FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

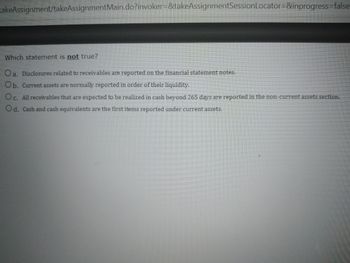

Transcribed Image Text:**Question: Identifying Incorrect Statements About Financial Reporting**

Below are statements regarding the reporting of receivables and other financial items. One of these statements is NOT true. Read each statement carefully to determine which one is incorrect:

a. Disclosures related to receivables are reported on the financial statement notes.

b. Current assets are normally reported in order of their liquidity.

c. All receivables that are expected to be realized in cash beyond 265 days are reported in the non-current assets section.

d. Cash and cash equivalents are the first items reported under current assets.

**Explanation:**

- **Option a:** This statement is true. Disclosures related to receivables, including important details and additional information, are indeed reported in the notes accompanying financial statements.

- **Option b:** This statement is true. Current assets are typically listed in order of liquidity, meaning the ease with which they can be converted to cash. This usually starts with cash and cash equivalents and proceeds to accounts receivable, inventory, etc.

- **Option c:** This statement is true. Receivables expected to be realized in cash beyond a standard operating cycle (often 365 days) are classified as non-current assets.

- **Option d:** This statement is true. Cash and cash equivalents are typically the first items listed under current assets due to their high liquidity.

Identify the statement that is NOT true based on the discussion above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- show how the accounts related to the preceding sale and collection activities shoukd be reported on the current year income statement PLEASE DO NOT ANSWER IMAGE FORMETarrow_forwardAnswer full question.arrow_forwardCan you add the information to the table below. Accounts Receivable Beginning balance Ending Balance 0 What is the net increase or decrease in the Cash account for year 2021?arrow_forward

- Other receivables, where collection is expected beyond one year, are classified as noncurrent assets and reported on the Balance Sheet under the caption O Cash and Cash Equivalents O Investments O none of these answers are correct O Fixed Assetsarrow_forwardMatch each description to the appropriate term. Clear All Measures how frequently during the year accounts Net realizable value receivable are being turned into cash Amounts owed by customers Receivables documented by a formal written instrument of credit All money claims against Notes receivable other entities The difference between Accounts receivable accounts receivable and turnover allowance for doubtful accountsarrow_forwardMatch the term with its definition. Allowance Method Cash Factoring Net Realizable Value Percentage-of-Receivables Method Restricted Cash A procedure that records unc [Choose ] Time Elapsed: Hide Time Attempt due: Apr 7 at 11:59pm 18 Hours, 38 Minutes, 32 Seconds The amount of the accounts receivable balance that the company actually expects to receive. Correct Answer A procedure that records uncollectible accounts by recording the bad debt expense on an estimated basis in the accounting period in which the sale on accout takes place. C A method of selling accounts receivable where the seller guarantees payment to the purchaser in the event the debtor fails to pay. Correct Answer short term investments with a maturity date of three months or less Generated through transactions from customers for goods bought or services rendered. Correct Answer When material, is required to be segregated and shown as either a current or long term asset on the balance sheet depending on it's expected…arrow_forward

- The income statement and the cash flows from operating activities section of the statement of cash flows are provided below for Syntric Company. The merchandise inventory account balance neither increased nor decreased during the reporting period. Syntric had no liability for insurance, deferred income taxes, or interest at any time during the period. Sales Cost of goods sold Gross margin Salaries expense Insurance expense Depreciation expense Depletion expense Interest expense Gains and losses: Gain on sale of equipment Loss on sale of land Income before tax Income tax expense SYNTRIC COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Net income Cash Flows from Operating Activities: Cash received from customers Cash paid to suppliers Cash paid to employees Cash paid for interest Cash paid for insurance Cash paid for income tax Net cash flows from operating activities $35.0 16.9 9.0 3.4 10.4 $ 271.7 (168.8) 102.9 (74.7) 19.0 (6.4) 40.8 (20.4) $ 20.4 $225.0…arrow_forwardThe statement of cash flows is normally a required basic financial statement for each period for which an earnings statement is presented. The statement should include a separate schedule listing the financing and investing activities not involving cash. Required: What are financing and investing activities not involving cash? What are two types of financing and investing activities not involving cash? Explain what effect, if any, each of the following seven items would have on the statement of cash flows. accounts receivable inventory depreciation deferred tax liability issuance of long-term debt in payment for a building payoff of current portion of debt sale of a fixed asset resulting in a loss or gainarrow_forwardCalculate the cash discount and the net amount due the transaction (in $). Amount ofInvoice Terms ofSale CashDiscount NetAmount Due $15,660.00 2/10, n/45 $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education