SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with general accounting question

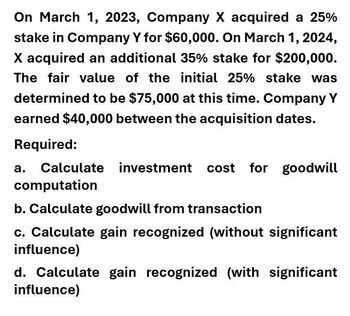

Transcribed Image Text:On March 1, 2023, Company X acquired a 25%

stake in Company Y for $60,000. On March 1, 2024,

X acquired an additional 35% stake for $200,000.

The fair value of the initial 25% stake was

determined to be $75,000 at this time. Company Y

earned $40,000 between the acquisition dates.

Required:

a. Calculate investment cost for goodwill

computation

b. Calculate goodwill from transaction

c. Calculate gain recognized (without significant

influence)

d. Calculate gain recognized (with significant

influence)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Buchanan Imports purchased McLaren Corporation for $5,000,000 cash when McLaren had net assets worth $4,500,000. A. What is the amount of goodwill in this transaction? B. What is Buchanans journal entry to record the purchase of McLaren? C. What journal entry should Buchanan write when the company internally generates additional goodwill in the year following the purchase of McLaren?arrow_forwardTimberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $830,000. The estimated market values of the purchased assets are building, $499,800; land, $284,200; land improvements, $29,400; and four vehicles, $166,600. Required:1-a. Allocate the lump-sum purchase price to the separate assets purchased.1-b. Prepare the journal entry to record the purchase.2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $31,000 salvage value.3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation.arrow_forwardTimberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $900,000. The estimated market values of the purchased assets are building, $508,800; land, $297,600; land improvements, $28,800; and four vehicles, $124,800. Required 1. Allocate the lump-sum purchase price to the separate assets purchased. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $27,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Analysis Component 4. Compared to straight-line depreciation, does accelerated depreciation result in payment of less total taxes over the asset’s life?arrow_forward

- Timberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $840,000. The estimated market values of the purchased assets are building, $484, 500; land, $304,000; land improvements, $66,500; and four vehicles, $95,000. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1 - b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining - balance depreciation.arrow_forwardTimberly Construction makes a lump-sum purchase of several assets on January 1 at a total cash price of $820,000. The estimated market values of the purchased assets are building, $527,350; land, $308,450; land improvements, $49,750; and four vehicles, $109,450. Required: 1-a. Allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $31,000 salvage value. 3. Compute the first-year depreciation expense on the land improvements assuming a five-year life and double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 2 Required 3 Allocate the lump-sum purchase price to th separate assets purchased. Total cost of Acquisition Allocation of total cost Building Land Land improvements Vehicles Total Estimated Market Value $ 0…arrow_forwardTimberly Construction makes a lump -sum purchase of several assets on January 1 at a total cash price of $850,000. The estimated market values of the purchased assets are building, $458, 150; land, $317,900; land improvements, $ 65,450; and four vehicles, $93,500. Required: 1-a. Allocate the lump - sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the first-year depreciation expense on the building using the straight-line method, assuming a 15-year life and a $30,000 salvage value. 3. Compute the first -year depreciation expense on the land improvements assuming a five-year life and double-declining - balance depreciation.Complete this question by entering your answers in the tabs below.arrow_forward

- Global Positioning Net purchased equipment on January 1, 2018, for $15,233. Suppose Global Positioning Net sold the equipment for $11,000 on December 31, 2020. Accumulated Depreciation as of December 31, 2020, was $10,155. Journalize the sale of the equipment, assuming straight-line depreciation was used. First, calculate any gain or loss on the disposal of the equipment. Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss)arrow_forwardUse the following information for the next six questions. You are auditing the financial statements of DISUKO Corporation and obtained the following information. DISUKO acquired an investment for P1,000,000. Transaction costs amount to P10,000. At year-end, the investment has a fair value of P900,000. 1. If the investment is classified as financial asset at fair value through profit or loss, how much would it be recorded upon acquisition? 2. If the investment is classified as financial asset at fair value through profit or loss, what is the amount of unrealized gain or loss to be reported in the statement of comprehensive income? 3. If the investment is classified as financial asset at fair value through other comprehensive income, how much would it be recorded upon acquisition? 4. If the investment is classified as as financial asset at fair value through other comprehensive income, what is the amount of unrealized gain or loss. to be reported in the income statement? 5. If the…arrow_forwardSolve the task that is attachedarrow_forward

- On July 1, 2018, Mundo Corporation purchased factory equipment for $50,000. Residual value was estimated at $2,000. The equipment will be depreciated over 10 years using the doubledeclining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depreciation expense of:arrow_forwardIf you are told that LSJ Company’s plant property and equipment value at 12/31/2023 is $750,000 of the company’s total assets of $1,000,000 …Apply your vertical analysis skills and calculate what percentage the PPE represents of total assets.arrow_forwardJRE2 Incorporated entered into a contract to install a pipeline for a fixed price of $2,365,000. JRE2 recognizes revenue upon contract completion. Estimated Cost to Complete. $ 1,660,000 621,000 0 Cost incurred. 2023 2024 2025 $ 272,000 1,710,000 560,000 In 2025, JRE2 would report gross profit (loss) of: . Multiple Choice $(177,000) $84,000, $61,000 $20.222arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT