FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Classified

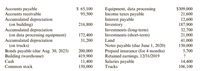

Jerrison Company operates a wholesale hardware business. The

following balance sheet accounts and balances are available for Jerrison

at December 31, 2019.

Required:

1. Prepare a classified balance sheet for Jerrison at December 31, 2019.

2. Compute Jerrison's

2019.

3. CONCEPTUAL CONNECTION If Jerrison's management is concerned

that a large portion of its inventory is obsolete and cannot be sold, how

will Jerrison's liquidity be affected?

Transcribed Image Text:Accounts payable

Accounts receivable

$ 65,100

95,500

Accumulated depreciation

(on building)

Accumulated depreciation

(on data processing equipment)

Accumulated depreciation

(on trucks)

Bonds payable (due Aug. 30, 2023)

Building (warehouse)

Equipment, data processing

Income taxes payable

Interest payable

Inventory

Investments (long-term)

Investments (short-term)

S309,000

21,600

12,600

187,900

32,700

21,000

41,000

150,000

216,800

172,400

31,200

Land

Notes payable (due June 1, 2020)

Prepaid insurance (for 4 months)

Retained earnings, 12/31/2019

Salaries payable

Trucks

200,000

419,900

5,700

?

Cash

11,400

14,400

106,100

Common stock

150,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Prepare a detailed multi-step income statement (including EPS presentation) for the year ended December 31, 2020. Show calculations for EPS (for continuing and discontinued sections). Show details of COST OF GOODS SOLD and OPERATING EXPENSES sections. 2. Prepare a Statement of Retained Earnings for the year ended December 31, 2020.arrow_forwardPlease do not give solution in image format thankuarrow_forwardReview the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. BEAN SUPERSTOREComparative Balance SheetDecember 31, 2017, 2018, and 2019 2019 2018 2017 Assets Cash $346,600 $330,460 $300,000 Accounts Receivable 65,000 65,000 59,000 Inventory 145,830 178,011 155,205 Equipment 100,465 101,202 103,085 Total Assets $657,895 $674,673 $617,290 Liabilities Salaries Payable $90,200 $88,563 $84,209 Accounts Payable 70,000 71,670 69,331 Notes Payable 42,000 50,650 58,250 Equity Common Stock 22,695 21,490 19,100 Retained Earnings 433,000 442,300 386,400 Total Liabilities and Equity $657,895 $674,673 $617,290 LEGUMES PLUSComparative Balance SheetDecember 31, 2017, 2018, and 2019 2019 2018 2017 Assets Cash $407,000 $388,450 $356,367 Accounts Receivable…arrow_forward

- Please be sure to provide detailed explanations and show work. The answers in RED are incorrect. Instructions: Prepare adjusting journal entries for the transactions only HIGHLIGHTED in RED.arrow_forwardPlease do not give solution in image format thankuarrow_forwardneed to enter the beginning balances in the summary and record the April transactions using a perpetual inventory system. include margin explanations for the changes in revenues and expenses please answer in text with workings and stepsarrow_forward

- Garrow_forwardDO NOT GIVE SOLUTION IN IMAGEarrow_forwardReview the select information for Bean Superstore and Legumes Plus (industry competitors), and then complete the following. BEAN SUPERSTOREComparative Balance SheetDecember 31, 2017, 2018, and 2019 2019 2018 2017 Assets Cash $346,600 $330,460 $300,000 Accounts Receivable 65,000 65,000 60,000 Inventory 145,830 178,011 155,205 Equipment 100,465 101,202 103,085 Total Assets $657,895 $674,673 $618,290 Liabilities Salaries Payable $90,300 $88,563 $84,209 Accounts Payable 71,000 71,670 69,331 Notes Payable 41,000 50,650 58,250 Equity Common Stock 22,695 21,990 19,100 Retained Earnings 432,900 441,800 387,400 Total Liabilities and Equity $657,895 $674,673 $618,290 LEGUMES PLUSComparative Balance SheetDecember 31, 2017, 2018, and 2019 2019 2018 2017 Assets Cash $407,000 $389,450 $356,367 Accounts Receivable…arrow_forward

- The following selected accounts and the current balances apper in the ledger of Acct 201 Co., for the fiscal year ended May 31, 2020. To answer the questions below, it will be helpful to use a scratch piece of paper and prepare a multiple-step income statement (Note: not all of the listed accounts are used on the income statement. Select those that should appear on the income statement.) Advertising Expense $550Cost of Merchandise Sold 7,850Customer Refunds Payable 40Delivery Expense 16Depreciation Expense-Office Equipment 50Depreciation Expense-Store Equipment…arrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardI also need the journal entry for december 31 2025arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education