FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

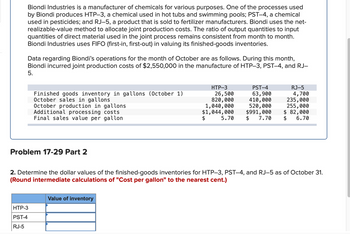

Transcribed Image Text:**Biondi Industries: Chemical Manufacturing and Inventory Management**

Biondi Industries specializes in manufacturing chemicals for diverse applications. Among several processes, three primary chemicals produced are:

- **HTP–3**: Used in hot tubs and swimming pools.

- **PST–4**: Utilized in pesticides.

- **RJ–5**: Supplied to fertilizer manufacturers.

Biondi employs the net-realizable-value method to allocate joint production costs, maintaining a consistent ratio of output to input materials each month. The company operates on a **FIFO (first-in, first-out)** basis for valuing finished goods inventories.

### October Operations Overview:

- **Joint Production Costs**: $2,550,000

#### Inventory and Sales Data for October:

| | **HTP–3** | **PST–4** | **RJ–5** |

|--------------------------|-----------|-----------|----------|

| Finished goods inventory (gallons) - Oct 1 | 26,500 | 63,900 | 4,700 |

| October sales (gallons) | 820,000 | 410,000 | 235,000 |

| October production (gallons) | 1,040,000 | 520,000 | 255,000 |

| Additional processing costs | $1,044,000 | $991,000 | $82,000 |

| Final sales value per gallon | $5.70 | $7.70 | $6.70 |

### Problem 17-29 Part 2:

Calculate the finished-goods inventory value for each chemical as of October 31, based on the provided data. **Round all intermediate cost-per-gallon calculations to the nearest cent.**

#### Value of Inventory:

| | **Value of Inventory** |

|----------|------------------------|

| **HTP–3** | |

| **PST–4** | |

| **RJ–5** | |

**Note**: The value of inventory calculation requires applying the FIFO method to determine the current inventory cost based on remaining stocks and production costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Under the net realizable value method, what portion of the joint costs would be allocated to Seduction and Romance, respectively?arrow_forwardanswer in text form please (without image)arrow_forwardCONSO Inc. manufactures joint products ALT and TAB, and a by-product DEL. Costs are assigned to the joint products by the net realizable value or final market value method which considers further processing costs in subsequent operations. It is the policy of CONSO Inc. to account for its by-product by market value or reversal cost method or deduction of net realizable value of by-product from the joint manufacturing costs of main products. The total manufacturing costs for 100,000 units were Php 1,520,000.00 during the year. Production and costs data follow: (a)Product Name: ALT, units produced:60,000, sales price per unit: Php 70.00, Further processing cost per unit Php 20.00 (b)Product Name: TAB, units produced:30,000, sales price per unit: Php 25.00, Further processing cost per unit Php 5.00 (C)Product Name: DEL, units produced:10,000, sales price per unit: Php 10.00, Further processing cost per unit Php 30.00, Selling and admin expense per unit, Php 5.00. 1.What is the value of DEL…arrow_forward

- A company manufactures products X and Y using a joint process. The joint processing costs are P10,000. Products X and Y can be sold at split-off for P12,000 and P8,000 respectively. After split-off, product X is processed further at a cost of P5,000 and sold for P21,000 whereas product Y is sold without further processing. If the company uses the net realizable value method for allocating joint costs, the joint cost allocated to X isarrow_forwardSelect Manufacturing Co. produces three joint products and one organic waste byproduct. Assuming the byproduct can be sold to an outside party, what is the correct accounting treatment of the byproduct proceeds received by the firm? a. Apply sale proceeds on a prorated basis to the joint products’ sales. b. Use the sale proceeds to reduce the common costs in the joint production process. c. Apply the sale proceeds to the firm’s miscellaneous income account. d. Either “b” or “c” can be usedarrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- Crane Minerals processes materials extracted from mines. The most common raw material that it processes results in three joint products: Spock, Uhura, and Sulu. Each of these products can be sold as is, or each can be processed further and sold for a higher price. The company incurs joint costs of $179,800 to process one batch of the raw material that produces the three joint products. The following cost and sales information is available for one batch of each product. Spock Uhura Sulu Incremental profit (loss) Sales Value at Split-Off Point Spock Uhura $209,700 Sulu 300,900 454,100 Save for Later $ Determine the incremental profit or loss that each of the three joint products. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses eg. (45).) sold as is Allocated Joint Costs $39.700 60,700 79,400 Spock process further Cost to Process Further $110,400 process further 85,100 249,700 $ Sales Value of Processed Product Indicate whether each of the…arrow_forwardDouble Company produces three products - DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Double's production, sales, and costs follows. Units Sold Price (after additional processing) Separable Processing cost Units Produced Total Joint Cost Sales Price at Split-off DBB-1 18,000 $ 65 $ 130,000 18,000 $25 DBB-2 27,000 $50 $ 64,000 27,000 $ 35 The amount of joint costs allocated to product DBB-1 using the physical measure method is: DBB-3 39,000 $75 $ 86,000 39,000 $ 55 Total 84,000 $ 280,000. 84,000 $ 3,700,000arrow_forwardCarol Components operates a Production Division and a Packaging Division. Both divisions are evaluated as profit centers. Packaging buys components from Production and assembles them for sale. Production sells many components to third parties in addition to Packaging. Selected data from the two operations follow: Capacity (units) Sales pricea Variable costs b Fixed costs Production 50,600 $ 252 $ 108 $ 30,000,000 a For Production, this is the price to third parties. b For Packaging, this does not include the transfer price paid to Production. Packaging 25,300 $ 792 $ 300 $ 18,000,000 Suppose Production is located in Country A with a tax rate of 30 percent and Distribution in Country B with a tax rate of 10 percent. All other facts remain the same. a. Optimal transfer price b. Transfer price c. Transfer price Required: a. Current output in Production is 25,300 units. Packaging requests an additional 5,960 units to produce a special order. What transfer price would you recommend? b.…arrow_forward

- Alphabet Soup Inc jointly produces A, B, and C at a joint cost of $100,000. The company uses the production method for byproducts and has estimated that B is a byproduct of manufacturing A and C with an estimated NRV of $6,000. The estimated NRVS of A and C are $80,000 and $80,000, respectively. If Alphabet Soup uses the NRV method in allocating joint costs, what will the cost allocation be? Select one: O a. $49,000 to A, $2,000 to B, and $49,000 to C. O b. $48,000 to A, $2,000 to B, and $48,000 to C. O c. $47,000 to A, $0 to B, and $47,000 to C. O d. $50,000 to A, $0 to B, and $50,000 to C. cross out cross out cross out cross outarrow_forwardsarrow_forwardRocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales Estimated total manufacturing overhead Estimated total direct labor-hours Activity Cost Pools and (Activity Measures) Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost The company has a conventional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below: Req 1A Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education