 Inventories 150 127 Land 320 422 Equipment 262 224 Accumulated depreciation—equipment (87) (54) Total assets $949 $800 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) $65 $47 Dividends payable 6 - Common stock, $1 par 160 102 Excess of paid-in capital over par 109 90 Retained earnings 609 561 Total liabilities and stockholders' equity $949 $800 The following additional information is taken from the records: Land was sold for $153. Equipment was acquired for cash. There were no disposals of equipment during the year. The common stock was issued for cash. There was a $79 credit to Retained Earnings for net income. There was a $31 debit to Retained…arrow_forwarduse the information in the income statement below to calculate operating cash flow (OCF). sales- $1,280 COGS- $620 Dep Exp- $180 EBIT- $480 Int Exp- $110 EBT- $370 Taxes- $78 NI- $292arrow_forward

- Instructions: Prepare a statement of cash flows for the year ended December 31, Problem 2 SATT KEXLER COMPANY efhiogitarorT 13,000 Comparative Balance Sheet 18,000 iosgu14,000ot 9,000 ba Dec. 2021 fon ai Dec. 2020 armald Assets etnlog-30 $28,000 Cash Accounts receivable Prepaid expenses Inventory Long-term investments Equipment Accumulated depreciation-equipment Total assets tye 25,000ntne 15,000 rot Inova oreahtnolen0-t 18,000 ol 30,000 (14,000) baimenydr no 7:000 60,000 (18,000) $85,000 50S ynune120,000 Liabilities and Stockholders' Equity $ 25,000 37,000 40,000 18,000 $120,000 1. Net income for the year ending December 31, 2021, was $25.000. 2. Cash dividends of $17,000 were declared and paid during the year. Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity $ 7,000 45,000 23,000 10,000 o lsu $85,000 Additional information: Long-term investments that had a book value of $18,000 were sold for $18.000. 4. There is no sale of…arrow_forwardCash received from long-term notes payable Purchase of investments Cash dividends paid Interest paid Financing Activities $ 56,000 14, 200 Compute cash flows from financing activities using the above company information. Note: Amounts to be deducted should be indicated by a minus sign. $ 45,600 22,800 0arrow_forwardStatement of Cash Flow Preparation Activity Consider the following journal entries: Entry (a) cash $4 %$4 81,000.00 common stock 81,000.00 (b) treasury stock 13,000.00 cash 13,000.00 (c) cash 60,000.00 sales revenue 60,000.00 (d) land 87,700.00 cash 87,700.00 (e) depreciation expense 9,000.00 accumulated depreciation 9,000.00 (f) dividends payable 16,500.00 cash 16,500.00 (g) land 18,000.00 cash 18,000.00 (h) cash 7,200.00 7,200.00 equipment (1) bonds payable cash 45,000.00 45,000.00 (1) building 164,000.00 164,000.00 note payable, long-term (k) loss on disposal of equipment | 1,400.00 equipment, net 1,400.00 Indicate whether each transaction would result in an operating activity, an investing activity, or a financing activity for an indirect method statement of cash flow and the accompanying schedule of non-cash investing and financing activities. Click here to enter text. %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education