FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

![!

Required information

Problem 7-45 (LO 7-2) (Algo)

[The following information applies to the questions displayed below.]

Matt and Meg Comer are married and file a joint tax return. They do not have any children.

Matt works as a history professor at a local university and earns a salary of $69,600. Meg

works part time at the same university. She earns $33,800 a year. The couple does not

itemize deductions. Other than salary, the Comers' only other source of income is from the

disposition of various capital assets (mostly stocks). (Use the tax rate schedules,

Dividends and Capital Gains Tax Rates.)

Note: Round your final answers to the nearest whole dollar amount.

Problem 7-45 Part-a (Algo)

a. What is the Comers' tax liability for 2022 if they report the following capital gains and losses for the year?

$ 9,800

(2,400)

Short-term capital gains

Short-term capital losses

Long-term capital gains

Long-term capital losses

15,800

(6,400)

Total tax liability](https://content.bartleby.com/qna-images/question/c8f05c49-8089-4092-b265-7f390ec44542/80fb7ec9-27b1-45f6-8446-c3f62a84eaf1/1qall2_thumbnail.jpeg)

Transcribed Image Text:!

Required information

Problem 7-45 (LO 7-2) (Algo)

[The following information applies to the questions displayed below.]

Matt and Meg Comer are married and file a joint tax return. They do not have any children.

Matt works as a history professor at a local university and earns a salary of $69,600. Meg

works part time at the same university. She earns $33,800 a year. The couple does not

itemize deductions. Other than salary, the Comers' only other source of income is from the

disposition of various capital assets (mostly stocks). (Use the tax rate schedules,

Dividends and Capital Gains Tax Rates.)

Note: Round your final answers to the nearest whole dollar amount.

Problem 7-45 Part-a (Algo)

a. What is the Comers' tax liability for 2022 if they report the following capital gains and losses for the year?

$ 9,800

(2,400)

Short-term capital gains

Short-term capital losses

Long-term capital gains

Long-term capital losses

15,800

(6,400)

Total tax liability

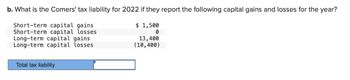

Transcribed Image Text:b. What is the Comers' tax liability for 2022 if they report the following capital gains and losses for the year?

$ 1,500

Short-term capital gains

Short-term capital losses

Long-term capital gains

Long-term capital losses

0

13,400

(10,400)

Total tax liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ______________ is the tax payment deadline for all individual taxpayers regardless if they have self-employment or unincorporated business income to report in 2021?arrow_forwardDuring 2020, Joan Matel is a resident of Ontario, Canada and has calculated her Taxable Income to be $56,700. Assume that Ontario’s rates are 5.05 percent on Taxable Income up to $48,535 and 9.15 percent on the next $48,534. Calculate her 2020 federal and provincial Tax Payable before consideration of credits, and her average rate of tax.arrow_forwardData: Alice is single and self-employed in 2020. Her net business profit on her Schedule C for the year is $200,000. Question: What is her self-employment tax liability and additional Medicare tax liability for 2020? Thx, Stephaniearrow_forward

- Determine from the tax table the amount of the income tax for each of the following taxpayers for 2020: Taxpayer(s) Filing Status Taxable Income Income Tax Allen Single $ 30,000 $______________________ Boyd MFS 34,545 $______________________ Caldwell MFJ 55,784 $______________________ Dell H of H 67,450 $______________________ Evans Single 75,000 $______________________arrow_forwardAre the following required to file a federal income tax return? 17 yr od dependent receives income from a trust of $1,000arrow_forwardWhat is Target’s liability for unrecognized tax benefits as of January 30, 2016? IfTarget were to prevail in court and realize $50 million more in tax savings than itthought more likely than not to occur, what would be the effect on the liability forunrecognized tax benefits and on net income?arrow_forward

- What will be the total tax (Federal + Provincial) for a taxable income of $92,340? Do calculation and choose answer. (Use the Federal Tax Rates for 2023 and Sample Question.) $28,447.08 $21,913.54 $18,642.60 $25,228.96arrow_forwardDetermine from the tax table or the tax rate schedule, whichever is appropriate, the amount of the income tax for each of the following taxpayers for 2020. Please show all work and calculations where appropriate. Taxpayer(s) Filing Status Taxable Income Income Tax Macintosh Single $35,700 Hindmarsh MFS $62,000 Kinney MFJ $143,000 Rosenthal H of H $91,500 Wilk Single $21,400arrow_forwardIf an individual itemizes deductions on his or her tax return, he or she may: a. deduct the gross unreimbursed medical expenses paid for the year b. deduct the net unreimbursed medical expenses paid for the year c. deduct 80% of the gross unreimbursed medical expenses paid for the year d. deduct 80% of the net unreimbursed medical expenses paid for the yeararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education