FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

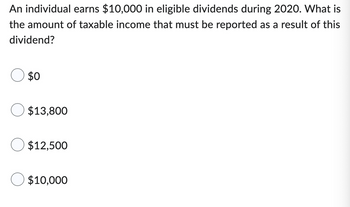

Transcribed Image Text:An individual earns $10,000 in eligible dividends during 2020. What is

the amount of taxable income that must be reported as a result of this

dividend?

$0

$13,800

$12,500

$10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- X derived the following income in 2020, shade A if the income is subject to regular income tax, B if it is subject to final tax, C if it subject to capital gains tax and D if it is exemptarrow_forwardWhat amount of business tax arising from the third quarter transactions?arrow_forwardThe Snella Company reports 2023 Pre-tax Net Income of $10,000. The following items exist: Premiums Paid for Key Officer Life Insurance Accrued Revenues Unearned Revenues $ 200 $ 80 $ 50 The tax rate is 20%, Indicate the amounts for 2023 Income Tax Expense and 12/31/23 Income Tax Payable, respectively: Select one: a. $2,040, $2,034 b. $1,960, $1,934 Oc. $1,960, $1,986 d. $2,040, $1,986 e. $2,034, $2,034arrow_forward

- For the 2022 tax year, llex Corporation has ordinary income of $200,000, a short-term capital loss of $30,000 and a long-term capital gain of $10,000. Calculate llex Corporation's tax liability for 2022. fill in the blank 1 of 1$.arrow_forward1. soru At the end of 2019, The Business with 20% Corporate tax rate has Expenses: TL3.150.000 and Revenues: TL3.375.000. How much is the Tax Payable if the business prepaid income tax of TL15.000 during the accounting period? a.TL30.000 b.TL15.000 c.TL45.000 d.TL60.000arrow_forwardA single taxpayer has the following information for 2020: $195,000 23,500 1,500 8,900 14,800 AGI State income taxes State sales tax Real estate taxes Gambling losses (gambling gains were S$5,000) The taxpayer's total allowable itemized deductions for 2020 are: A) $15,000 B) $47,200 C) $38,900 D) $24,800arrow_forward

- A single taxpayer provided the following information for 2022: Salary $80,000 Interest on local government bonds (qualifies as a tax exclusion) 4,000 Allowable itemized deductions 13,000 What is taxable income?arrow_forwardi need the answer quicklyarrow_forwardWhat is this individual's gross personal cash flow available for debt service if an individual's personal tax returns list: Wages and salaries are $80,000; Non-taxable amount of retirement distribution is $4,000; Taxable amount of retirement distribution is $21,000; Net profit from a sole proprietorship is $8,000; Depreciation within the sole proprietorship is $7,000; Annual living expenses on the individual's personal financial statements are $16,000.arrow_forward

- What is the tax liability for a couple with 2 children and a taxable income of $102,000? Group of answer choices $16,274 $13,055 $17,880 $12,847arrow_forwardA single person has taxable income of $85,000 per year. She earns $1,800 in interest from a certificate of deposit. How much federal income tax expense will be calculated on these earnings? Tax year 2019. Deduction amount 12,200. Tax rate 24%arrow_forwardhardilkarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education