FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

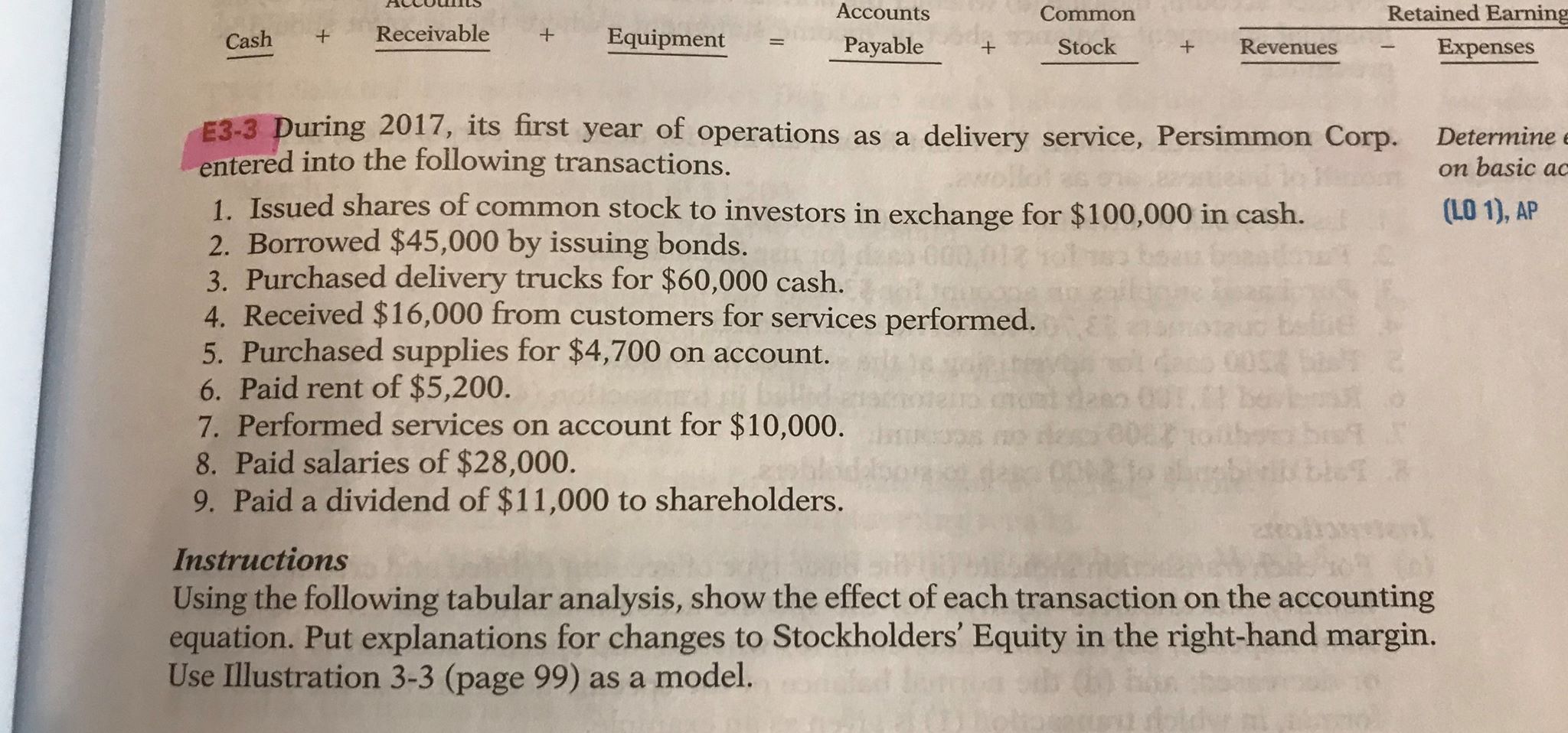

Transcribed Image Text:Accounts

Retained Earning

Common

Receivable

Equipment

Cash

Payable

Stock

Revenues

Expenses

E3-3 During 2017, its first year of operations as a delivery service, Persimmon Corp.

entered into the following transactions.

1. Issued shares of common stock to investors in exchange for $100,000 in cash.

2. Borrowed $45,000 by issuing bonds.

3. Purchased delivery trucks for $60,000 cash.

4. Received $16,000 from customers for services performed.

5. Purchased supplies for $4,700 on account.

6. Paid rent of $5,200.

7. Performed services on account for $10,000.

8. Paid salaries of $28,000.

9. Paid a dividend of $11,000 to shareholders.

Determine e

on basic ac

(LO 1), AP

001.0

Instructions

Using the following tabular analysis, show the effect of each transaction on the accounting

equation. Put explanations for changes to Stockholders' Equity in the right-hand margin.

Use Illustration 3-3 (page 99) as a model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Balance Sheet Baggett Company's balance sheet accounts and amounts as of December 31, 2016, are shown in random order as follows: Account Debit (Credit) Account Debit (Credit) Income Taxes Payable $(3,800) Additional Paid-in Capital on Preferred Prepaid Items 1,800 Stock $(7,900) Additional Paid-in Capital on Common Stock (9,300) Allowance for Doubtful Accounts (1,600) Land 12,200 Bonds Payable (due 2020) (23,000) Notes Payable (due 2019) (6,000) Buildings 57,400 Notes Receivable (due 2018) 16,400 Sinking Fund to Retire Bonds Payable 5,000 Accounts Receivable 12,600 Advances from Customers (long-term) (2,600) Premium on Bonds Payable (1,400) Cash 4,300 Accounts Payable (13,100) Accumulated Depreciation: Equipment (9,700) Inventory 7,400 Retained Earnings (18,300) Accumulated Depreciation: Buildings (21,000) Preferred Stock, $100 par (18,600) Patents (net) 4,600 Wages Payable (1,400) Equipment 28,700 Common Stock, $10 par (12,700) Required: 1. Prepare a December 31, 2016 balance sheet…arrow_forwardFollowing is the balance sheet for 3M Company. At December 31 2015 2014 Cash and cash equivalents $ 1,798 $ 1,897 Marketable securities-current 118 1,439 Accounts receivable, net 4,154 4,238 Inventories 3,518 3,706 Other current assets 1,398 1,023 Total current assets 10,986 12,303 Marketable securities-noncurrent 126 117 Property, plant and equipment--net 8,515 8,489 Goodwill 9,249 7,050 Intangible assets-net 2,601 1,435 Prepaid pension benefits 188 46 1,053 $32,718 1,769 $31,209 Other assets Total assets $ $ Short-term debt & current portion of LT debt Accounts payable 2,044 106 1,694 1,807 Accrued payroll 644 732 Accrued income taxes 332 435 Other current liabilities 2,404 2,884 Total current liabilities 7,118 5,964 Long-term debt 8,753 6,705 Pension and postretirement benefits 3,520 3,843 Other liabilities 1,580 1,555 Total liabilities 20,971 18,067 3M Company shareholders' equity: Common stock 9. Additional paid-in capital Retained earnings 4,791 4,379 36,575 34,317 Treasury stock…arrow_forwardAlpesharrow_forward

- 5arrow_forwardPizza, Inc. balance sheet statement for December 31. 2015 with the following information tound to the nearest thousand i Data Table Barron Pizza, Inc. Balance Sheet as of Decemb Retained earnings: $43,512 Accounts payable: $74,547 Accounts receivable: $34,808 Common stock: $119,856 Cash: $8,258 Short-term debt $188 ($ in thousands) LIABILIT Current Inventory: $23,487 Goodwill: $48,302 Long-term debt S80,147 Other noncurrent liabilities: $42,597 Net plant, property, and equipment. $192,340 Other noncurrent assets.$16,738 Long-term investments: $22,330 Other current assets: $14,584 Total cur Total liat OWNER! Print Done a意前 %24 %24 %24 %24 %24arrow_forwardQuestion Carlene Johnson is the Accountant in the Finance Department at Fairway Trading Limited who manages the company Accounts Receivables. She was given the following information by the Finance Manager which was extracted from the debtor's ledger as at December 31, 2022. Category of Total value of Customers Sales To Customer $ Keith Green Karen White June Hinds John Wayne 180,0000 240,000 390,000 380,000 Paul Gayle 346,000 Date of Sales December 16, 30 days 2021 December 10, 60 days 2021 November 15, 2022 30 days June 26, 2022 30 days 30 days August 25, 2022 Terms Percentage provision to be created Date of Last Payment on A/C January 15, 2022 February 14, 2022 December 20, 2022 October 24, 2022 September 24, 2022 Total Amount Paid to Date on Account S 90,500 180,000 170,000 295,000 235,000 The Accountant decided that she would age the debt outstanding in the following category and the percentage to be provided for bad debt in the amount stated beside each category accordingly. Aging…arrow_forward

- Prepaid rent Accounts receivable Cash Comon stock Retained earnings Current assets Prepare a classified balance sheet. Note: Allowance for doubtful accounts is subtracted from accounts receivable on the company's balance sheet. Total assets otal current assets Long-term Investments Current labies BENNETT COMPANY Balance Sheet Long term is Total abilities December 31 Assets Liabilities $ 2,700 Accounts payable 18,500 Allowance for doubtful accounts 29,098 Notes payable (due in 10 years) 13,500 Notes receivable (due in 4 years) 24,200 Equity Total quity Total abilities and equity 5 S 0 0 $ 4,200 1,000 11,400 0arrow_forwardOn January 1, 2021, Displays Incorporated had the following account balances: Debit 41,000 38,000 44,000 77,000 246,000 Accounts Cash Accounts receivable Supplies Inventory Land Accounts payable Notes payable (5%, due next year) Common stock Retained earnings Totals $ Credit $ 56,000 39,000 205,000 146,000 $ 446,000 $ 446,000 From January 1 to December 31, the following summary transactions occurred: a. Purchased inventory on account for $349,000. b. Sold inventory on account for $665,000. The cost of the inventory sold was $329,000. c. Received $594,000 from customers on accounts receivable. d. Paid freight on inventory received, $43,000. e. Paid $339,000 to inventory suppliers on accounts payable of $347,000. The difference reflects purchase discounts of $8,000. f. Paid rent for the current year, $61,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $169,000. The payment was recorded to Salaries Expense. Year-end adjusting entries: a. Supplies on…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education