FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

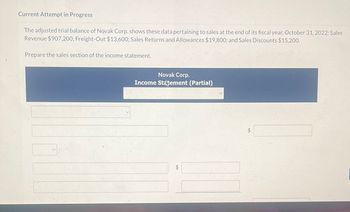

Transcribed Image Text:Current Attempt in Progress

The adjusted trial balance of Novak Corp. shows these data pertaining to sales at the end of its fiscal year, October 31, 2022: Sales

Revenue $907,200; Freight-Out $13,600; Sales Returns and Allowances $19,800; and Sales Discounts $15,200.

Prepare the sales section of the income statement.

Novak Corp.

Income Statement (Partial)

+A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The adjusted trial balance of Wildhorse Company shows the following data pertaining to sales at the end of its fiscal year October 31, 2022: Sales Revenue $904,600, Freight-Out $16,600, Sales Returns and Allowances $29,800, and Sales Discounts $16,500.Prepare separate closing entries for (1) sales revenue and (2) the contra accounts to sales revenue. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit 1. Oct. 31 enter an account title for the closing entry on October 31 enter a debit amount enter a credit amount enter an account title for the closing entry on October 31 enter a debit amount enter a credit amount 2. Oct. 31 enter an account title for the closing entry on October 31 enter a debit amount enter a credit amount enter an account title for the closing entry on October 31 enter a debit amount enter a credit amount…arrow_forwardanswer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardThe financial statements of Crane, Inc's. 2025 annual report disclose the following information: (in millions) May 24, 2025 $250 ttempt in Progress Inventories Sales Cost of goods sold Net income (a) (b) 2025 Fiscal Year $3,900 1,300 320 May 25, 2024 $240 Inventory turnover 2024 $3,900 1,300 Compute Crane's (a) inventory turnover and (b) the average days to sell inventory for 2025 and 2024. (Round inventory turnover to 2 decimal places, e.g. 7.63 and average days to sell inventory to 1 decimal place, e.g. 65.1.) 300 Average days to sell inventory May 26, 2023 $200 2025 times days 2024 times daysarrow_forward

- The following selected account data is taken from the records of Reese Industries for 2019. Assume the perpetual inventory system is used. Sales $643,363 Merchandise Inventory 581,620 Sales Discounts 58,030 Interest Expense 3,877 Sales Returns and Allowances 90,232 Interest Revenue 10,268 Cost of Goods Sold 227,598 Rent Expense 15,090 Depreciation Expense-Office Equipment 3,600 Insurance Expense 2,450 Advertising Expense 12,810 Accounts Receivable 102,440 Office Supplies Expense 1,600 Rent Revenue 23,650 Sales Salaries Expense 30,410 Accounts Payable 136,404 Common Stock 59,419 Marketing Expense 33,000 A. Use the data provided to compute net sales for 2019. B. Prepare a simple income statement for the year ended December 31, 2019. Reese Industriesarrow_forward1. Prepare a detailed multi-step income statement (including EPS presentation) for the year ended December 31, 2020. Show calculations for EPS (for continuing and discontinued sections). Show details of COST OF GOODS SOLD and OPERATING EXPENSES sections. 2. Prepare a Statement of Retained Earnings for the year ended December 31, 2020.arrow_forwardB. For Multi-Method SCI: Dan Bam Company is in its second year of operation. Information on its operation is given below. Prepare a Multi-Step SCI. DanBam Company Statement of Comprehensive Income For the year ended December 31, 2018 Sales P 430,500 Sales Returns & Allowances 120,000 Sales Discounts 25,000 Merchandise Inventory, Beginning 103,300 Purchases 150,000 Freight-in 1,800 Purchase Returns & Allowances 86,000 Purchase Discount 3,200 Merchandise Inventory. Ending 110,700 Rent Expense 44,000 Salaries Expense 58,400 Utiitites Expense 5,000 Gas & Oil Expense 7,500 Repairs & Maintenance Expense 6,000 Taxes & Licenses 16,000 Interest Income 2,000 Interest Expense 4,000arrow_forward

- The following is selected information from Mars Corp. Inventory, February 28, 2018 $456,000 Inventory, March 31, 2018 330,000 Purchase Discounts 12,450 Purchase Returns and Allowances 23,870 Sales 277,900 Sales Discounts 34,650 Gross Purchases 126,200 Compute net purchases, and cost of goods sold for the <) month of March. Assume the perpetual and periodic methods are used. Net purchases $1 Cost of Goods Sold $arrow_forwardPresented below is selected information related to Metlock, Inc. for the year ended January 31, 2022. Ending inventory per Insurance expense $ 11,150 perpetual records $ 31,180 Rent expense 21,280 Ending inventory actually Salaries and wages expense 55,630 on hand 30,480 Sales discounts 11,090 Cost of goods sold 218,770 Sales returns and allowances 15,740 Freight-out 7,290 Sales revenue 404,680 Prepare the necessary adjusting entry for inventory.arrow_forwardLopez Company reports unadjusted first-year merchandise sales of $100,000 and cost of merchandise sales of $30,000. a. Compute gross profit (using the unadjusted numbers above). b. The company expects future returns and allowances equal to 5% of sales and 5% of cost of sales. 1. Prepare the year-end adjusting entry to record the sales expected to be refunded. 2. Prepare the year-end adjusting entry to record the cost side of sales returns and allowances. 3. Recompute gross profit using the adjusted numbers from parts 1 and 2. c. Is Sales Refund Payable an asset, liability, or equity account? d. Is Inventory Returns Estimated an asset, liability, or equity account?arrow_forward

- The trial balance of Ivanhoe Company at the end of its fiscal year, August 31, 2025, includes these accounts: Beginning Inventory $24,450, Purchases $194,940, Sales Revenue $195,900, Freight-In $9,740, Sales Returns and Allowances $4,620, Freight-Out $1,690, and Purchase Returns and Allowances $5,810. The ending inventory is $20,500. Prepare a cost of goods sold section (periodic system) for the year ending August 31, 2025. * : : + ◆ + IVANHOE COMPANY Cost of Goods Sold $ + $ SUPPORTarrow_forwardNext Hope reported the following income statement for the year ended December 31, 2026: View the income statement. Requirements 1. 2. Compute Next Hope's inventory turnover rate for the year. (Round to two decimal places.) Compute Next Hope's days' sales in inventory for the year. (Round to two decimal places.) ... Requirement 1. Compute Next Hope's inventory turnover rate for the year. (Round to two decimal places.) Select the labels and enter the amounts to compute the inventory turnover rate. (Round your answer to two decimal places, X.XX.) Income statement = Inventory turnover = times Next Hope Income Statement Year Ended December 31, 2026 Requirement 2. Compute Next Hope's days' sales in inventory for the year. (Round to two decimal places.) ÷ ÷ Select the labels and enter the amounts to compute the days' sales in inventory for the year. (Enter all amounts to two decimal places, X.XX.) Days' sales in inventory days Net Sales Revenue $ 148,000 Cost of Goods Sold: = Beginning…arrow_forwardInventory at the beginning of the year cost $13,900. During the year, the company purchased (on account) inventory costing $86,500. Inventory that had cost $82,500 was sold on account for $97,000. Required: a. Calculate the amount of ending inventory. b. What was the amount of gross profit? c. Prepare journal entry to record sale of inventory assuming a perpetual system is used. Debit Credit Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education