FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

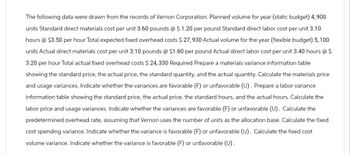

Transcribed Image Text:The following data were drawn from the records of Vernon Corporation. Planned volume for year (static budget) 4,900

units Standard direct materials cost per unit 3.60 pounds @ $ 1.20 per pound Standard direct labor cost per unit 3.10

hours @ $3.50 per hour Total expected fixed overhead costs $27,930 Actual volume for the year (flexible budget) 5, 100

units Actual direct materials cost per unit 3.10 pounds @ $1.60 per pound Actual direct labor cost per unit 3.40 hours @ $

3.20 per hour Total actual fixed overhead costs $24, 330 Required Prepare a materials variance information table

showing the standard price, the actual price, the standard quantity, and the actual quantity. Calculate the materials price

and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). Prepare a labor variance

information table showing the standard price, the actual price, the standard hours, and the actual hours. Calculate the

labor price and usage variances. Indicate whether the variances are favorable (F) or unfavorable (U). Calculate the

predetermined overhead rate, assuming that Vernon uses the number of units as the allocation base. Calculate the fixed

cost spending variance. Indicate whether the variance is favorable (F) or unfavorable (U). Calculate the fixed cost

volume variance. Indicate whether the variance is favorable (F) or unfavorable (U).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following data is given for the Bahia Company: Budgeted production 1,094 units Actual production 919 units Materials: Standard price per pound $1.861 Standard pounds per completed unit 12 Actual pounds purchased and used in production 10,697 Actual price paid for materials $21,929 Labor: Standard hourly labor rate $14.09 per hour Standard hours allowed per completed unit 4.5 Actual labor hours worked 4,732.85 Actual total labor costs $72,176 Overhead: Actual and budgeted fixed overhead $1,021,000 Standard variable overhead rate $28.00 per standard labor hour Actual variable overhead costs $132,520 Overhead is applied on standard labor hours. The variable factory overhead controllable variance is a.$163,322.67 unfavorable b.$163,322.67 favorable c.$16,726.00 unfavorable d.$16,726.00 favorablearrow_forwardCalculate the total, fixed, and variable predetermined manufacturing overhead rates. (Round answers to 2 decimal places, e.g. 15.25.) Variable manufacturing overhead $ Fixed manufacturing overhead Total manufacturing overhead $ Total overhead variance Budget overhead variance Volume overhead variance Rate Calculate the total, budget, and volume overhead variances.arrow_forwardPrepare a flexible production budget for the year ending December 31 for Cedar Jeans Company using production levels of 16,000, 18,000, and 20,000 units produced. The following additional information is necessary to complete the budget: Variable costs: Direct labor ($6.00 per unit) Direct materials ($8.00 per unit) Variable manufacturing costs ($2.50 per unit) Fixed costs: Supervisor's salaries $80,000 Rent 12,000 Depreciation on equipment 24,000arrow_forward

- Benson Manufacturing Company established the following standard price and cost data. Sales price Variable manufacturing cost $ 8.00 per unit $3.40 per unit $ 2,400 total $900 total Fixed manufacturing cost Fixed selling and administrative cost Bertson planned to produce and sell 2,700 units. Actual production and sales amounted to 3,000 units. Required a. Prepare the pro forma income statement in contribution format that would appear in a master budget. b. Prepare the pro forma income statement in contribution format that would appear in a flexible budget Complete this question by entering your answers in the tabs below. Required A Required Prepare the pro forma income statement in contribution format that would appear in a master budget. BENSON MANUFACTURING COMPANY Pro Forma Income Statement Master Budget 2,700 Units oarrow_forwardThe following data is given for the Bahia Company: Budgeted production 1,093 units Actual production 930 units Materials: Standard price per pound $1.884 Standard pounds per completed unit 11 Actual pounds purchased and used in production 9,923 Actual price paid for materials $20,342 Labor: Standard hourly labor rate $14.83 per hour Standard hours allowed per completed unit 4.7 Actual labor hours worked 4,789.5 Actual total labor costs $73,040 Overhead: Actual and budgeted fixed overhead $1,001,000 Standard variable overhead rate $26.00 per standard labor hour Actual variable overhead costs $134,106 Overhead is applied on standard labor hours. The variable factory overhead controllable variance isarrow_forwardThe following data are given for Bahia Company: Budgeted production (at 100% of normal capacity) Actual production Materials: Standard price per pound Standard pounds per completed unit Actual pounds purchased and used in production Actual price paid for materials Labor: Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead: Actual and budgeted fixed overhead Standard variable overhead rate Actual variable overhead costs 1,054 units 902 units $1.93 12 10,499 $21,523 $14.67 per hour 4.8 4,645.3 $70,841 $1,035,000 $26.00 per standard labor hour $130,068 Overhead is applied on standard labor hours. Round your final answer to the nearest dollar. Do not round int The fixed factory overhead volume variance isarrow_forward

- Anthon Corporation has provided the following information regarding last month's activities. Units produced (actual) 10,920 Master production budget Direct materials. Direct labor $ 240,372 203,952 278,613 Overhead Standard costs per unit Direct materials Direct labor Variable overhead Actual costs Direct materials purchased and used Direct labor Overhead Direct materials Direct labor Variable overhead Fixed overhead $ 3.96 per liter x 5 liters per unit of output $ 33.60 per hour x 0.50 hour per unit $ 29.90 per direct labor-hour Variable overhead is applied on the basis of direct labor-hours. Required: Calculate all variable production cost price and efficiency variances and fixed production cost price and production volume variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Price Variance $ 234,780 (60,200 liters) 181,260 (5,300 hours)…arrow_forwardUse this information for Harry Company to answer the question that follow.The following data are given for Harry Company: Budgeted production 26,000 units Actual production 27,500 units Materials: Standard price per ounce $6.50 Standard ounces per completed unit 8 Actual ounces purchased and used in production 228,000 Actual price paid for materials $1,504,800 Labor: Standard hourly labor rate $22.00 per hour Standard hours allowed per completed unit 6.6 Actual labor hours worked 183,000 Actual total labor costs $4,020,000 Overhead: Actual and budgeted fixed overhead $1,029,600 Standard variable overhead rate $24.50 per standard labor hour Actual variable overhead costs $4,520,000 Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.)The direct labor rate variance is a.$5,490 favorable b.$5,490 unfavorable c.$33,000 unfavorable d.$33,000 favorablearrow_forwardZachary Manufacturing Company established the following standard price and cost data. Sales price $ 8.60 per unit Variable manufacturing cost 4.00 per unit Fixed manufacturing cost 2,900 total Fixed selling and administrative cost 800 total Zachary planned to produce and sell 2,100 units. Actual production and sales amounted to 2,300 units. Required Prepare the pro forma income statement in contribution format that would appear in a master budget. Prepare the pro forma income statement in contribution format that would appear in a flexible budget. Prepare the pro forma income statement in contribution format that would appear in a master budget. ZACHARY MANUFACTURING COMPANY Pro Forma Income Statement Master Budget 0 $0 Prepare the pro forma income statement in contribution format that would appear in a flexible budget.…arrow_forward

- Draw up a flexible budget for overheadexpenses on the basis of the following data and determine the overhead rates at 70%, 80% and 90% plant capacity. At 80% Capacity OMR. Variable Overheads: Indirect labor 12,000 Stores including spares 4,000 Semi-variable Overheads: Power (30% fixed, 70% variable) Repairs and maintenance (60% fixed, 40% variable) 20,000 2,000 Fixed Overheads: Depreciation 11,000 3,000 10,000 62,000 1,24,000 hrs. Insurance Salaries Total Overheads Estimated direct labor hoursarrow_forwardZ Ltd has prepared the Budget for the production of 1,00, 000 units from a costing period as unuer. \table[[Particulars, Amount per unit (7)], [Raw materials,10.08], [Direct Labour,3], [Direct Expenses, 0.40], [Works Overhead (60% fixed), 10], [Administration Overhead (80% fixed), 1.60], [Sales Overhead (50% fixed), 0.80]] Actual production of the year is only 60, 000 units. Prepare the Budget for original and revised levels of output.arrow_forwardTop Dog Company has a budget with sales of 7,500 units and $3,400,000. Variable costs are budgeted at $1,850,000, and fixed overhead is budgeted at $970,000. What is the budgeted manufacturing cost per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education