FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

DO NOT GIVE ANSWER IN IMAGE FORMAT

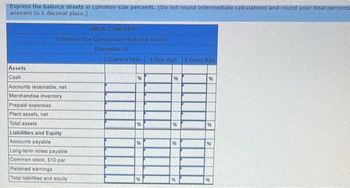

Transcribed Image Text:Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percenta

answers to 1 decimal place.)

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Common-Size Comparative Balance Sheets

December 31

SIMON COMPANY

Liabilities and Equity

Accounts payable

Long-term notes payable

Common stock, $10 par

Retained earnings

Total liabilities and equity

Current Year

%

%

1 Year Ago 2 Years Ago

%

%

![Use the following information for the Exercises below. (Algo)

[The following information applies to the questions displayed below]

Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Current Year

$ 26,076

76,346

94,052

8,569

245,937

$ 450,980

$ 113,417

83,936

162,500

91,127

$ 450,980

1 Year Ago

Liabilities and Equity

Accounts payable

Long-tere notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

For both the current year and one year ago, compute the following ratios:

$ 30,480

53,884

74,081

8,246

222,085

$ 388,776

TAL

$ 65,703

88,524

162,500

72,049

$ 388,776

2 Years Ago

$ 34,058

44,529

47,428

3,711

204,274

$ 334,000

$ 43,206

73,814

162,500

54,480

$ 334,000

Exercise 13-6 (Algo) Common-size percents LO P2

1. Express the balance sheets in common-size percents

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total

assets favorable or unfavorable?

3. Assuming annual sales have not changed in the last three years, is the change in merchandise Inventory as a percentage of total

assets favorable or unfavorable?](https://content.bartleby.com/qna-images/question/c7cdeda0-e51d-40f1-9e69-3ed0a65ba448/83505de8-1e26-4ae5-9182-9620b7c220eb/wccfrm_thumbnail.jpeg)

Transcribed Image Text:Use the following information for the Exercises below. (Algo)

[The following information applies to the questions displayed below]

Simon Company's year-end balance sheets follow.

At December 31

Assets

Cash

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

Current Year

$ 26,076

76,346

94,052

8,569

245,937

$ 450,980

$ 113,417

83,936

162,500

91,127

$ 450,980

1 Year Ago

Liabilities and Equity

Accounts payable

Long-tere notes payable

Common stock, $10 par value

Retained earnings

Total liabilities and equity

For both the current year and one year ago, compute the following ratios:

$ 30,480

53,884

74,081

8,246

222,085

$ 388,776

TAL

$ 65,703

88,524

162,500

72,049

$ 388,776

2 Years Ago

$ 34,058

44,529

47,428

3,711

204,274

$ 334,000

$ 43,206

73,814

162,500

54,480

$ 334,000

Exercise 13-6 (Algo) Common-size percents LO P2

1. Express the balance sheets in common-size percents

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total

assets favorable or unfavorable?

3. Assuming annual sales have not changed in the last three years, is the change in merchandise Inventory as a percentage of total

assets favorable or unfavorable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education