FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

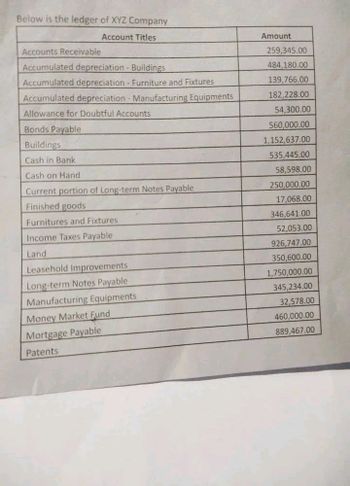

Transcribed Image Text:Below is the ledger of XYZ Company

Account Titles

Accounts Receivable

Accumulated depreciation - Buildings

Accumulated depreciation - Furniture and Fixtures

Accumulated depreciation - Manufacturing Equipments

Allowance for Doubtful Accounts

Bonds Payable

Buildings

Cash in Bank

Cash on Hand

Current portion of Long-term Notes Payable

Finished goods

Furnitures and Fixtures

Income Taxes Payable

Land

Leasehold Improvements

Long-term Notes Payable

Manufacturing Equipments

Money Market Fund

Mortgage Payable

Patents

Amount

259,345.00

484,180.00

139,766.00

182.228.00

54,300.00

560,000.00

1,152,637.00

535,445.00

58,598.00

250,000.00

17,068.00

346,641.00

52,053.00

926,747.00

350,600.00

1,750,000.00

345,234.00

32,578.00

460,000.00

889,467.00

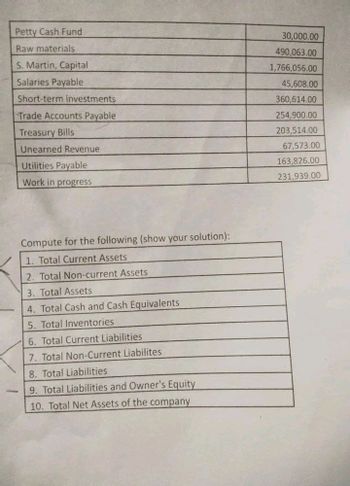

Transcribed Image Text:Petty Cash Fund

Raw materials

S. Martin, Capital

Salaries Payable

Short-term investments

Trade Accounts Payable

Treasury Bills

Unearned Revenue

Utilities Payable

Work in progress

Compute for the following (show your solution):

1. Total Current Assets

2. Total Non-current Assets

3. Total Assets

4. Total Cash and Cash Equivalents

5. Total Inventories

6. Total Current Liabilities

7. Total Non-Current Liabilites

8. Total Liabilities

9. Total Liabilities and Owner's Equity

10. Total Net Assets of the company

30,000.00

490,063.00

1,766,056.00

45,608.00

360,614.00

254,900.00

203,514.00

67,573.00

163,826.00

231,939.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 10 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data table (Click on the icon in order to copy its contents into a spreadsheet.) Inventory Common stock Cash Operating expenses Short-term notes payable Interest expense Depreciation expense Sales Accounts receivable Accounts payable Long-term debt Cost of goods sold Buildings and equipment Accumulated depreciation Taxes General and administrative expense Retained earnings 6,470 45,070 16,570 1,380 600 870 540 12,740 9,560 4,750 54,860 5,710 122,330 33,960 1,400 870 ? I Xarrow_forwardHelp please with this questionarrow_forwardSe.104.arrow_forward

- Suppose the following items were taken from the December 31, 2025, assets section of the Boeing Company balance sheet. (All dollars are in millions.) Inventory Notes receivable-due after December 31, 2026 Notes receivable-due before December 31, 2026 Accumulated depreciation-buildings eTextbook and Media List of Accounts Save for Later TS V $16,140 > 5,530 345 12,530 Patents Buildings Cash Prepare the assets section of a classified balance sheet. (List the Current Assets in order of liquidity. Enter amounts in millions) Accounts receivable Debt investments (short-term) BOEING COMPANY Partial Balance Sheet (in millions) Assets $13,040 20,700 $ 7.900 5,590 1,590 Assistance Used Attempts: 0 of 3 used Submit Answerarrow_forwardPrepare a blance sheetarrow_forwardPlease help mearrow_forward

- i need the answer quicklyarrow_forwardaarrow_forwardListed below is a selection of accounts found in the general ledger of Marshall Corporation as of December 31, 2026: Accounts receivable Research & development costs Goodwill Internet domain name Organization costs Initial operating loss Prepaid insurance Non-competition agreement Radio broadcasting rights Customer list Premium on bonds payable Video copyrights Trade name Notes receivable Instructions List those accounts that should be classified as intangible assets.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education