FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

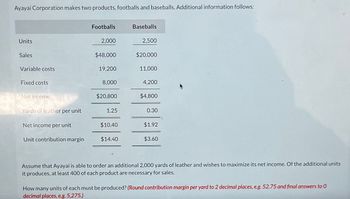

Transcribed Image Text:Ayayai Corporation makes two products, footballs and baseballs. Additional information follows:

Footballs

Baseballs

Units

2,000

2,500

Sales

$48,000

$20,000

Variable costs

19,200

11,000

Fixed costs

8,000

4,200

Net income

$20,800

$4,800

Yards of leather per unit

1.25

0.30

Net income per unit

$10.40

$1.92

Unit contribution margin

$14.40

$3.60

Assume that Ayayai is able to order an additional 2,000 yards of leather and wishes to maximize its net income. Of the additional units

it produces, at least 400 of each product are necessary for sales.

How many units of each must be produced? (Round contribution margin per yard to 2 decimal places, e.g. 52.75 and final answers to O

decimal places, e.g. 5,275.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Smoky Mountain Corporation makes two types of hiking boots—the Xtreme and the Pathfinder. Data concerning these two product lines appear below: Xtreme Pathfinder Selling price per unit $ 120.00 $ 87.00 Direct materials per unit $ 65.20 $ 51.00 Direct labor per unit $ 11.20 $ 8.00 Direct labor-hours per unit 1.4 DLHs 1.0 DLHs Estimated annual production and sales 30,000 units 65,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Estimated total manufacturing overhead $ 2,033,000 Estimated total direct labor-hours 107,000 DLHs Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company’s traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing…arrow_forward1. Motor Division makes a motor that it sells to customers outside of the company. Data concerning this motor appear below: Selling Price to Outside Customers Variable Cost per Unit Total Fixed Costs Capacity in Units $ 250 180 $10,000 30,000 $ Consumer Division of the same company would like to use the motor manufactured by Motor Division in one of its products. Consumer Division currently purchases the part made by an outside company for $225 per unit. Consumer Division requires 3,000 units of the motor each period. Motor Division is currently selling 30,000 units to outside customers. If Motor Division sells to Consumer Division rather than to outside customers, the variable cost per unit would be $5 lower. What should be the lowest acceptable transfer price from the perspective of the Motor Division? A) B) C) D) E) $250. $175 $245. $180. $225arrow_forward3C AND 3Darrow_forward

- Zeta Company sells a single product with a selling price of $300 per unit. Per unit variable costs are $82.00 and total fixed costs are $127,500. The number of units Zeta needs to sell to achieve its target profit of $50,000 is closest to: 610 814 a. b. C. d. 1,555 2,165arrow_forwardYour Company sells 3 products, A, B and C that use the same company, facility and resources. Details are below: A Average monthly units sold 10,000 2,000 8,000 Sales price per unit 2,000 1,000 5,000 Variable cost per unit 1,500 500 3,000 Total break even units are 1,000. 1. Calculate: i. Quantity and value of units of each A, B and C at breakeven Fixed cost based on the data given above ii. 2. Without making further calculations, explain that if fixed cost increases by 10% what impact would this have on the break-even point?arrow_forwardThe following data are for Greasy Gary's Grubhouse: West East Sales volume (units): Hub Cap 14,000 9,000 Gas Can 6,500 18,000 Sales price per unit: Hub Cap $36 $28 Gas Can $22 $31 The variable cost of goods sold per unit Hub Cap $19 $17 Gas Can $9 $14 Variable selling and administrative per unit Hub Cap $ 5 $ 4 Gas Can $ 3 $2 (a) Complete a contribution margin by sales territory and by-product (b) Analyze the statements and comment on what can help the company in terms of profitability, product placement, and territory. List 3 pros and cons to each product and territory.arrow_forward

- CVP single product; comprehensiveBeantown Baseball Company makes baseballs that sell for $13 per two-pack. Current annual production and sales are 960,000 baseballs. Costs for each baseball are as follows:Direct material$2.00Direct labor1.25Variable overhead0.50Variable selling expenses0.25Total variable cost$4.00Total fixed overhead$1,250,000a. Calculate the unit contribution margin in dollars and the contribution margin ratio for the company.Note: Round percentage to two decimal places (for example, round 32.5555% to 32.56%).Unit contribution margin in dollars $AnswerContribution margin ratio Answer%\\narrow_forwardFRANCORP sells two products. Products M N Selling price per unit $80 $60 Less variable expenses per unit $46 $40 Contribution margin per unit $34 $20 Current demand per week (units) 2,100 2,400 Processing time required on machine XYZ per unit 2 min. 1 min. Machine XYZ is a constrained resource and is being used at 100% capacity. Machine XYZ has a capacity of 3,000 minutes per week. Assuming FRANCORP wants to maximize its total contribution margin, how much of each product should it produce? a. 2400 units of N and 300 units of M b. 300 units of N and 2100 units of M c. 1200 units of N and 1050 units of M d. 2400 units of N and 0 units of Marrow_forwardi need the answer quicklyarrow_forward

- Donnelly Company has three products, R2, R4, and R2D2. The following information is available: Product R2 Product R4 Product R2D2 Sales $30,000 $45,000 $12,000 Variable Costs 18,000 24,000 7,500 Contribution Margin 12,000 21,000 4,500 Fixed Costs: Avoidable 4,500 9,000 3,000 Unavoidable 3,000 4,500 2,700 Operating Income $4,500 $7,500 $(1,200) Donnelly Company is thinking of dropping Product R2D2 because it is reporting a loss. Assuming Donnelly drops Product R2D2 and does not replace it, what will happen to operating income?arrow_forwardManatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: Sales Price Variable Cost per Unit Product per Unit $275 350 395 Model 101 Model 201 Model 301 The current product mix is 4:3:2. The three models share total fixed costs of $657,000. $180 215 240 A. Calculate the sales price per composite unit. Sales price $ B. What is the contribution margin per composite unit? Contribution margin $ per composite unit Break-even point in dollars $ Break-even point in units per composite unit. C. Calculate Manatoah's break-even point in both dollars and units. unitsarrow_forwarddevubenarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education