FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

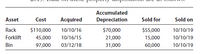

| Copper Industries (a sole proprietorship) sold three § 1231 assets during 2019. Data on these property dispositions are as follows: a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset. b. Assuming that Copper has $6,000 nonrecaptured net § 1231 losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term |

Transcribed Image Text:Accumulated

Asset

Cost

Acquired

Depreciation

Sold for

Sold on

Rack

$110,000

10/10/16

$70,000

$55,000

10/10/19

Forklift

45,000

10/16/15

21,000

15,000

10/10/19

Bin

97,000

03/12/18

31,000

60,000

10/10/19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pole Co. at the end of 2018, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Use of the depreciable assets will result in taxable amounts of €350,000 in each of the next three years. The estimated litigation expenses of €840,000 will be deductible in 2021 when settlement is expected. Instructions a. Prepare a schedule of future taxable and deductible amountsarrow_forwardAyres Services acquired an asset for $128 million in 2021. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset’s cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2021, 2022, 2023, and 2024 are as follows: ($ in millions) 2021 2022 2023 2024 Pretax accounting income $ 360 $ 380 $ 395 $ 430 Depreciation on the income statement 32 32 32 32 Depreciation on the tax return (55 ) (39 ) (21 ) (13 ) Taxable income $ 337 $ 373 $ 406 $ 449 Required:For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. (Leave no cell blank, enter "0" wherever applicable. Enter your answers in millions…arrow_forwardZeno, Incorporated sold two capital assets in 2022. The first sale resulted in a$53,000 capital loss, and the second sale resulted in a $25,600 capital gain. Zenowas incorporated in 2018, and its tax records provide the following information:2018 2019 2020 2021Ordinary income $ 443,000 $ 509,700 $ 810,300 $ 921,Net capital gain 22,000 0 4,120 13,Taxable income $ 465,000 $ 509,700 $ 814,420 $ 934,Required:a.Compute Zeno’s tax refund from the carryback of its 2022 nondeductible capitalloss. Zeno’s marginal tax rate was 21 percent for each prior year.b. Compute Zeno’s capital loss carryforward into 2023.arrow_forward

- Crane Inc. owns assets to which it applies the revaluation model (asset-adjustment method). The following additional information is available: 1. The depreciation expense for 2024 was $6780. 2. Between December 31, 2023, and December 31, 2024, the property's fair value had increased by $33900. 3. The December 31, 2024, balance in the revaluation surplus account (prior to any fair value adjustments) was $2260. The adjusted December 31, 2024, balance in the related contra-asset account will be ○ $11300. $15820. ○ $0. ○ $13560.arrow_forwardAyres Services acquired an asset for $80 million in 2024. The asset is depreciated for financial reporting purposes over four years on a straight-line basis (no residual value). For tax purposes the asset's cost is depreciated by MACRS. The enacted tax rate is 25%. Amounts for pretax accounting income, depreciation, and taxable income in 2024, 2025, 2026, and 2027 are as follows: Pretax accounting income Depreciation on the income statement Depreciation on the tax return Taxable income Required: 2024 $ 330 20 (25) $325 Cumulative Temporary Difference Deferred Tax Liability ($ in millions) 2025 $350 20 (33) $337 2026 $365 20 (15) $370 $413 Beginning of 2024 2027 $ 400 For December 31 of each year, determine (a) the cumulative temporary book-tax difference for the depreciable asset and (b) the balance to be reported in the deferred tax liability account. Note: Leave no cell blank, enter "0" wherever applicable. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000…arrow_forwardOn June 7, 2021, James Corporation sold a tract of land for P70,000 that resulted in a P30,000 gain on the sale. James agreed to accept one payment of P35,000 on August 15 and the second payment of P35,000 on December 15. James had a calendar year-end. What amount of gain was reported during the second, third, and fourth quarters of the year from this sale?arrow_forward

- Michael Company acquired a depreciable asset at the beginning of 2020 at a cost of $30 million. On December 31, 2020, Madison gathered the following information related to this asset Fair value of the asset (Net Selling Price) $26.5 million Sum of future cash flows from the use of the asset $25 million Present value of future cash flows $26 million The remaining useful life of the asset 9 years Required: Under IFRS: 1) The determination and measurement of impairment loss? 2) Following journal entry would be made to reflect the impairment of this equipment on December 31, 2020?arrow_forwardOmar Company owns a property which was revalued to $ 625,000 on 31 December 2018 with a revaluation gain of $250,000 being recognized as other comprehensive income and recorded in the revaluation surplus. At 31, December 2020 the property had a carrying amount of $575,000 but the recoverable amount of the property was estimated at only $250,000. 1- What is the amount of impairment? 2- How the revaluation and the impairment should be treated in the financial statements?arrow_forwardStag, a public limited company, is preparing its financial statements for the year ending 31 December 2021. The exhibits contain information relevant to the question. Exhibit 1– Accounting for ImpairmentStag plc, which has a 31 December year end, acquired an item of property, plant, and equipment (PPE) on 1 January 2019 for £50,000 for which it applies the revaluation model. The asset is depreciated on a straight-line basis over its useful economic life of ten years (the assumed residual value is nil). On 1 January 2020, it was established that the gross replacement cost of the asset (i.e. the gross revalued amount of the asset before any depreciation is deducted) was £60,000. On 31 December 2021, there are indications that the asset is impaired, an impairment test is carried out, and the recoverable amount at that date is estimated as £30,000. Requirement:Using Exhibit 1, explain the impact of the transactions on the financial statements 2020 and 2021. (Hint: you can show the double…arrow_forward

- During 2021, Cullumber Company purchased the net assets of Riverbed Corporation for $2206600. On the date of the transaction, Riverbed had $601800 of liabilities. The fair value of Riverbed's assets when acquired were as follows: Current assets $1083240 Noncurrent assets 2527560 $3610800 How should the $802400 difference between the fair value of the net assets acquired ($3009000) and the cost ($2206600) be accounted for by Cullumber? O The current assets should be recorded at $1083240 and the noncurrent assets should be recorded at $1725160. O A deferred credit of $802400 should be set up and then amortized to income over a period not to exceed forty years. O The $802400 difference should be recognized as a gain. O The $802400 difference should be credited to retained earnings.arrow_forwardAbba Company accounted for noncurrent assets using the revaluation model. On June 30, 2021, the entity classified a land as held for sale. At that date, the carrying amount was P2,900,000 and the balance of the revaluation surplus was P200,000. On June 30, 2021, the fair value was estimated at P3,300,000 and the cost of disposal at P200,000. On December 31, 2021, the fair value was estimated at P3,250,000 and the cost of disposal at P250,000. What amount should be reported as revaluation surplus on December 31, 2021? a. 600,000 b. 400,000 c. 200,000 d. 300,000arrow_forwardOn January 1, 2019, Intimate Corporation purchased land at a cost of P7,200,000. The entity used the revaluation model for this asset. The fair value of the land was P8,400,000 on December 31, 2019 and P10,200,000 on December 31, 2020. On July 1, 2021, the entity decided to sell the land and therefore classified the asset as held for sale. The fair value of the land on this date is P9,120,000. The estimated cost of disposal is almost zero. On December 31, 2021, the land was sold for P9,600,000. What amount of OCI should be recognized in the statement of comprehensive income for the year ended December 31, 2020? ₱480,000 ₱3,000,000 ₱1,080,000 ₱1,800,000 What amount of gain or loss on sale of land is recognized in 2021? ₱480,000 gain ₱2,400,000 gain ₱600,000 loss ₱1,200,000 gain What amount of OCI is transferred…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education