FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

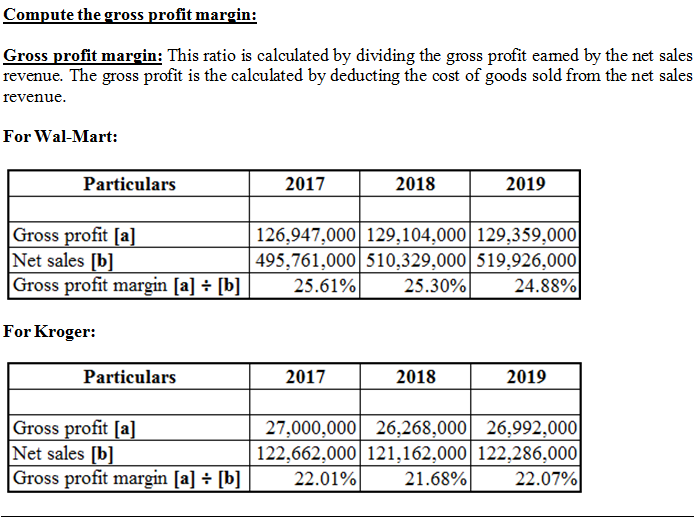

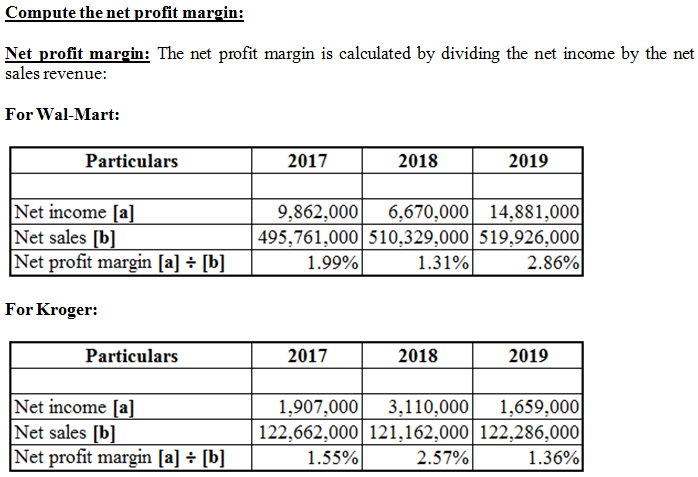

Find gross profit margin, profit margin, return on assets, and return on equity for both companies for years 2017, 2018, and 2019.

Transcribed Image Text:Walmart

As Reported Annual Balance Sheet

Report Date

2019

2018

2017

2016

Scale

Thousands

Thousands

Thousands

Thousands

Assets

6,867,000

5,835,000

43,046,000

1,941,000

57,689,000

107.710,000

Cash & cash equivalents

Receivables, net

9,465,000

7,722,000

6,756,000

6,283,000

44,269,000

6.284.000

44,435,000

1,622,000

61,806,000

105,208,000

5,614,000

43,783,000

3,511,000

59,664,000

107,675,000

Inventories

Prepaid expenses & other current assets

3,623,000

61,897,000

104,317,000

Total current assets

Property & equipment, net

Operating lease right-of-use assets

Finance lease right-of-use assets, net

Property under capital lease & financing obligations, net

Goodwill

17,424,000

4,417,000

7,078,000

31,181,000

14,822,000

219,295,000

7,143,000

18,242,000

11,798,000

204,522,000

6,468,000

17,037,000

9,921,000

198,825,000

31,073,000

Other long-term assets

Total assets

16,567,000

236,495,000

Liabilities & Equity

Short-term borrowings

Accounts payable

575,000

46,973,000

22,296,000

280,000

5,362,000

1,793,000

5,225,000

47,060,000

22,159,000

428,000

1,876,000

5,257,000

46,092,000

22,122,000

645,000

3,738,000

1,099,000

41,433,000

20,654,000

921,000

2,256,000

Accrued liabilities

Accrued income taxes

Long-term debt due within one year

Operating lease obligations due within one year

Finance lease obligations due within one year

Capital lease & financing obligations due within one year

511,000

77,790,000

43,714,000

16,171,000

729,000

77,477,000

43,520,000

667,000

78,521,000

30,045,000

565,000

66.928,000

Total current liabilities

Long-term debt

Long-term operating lease obligations

Long-term finance lease obligations

Long-term capital lease & financing obligations

36,015,000

4,307,000

12,961,000

154,943,000

284,000

3,247,000

83,943,000

(12,805,000)

6,883,000

81,552,000

6,683,000

11,981,000

139,661,000

288,000

2,965,000

80,785,000

(11,542,000)

6,780,000

8,354,000

123,700,000

295,000

2,648,000

85,107,000

(10,181,000)

6,003,000

9,344,000

118,290,000

305,000

2,371,000

89,354,000

(14,232,000)

2,737,000

80,535,000

Deferred income taxes & other liabilities

Total Liabilities

Common stock

Capital in excess of par value

Retained earnings (accumulated deficit)

Accumulated other comprehensive income (loss)

Noncontrolling interest

Total equity

7,138,000

79,634,000

2,953,000

80,822,000

Additional Information

27.753.000

Net cash flows from operating activities

Land

Buildings & improvements

Fixtures & equipment

25.255.000

28,337,000

31,530,000

24,619,000

105,674,000

58,607,000

24,526,000

101,006,000

54,488,000

2,316,000

3,474,000

185,810,000

81.493,000

104,317,000

25,298,000

101,155,000

52,695,000

2,387,000

3,619,000

185,154,000

77,479,000

107,675,000

24,801,000

98,547,000

48,998,000

2,845,000

4,301,000

179,492,000

71,782,000

107,710,000

Transportation equipment

Construction in progress

2,377,000

Property & equipment, gross

Less: accumulated depreciation

Property & equipment, net

3,751,000

195,028,000

89,820,000

105,208,000

As Reported Annual Income Statement

Report Date

2019

2018

2017

Scale

Thousands

Thousands

Thousands

519,926,000

4,038,000

523,964,000

394,605,000

510,329,000

4,076,000

514,405,000

385,301,000

129,104,000

107,147,000

21,957,000

1,975,000

Net sales

495,761,000

4,582,000

500,343,000

373,396,000

126,947,000

106,510,000

20,437,000

1,978,000

352,000

152,000

(3,136,000)

Membership & other income

Total revenues

Cost of sales

Gross Profit

Operating, selling, general & administrative expenses

Operating income (loss)

Interest expense on debt

Interest expense on finance, capital lease & financing obligations

Interest income

Gain (loss) on extinguishment of debt

Other gains & (losses)

129,359,000

108,791,000

20,568,000

2,262,000

337,000

189,000

371,000

217,000

1,958,000

20,116,000

4,915,000

15,201,000

(320,000)

14,881,000

(8,368,000)

11,460,000

4,281,000

7,179,000

15,123,000

4,600,000

Income (loss) before income taxes

Provision (benefit) for income taxes

Income (loss) after income taxes

Less consolidated net income attributable to noncontrolling interest

Net Income

10,523,000

(509,000)

6,670,000

(661,000)

9,862,000

Additional Information

Weighted average shares outstanding - basic

Weighted average shares outstanding - diluted

Year end shares outstanding

2.850,000

2,868,000

2,832,000

2,929,000

2,945,000

2,878,000

2,995,000

3,010,000

2,952,000

Transcribed Image Text:Kroger

As Reported Annual Balance Sheet

Report Date

2018

Thousands

2019

2017

2016

Scale

Thousands

Thousands

Thousands

Cash & temporary cash investments

Store deposits in-transit

Receivables

399,000

1,179,000

1,706,000

7,084,000

429,000

1,181,000

1,589,000

6.846.000

166,000

592,000

10,803,000

21,635,000

347,000

1,161,000

1,637,000

6.533,000

322,000

910,000

1,649,000

6,561,000

Inventory

604,000

835,000

11,117,000

21,071,000

Assets held for sale

0.00

522,000

10,890,000

21,871,000

898,000

10,340,000

21,016,000

Prepaid & other current assets

Total current assets

Property, plant & equipment, net

Operating lease assets

Intangibles, net

Goodwill

6,814,000

1,066,000

3,076,000

1,258,000

3,087,000

1,335,000

1,100,000

2,925,000

984,000

37,197,000

1,153,000

3,031,000

965,000

36,505,000

Other assets

1,539,000

Total assets

45,256,000

38,118,000

Liabilities

1,965,000

Current portion of long-term debt including obligations under fin

Current portion of long-term debt including obligations under ca

Current portion of operating lease liabilities

Trade accounts payable

Accrued salaries & wages

3,157,000

3,560,000

2,252,000

597,000

6,349,000

1,168,000

6,059,000

1,227,000

5,858,000

1,099,000

5,818,000

1,234,000

251.000

Deferred income taxes

Liabilities held for sale

51,000

3,780,000

14,274,000

259,000

3,421,000

14,197,000

3,305,000

12,860,000

Other current liabilities

Total current liabilities

Noncurrent operating lease liabilities

Long-term debt including obligations under finance leases

Long-term debt including obligations under capital leases & fina

Deferred income taxes

4,164,000

14,243,000

6,505,000

12,111,000

12,072,000

1,562,000

494,000

1,881,000

30,283,000

12,029,000

11,825,000

1,927,000

1,524,000

1,659,000

29,795,000

1,466,000

608,000

1,568,000

792,000

Pension & postretirement benefit obligations

Other long-term liabilities

1,750,000

36,683,000

1,706,000

Total liabilities

30,292,000

1.918,000

3,161,000

(471,000)

17,007,000

14,684,000

(26,000)

6,905,000

1,918,000

3,070,000

(715,000)

15,543,000

13,118,000

12,000

6,710,000

Common shares

1.918.000

1,918,000

3,245,000

(346,000)

19,681,000

16,612,000

(51,000)

7,835,000

Additional paid-in capital

3,337,000

(640,000)

20,978,000

16.991,000

Accumulated other comprehensive income (loss)

Retained earnings (accumulated deficit)

Common shares in treasury, at cost

Noncontrolling interests

Total equity (deficit)

Additional Information

Net cash flows from operating activities

Land

(29,000)

8,573,000

4,664,000

3,299,000

12,553,000

15,031,000

10,832,000

3,166,000

966,000

45,847,000

4,164,000

3,254,000

12,245,000

14,277,000

10,306,000

3,413,000

3,201,000

12,072,000

13,635,000

9,773,000

2,050,000

1,000,000

41,731,000

20,660,000

21,071,000

4.272.000

Buildings & land improvements

Equipment

Leasehold improvements

Construction-in-progress

Leased property under capital leases & financing obligations

Total property, plant & equipment

Accumulated depreciation & amortization

Property, plant & equipment, net

As Reported Annual Income Statement

Report Date

3,197,000

11,643,000

13,495,000

9,342,000

1,979,000

932,000

40,588,000

2,716,000

1,066,000

43,864,000

22,229,000

21,635,000

23,976,000

19.572.000

21,871,000

21,016,000

2019

2018

2017

Scale

Thousands

Thousands

Thousands

122,286,000

95,294,000

26,992,000

21,208,000

884,000

2,649,000

Sales

121,162,000

94,894,000

26,268,000

20,305,000

884,000

2,465,000

2,614,000

620,000

26,000

228,000

1,782,000

3,978,000

900,000

3,078,000

32,000

3,110,000

Cost of sales

122,662,000

95,662,000

27,000,000

21,568,000

911,000

2,436,000

2,085,000

601,000

Gross Profit

Operating, general & administrative

Rent

Depreciation & amortization

Operating profit (loss)

Interest expense

Non-service component of company-sponsored pension plan c

Mark to market gain (loss) on Ocado International Holdings Limit

2,251,000

603,000

157,000

176,000

1,981,000

469,000

1,512,000

Gain on sale of businesses

Net earnings before income tax expense (benefit)

Income tax expense (benefit)

Net earnings after income tax expense (benefit)

Net earnings (loss) attributable to noncontrolling interests

Net earnings (loss) attributable to The Kroger Co.

1,484,000

(405,000)

1,889,000

147,000

1,659,000

18,000

1,907,000

Additional Information

Weighted average shares outstanding - basic

Weighted average shares outstanding - diluted

Year end shares outstanding

799,000

805,000

788,000

810,000

818,000

798,000

895,000

904,000

870,000

Expert Solution

arrow_forward

Step 1

Ratio analysis: This is the quantitative analysis of financial statements of a business enterprise. Under this analysis, different financial indicators are compared to evaluate the efficiency, liquidity, and profitability of the enterprise.

arrow_forward

Step 2

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Show how the ROCE ratio for ABC Ltd. the company that we have been discussing this week can be analysed into the two elements (Operating profit margin and sales revenue to capital employed) for each of the years 2018 and 2019. What conclusions can you draw from your figures?arrow_forwardUsing the fiscal year end 2020 annual report for General Mills, Inc. and the figures from the 2020 annual report as noted below, calculate the financial ratios for 2020 and 2019 indicated using the EXCEL template provided:1. The average collection period 2.Days sales in inventory 3. debt to equity ratio 4. Times interest earned 5. Operating cash flow to Capital expenditures ratio 6. Earnings per share 7. Price earnings ratio 8. Dividend yield 9. Dividend payout ratio 10. Total assets 2020 = $30,806.7Total stockholders’ equity 2020 = $8,349.5Total current liabilities 2020 = $7,491.5Accounts receivable 2020 = $1,615.1Inventory 2020 = $1,426.3Year-end closing stock price May 2020 = $58.80Year-end closing stock price May 2019 = $53.56arrow_forwardBegin by calculating the gross profit for each year, then prepare a horizontal analysis of revenues and gross profitlong dash—both in dollar amounts and in percentageslong dash—for 20192019 and 20182018. (Enter amounts in millions as provided to you in the problem statement. Round the percentages to one decimal place, X.X%. Use a minus sign or parentheses to indicate a decrease.) McDonald Corp. Income Statement - (Partial) Years Ended December 31, 2019 and 2018 (Amounts in millions) 2019 2018 2017 Revenues $9,575 $9,300 $8,975 Cost of Goods Sold 6,250 6,000 5,890 Gross Profitarrow_forward

- Calculate the financial indicators of the firm Merck for the year 2018 and fill in the spaces marked in the table. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio …. …. 0.47 Debt-to-equity ratio …. …. 0.38 Interest coverage ratio …. …. -9.43 Liquidity Ratios Current ratio …. …. 3.47 Quick ratio …. …. 2.12 Cash ratio …. …. 2.24 Profitability Ratios Profit margin …. …. -93.4% ROE (Return on equity), after tax …. …. -248.5 ROA (Return on assets) …. …. -146.5 Gross margin …. …. 55.3% Operating margin (Return on sales) …. …. -42.9% Activity or Efficiency Ratios Asset turnover …. …. 1.08 Receivables turnover (days) …. …. 16 Inventory turnover (days)…arrow_forwardObtain Target Corporation's annual report for its 2018 fiscal year (year ended February 2, 2019) at http://investors.target.com a. What was Target's gross margin percentage for the fiscal year ended February 2, 2019 (2018) and 2017? Use "Sales" for these computations b. What was Target's Return on Sales percentage for 2018 and 2017? Use "Total Revenue" for these computations. c. Target's return on ales percentage for 2017 was higher than it was in 2018. Ignoring taxes, how much higher would Target's 2018 net income have been if it's return on sales percentage in 2018 had been the same as for 2017?arrow_forwardWith a given information below: (A) Prepare Income Statement and Balance Sheet in the Year 2020. (B) Analyze Income Statement and Balance Sheet in the Year 2020 Vertically. (C) Compute Financial Ratios: (1) ROE, (2) ROA, (3) Average Collection Period, (4) Debt to Asset, (5) Debt to Equity, (6) Time Interest Earned, (7) Total Assets Turnover, (8) Operating Profit Margin, (9) Return On Common Equity (ROCE), (10) Net Working Capital Ratio, (11) Quick Ratio, (12) Current Ratio. Cash $6,000 Sales $100,000 Utility Expense $8,000 Buildings $65,000 Common Stock $45,000 Accounts Payable $12,000 Supplies $4,000 Cost of Goods Sold $58,000 Interest Expense $5,000 Additional Paid in Capital $20,000 Bonds Payable $40,000 Supplies Expense $3,000 Salaries Expense $16,000 Accounts Receivable $10,000 Inventories $45,000 Retained Earnings $5,000 (beg. bal.) Income Tax Rate 20%arrow_forward

- The image uploaded is the calculation of Societe Generale Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forwardProjecting NOPAT and NOA Using Parsimonious Forecasting Method Following are Logitech's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) for its fiscal year ended March 31, 2019 ($ thousands). Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Financial information Net sales Net operating profit after tax (NOPAT) Net operating assets (NOA) $2,788,322 211,362 571,823 Use the parsimonious method to forecast Logitech's sales, NOPAT, and NOA for fiscal years ended March 31, 2020 through 2023 using the following assumptions. Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with two decimal places_. Note: When completing the question…arrow_forwardUse the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forward

- please step by step solution.arrow_forwardF. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:arrow_forwardCalculate the Current Ratio, Debt Ratio, Return on Assets (ROA) and Return on Equity (ROE). For the ROA and ROE, you should use the average total assets and the average total equity in your calculations. (The average is the total across two years divided by two). Calculate these values for each of 2011-2014. Interpret your calculations: what does this information mean? How is the company doing?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education