Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

nik.2

answer must be in table format or i will give down vote

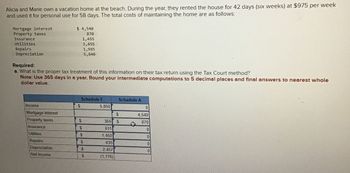

Transcribed Image Text:Alicia and Marie own a vacation home at the beach. During the year, they rented the house for 42 days (six weeks) at $975 per week

and used it for personal use for 58 days. The total costs of maintaining the home are as follows:

Mortgage interest

Property taxes

Insurance

Utilities

Repairs

Depreciation

Required:

$ 4,540

870

1,455

3,455

1,985

5,840

a. What is the proper tax treatment of this information on their tax return using the Tax Court method?

Note: Use 365 days in a year. Round your intermediate computations to 5 decimal places and final answers to nearest whole

dollar value.

Schedule E

Income

Mortgage interest

$

5,850

Schedule A

0

$

Property taxes

Insurance

Utilities

EA

365

65

$

4,540

870

+

$

611

$

1,450

Repairs

$

835

0

Depreciation

$

SA

2,457

0

Net income

$

(1,776)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sally owns a rental house. Her house income is 1000 a month. The expenses for the year are as follows: mortgage interest 3600, property tax is 1545, property manager is 1200, insurance 400, cleaning and maintenance 600 repairs 55 and depreciation 2000. What is Sally's net income loss from the rental property?arrow_forwardSubject: acountingarrow_forwardAmy financed the purchase of her living room suite over two years. Her monthly payments are $231.02 and she is charged an interest rate of 19.6% compounded semiannually. What was the purchase price of Amy’s furniture? ____________ b. How much is the cost of financing? _____________arrow_forward

- Vkarrow_forwardMargo and Bill file as MFJ. During the year, they paid the following: $6,500 Mortgage interest on main home (acquisition mortgage of $400,000) Credit card interest Auto loan interest Loan interest on an empty lot purchase to build a second home $ 400 $3,500 $2,500 What amount can they report as deductible mortgage interest? Answer:arrow_forwardDuring the year, Rita rented her vacation home for twelve days for $2,400 and she used it personally for three months. The following expenses were incurred on the home: Property taxes $ 2, 200 Mortgage interest 10, 800 Utilities and maintenance 1,900 Depreciation 5, 000 Insurance 900 Calculate the gross income recognized from the rental property a. $0 b. $780 c. $1,300 d. $2,400arrow_forward

- 6. In the current year, Clara rented her apartment on AirBnb for 13 days. She received gross rental income of $3,100. Her expenses for the apartment are: - Operating expenses $4,000 - Depreciation $2,000 - Mortgage interest and Property taxes $4,000 - Utilities/repairs $2,000 Calculate the income and expenses reported for the rental activity. What will Clara report on her tax return for this rental activity? $3,100 income, $3,100 expenses $3,100 income, $0 expenses Clara will not report anything. $3,100 income; $12,000 expensesarrow_forwardDuring the year (not a leap year), Anna rented her vacation home for 30 days, used it personally for 20 days, and left it vacant for 315 days. She had the following income and expenses: Rent income Expenses Real estate taxes Interest on mortgage Utilities Repairs Roof replacement (a capital expenditure) Depreciation $ 7,000 IF 2,500 9,000 2,400 1,000 12,000 7,500 a. Compute Anna's net rent income or loss and the amounts she can itemize on her tax return, using the court's approach to allocating property taxes and interest. b. How would your answer in part (a) differ using the IRS's method of allocating property taxes and interest?arrow_forwardaccarrow_forward

- A taxpayer owns a four-plex in Chicago, IL. She rents out 3 units and lives in the fourth. Her income and expenses for the entire four-plex are as follows: mortgage interest $8,200, property taxes $9,000, insurance $3,000, utilities $2,000, repairs and maintenance $1,000, depreciation on the entire complex of $5,000, and rental income of $25,000. What amount of net rental income or loss should she report on her current tax return?arrow_forwardJohn owns a second home in Palm Springs, CA. During the year, he rented the house for $5,000 for 56 days and used the house for 14 days during the summer. The house remained vacant during the remainder of the year. The expenses for the home included $5,000 in mortgage interest, $850 in property taxes, $900 for utilities and maintenance, and $3,500 of depreciation. What is John's deductible rental loss, before considering the passive loss limitations? $200 $875 $2,500 $3,200 $0arrow_forwardWhat does the rental activity have on her AGI for this year? - increased by, decreased by, or no effect?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT