SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

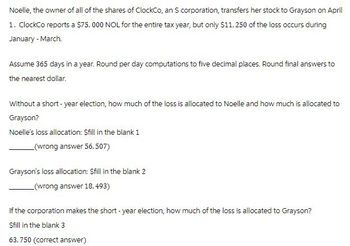

Transcribed Image Text:Noelle, the owner of all of the shares of ClockCo, an S corporation, transfers her stock to Grayson on April

1. ClockCo reports a $75,000 NOL for the entire tax year, but only $11, 250 of the loss occurs during

January-March

Assume 365 days in a year. Round per day computations to five decimal places. Round final answers to

the nearest dollar.

Without a short - year election, how much of the loss is allocated to Noelle and how much is allocated to

Grayson?

Noelle's loss allocation: $fill in the blank 1

(wrong answer 56,507)

Grayson's loss allocation: Sfill in the blank 2

(wrong answer 18, 493)

If the corporation makes the short-year election, how much of the loss is allocated to Grayson?

Sfill in the blank 3

63,750 (correct answer)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the last five months of the year, Dwana opens a new Internet telecommunications business called Dwan-Com. Dwan-Com bills 50,000 of revenues, but receives only 40,000 cash. Dwan-Com incurs 3,000 of supply expenses, and 41,000 of labor costs. Dwan-Com pays for 2,200 of the supplies and 38,000 of the labor costs in the current year. a. What is Dwan-Coms taxable income if it elects the cash method of accounting? b. What is Dwan-Coms taxable income if it elects the accrual method of accounting? c. What method of accounting do you recommend that Dwan-Com elect?arrow_forwardNoelle, the owner of all of the shares of ClockCo, an S corporation, transfers her stock to Grayson on April 1. ClockCo reports a $90,000 NOL for the entire tax year, but only $13,500 of the loss occurs during January-March. Assume 365 days in a year. Round per day computations to five decimal places. Round final answers to the nearest dollar. Without a short-year election, how much of the loss is allocated to Noelle and how much is allocated to Grayson? Noelle's loss allocation: $ X Grayson's loss allocation: X If the corporation makes the short-year election, how much of the loss is allocated to Grayson? 76,500arrow_forwardTabitha sells real estate on March 2 of the current year for $366,400. The buyer, Ramona, pays the real estate taxes of $18,320 for the calendar year, which is the real estate property tax year. Round any division to four decimal places and use in subsequent calculations. Round your final answers to the nearest dollar. Assume a 365-day year. a. Determine the real estate taxes apportioned to and deductible by the seller, Tabitha, and the amount of taxes deductible by Ramona. Tabitha: $ Ramona: $ b. Calculate Ramona's basis in the property and the amount realized by Tabitha from the sale. Tabitha: $ Ramona: $arrow_forward

- Taylor Corporation is a calendar year taxpayer. Devon owns all of its stock. Her basis for the stock is $5,000. On April 1 of the current (non-leap) year Taylor distributes $54,000 to Devon. Read the requirement. a. Current earnings and profits (E&P) of $20,000; accumulated E&P of $18,000. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar. Complete all input fields. For zero amounts, enter a 0. Use parentheses or a minus sign for losses and E&P deficits.) Situation a. Distribution Dividend income Remaining distribution Return of capital Capital gain (loss) Carryforward accumulated E&P Requirement Determine the tax consequences of the cash distribution in each of the following independent situations: a. Current E&P of $20,000; accumulated E&P of $18,000. b. Current E&P of $26,000; accumulated E&P deficit of $(16,000). C. Current E&P deficit of $(70,000); accumulated E&P of $50,000. d. Current E&P deficit of $(16,000); accumulated…arrow_forwardPlease help me to solve this problemarrow_forwardGary receives $40,000 worth of Quantro, Inc., common stock from his late grandmother's estate. Early in the year, he receives a $100 cash dividend. Four months later, he received a 2% stock dividend. Near the end of the year, Gary sells the stock for $42,000. Due to these events only, how much must Gary include in his gross income for the year?arrow_forward

- At the beginning of the tax year, Lizzie holds a $10,000 stock basis as the sole shareholder of Spike, Inc., an S corporation. During the year, Spike reports the following: Net taxable income from sales $25,000 Net short-term capital loss (18,000) Cash distribution to Lizzie, 12/31 40,000 If an amount is zero, enter "0". a. Determine Lizzie's stock basis at the end of the year. $fill in the blank 1. b. Of Lizzie's $40,000 cash distribution, $fill in the blank 2 is tax-free and $fill in the blank 3 is . c. $fill in the blank 5 of the short-term capital loss is suspended this year.arrow_forwardNonearrow_forwardMike Barton owns Barton Products, In. The corporation has 30 employees. Barton Corporation expects $800,000 of net income before taxes in 2021. Mike is married and files a joint return with his wife, Elaine, who has no carnings of her own. Mike and Elaine have no other income, file a joint tax return, and claim the standard deduction. Mike's salary is $200,000 per year (already deducted in computing Barton Corporation's $800,000 net income).A. Identify and write down the given facts. Then, calculate the tax liability for Barton Corporation and for Mike and Elaine. B. Should Mike increase his salary from Barton by $50,000 to reduce the overall tax burden to himself and Barton Products? Because of the Social Security cap, the corporation and Mike each would incur a 1,45% payroll tax with the corporate portion being deductible.arrow_forward

- Andrew, who is single, retired from his job this year. He received a salary of $26,000 for the portion of the year that he worked, tax-exempt interest of $2,600, and dividends from domestic corporations of $3,700. On October 1, he began receiving monthly pension payments of $700 and Social Security payments of $500. Assume an exclusion ratio of 40% for the pension. Andrew owns a duplex that he rents to others. He received rent of $11,000 and incurred $16,000 of expenses related to the duplex. He continued to actively manage the property after he retired from his job. Requirement Compute Andrew's adjusted gross income. Salary Dividend income 26,000 3,700 Rental income 11,000 Social security income (taxable portion) ? Pension income (taxable portion) Gross income Minus: Deductions for Adjusted gross income Rental income Adjusted gross income -16,000arrow_forwardAndrew, who is single, retired from his job this year. He received a salary of $22,000 for the portion of the year that he worked, tax-exempt interest of $3,800, and dividends from domestic corporations of $2,600. On September 1, he began receiving monthly pension payments of $900 and Social Security payments of $500. Assume an exclusion ratio of 40% for the pension. Andrew owns a duplex that he rents to others. He received rent of $11,000 and incurred $16,000 of expenses related to the duplex. He continued to actively manage the property after he retired from his job. Requirement Compute Andrew's adjusted gross income. Gross income Minus: Deductions for Adjusted gross income Adjusted gross incomearrow_forwardAndrew, who is single, retired from his job this year. He received a salary of $24,000 for the portion of the year that he worked, tax-exempt interest of $3,000, and dividends from domestic corporations of $3,900. On August 1, he began receiving monthly pension payments of $1,200 and Social Security payments of $500. Assume an exclusion ratio of 40% for the pension. Andrew owns a duplex that he rents to others. He received rent of $9,000 and incurred $11,000 of expenses related to the duplex. He continued to actively manage the property after he retired from his job. Requirement Compute Andrew's adjusted gross income. Salary Dividend income Pension income (taxable portion) Rental income Social security income (taxable portion) Gross income Minus: Deductions for Adjusted gross income Rental expenses Adjusted gross incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT