Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

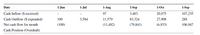

What is the cash position (overdraft) amount for the 1-Aug column in the table?

Transcribed Image Text:Date

1-Jun

1-Jul

1-Aug

1-Sep

1-Oct

1-Sep

Cash Inflow ($ received)

97

3,483

20,975

107,235

Cash Outflow ($ expended)

100

3,584

11,579

83,324

27,908

288

Net cash flow for month

(100)

(11,482)

(79,841)

(6,933)

106,947

Cash Position (Overdraft)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- WHAT DOES THE STATEMENT OF CASH FLOWS SHOW US?arrow_forwardConsider the following cash flows: Year Cash Flow 0 –$ 34,000 1 13,600 2 18,100 3 11,000 What is the IRR of the cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardWhat is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year Cash Flow 0 –$ 17,300 1 8,000 2 9,300 3 7,800arrow_forward

- Direction: Define, draw the cash flow diagram, and write the general formula of the following: ANNUITY 1. Ordinary Annuity a) Sum/Future of Ordinary Annuity b) Present Worth of Ordinary Annuity 2. Annuity Due 3. Deferred Annuityarrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forwardDistribution lines on a journal entry are also shown on the Statement of Cash Flows. True or Falsearrow_forward

- Please solve using Excel and show formulas. You have decided to buy a car with price tag of $60,000 but you are able to negotiate the price down to $58,000. You have $5,000 saved, so you need to borrow $53,000 in a 5-year loan from your bank (your bank offers lower rates than the auto-dealer) at a 4.5% APR (annual rate). How much will you owe to the bank after 3 years?arrow_forwardConsider the following cash flows: Year Cash Flow 0 –$ 32,500 1 14,300 2 17,400 3 11,700 What is the IRR of the cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardWhat is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year 0 -~3 1 2 IRR Cash Flow -$ 16,900 7,600 8,900 7,400 %arrow_forward

- 3.arrow_forwardCan you please write the calculations step by step including the formulas. How did you calculate the Cash flow in order to calculate the cumulative cash flow after that?arrow_forwardWhat is the IRR of the following set of cash flows? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Year 0 1 2 23 IRR Cash Flow -$ 16,600 7,300 8,600 7,100 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education