FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![**Title: Understanding T-Accounts and Month-End Balances**

**Objective:**

Learn how to post transactions to T-accounts and determine month-end balances.

---

**Instructions:**

Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of information presented in the question.)

---

**T-Accounts:**

1. **Cash**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

2. **Accounts Receivable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

3. **Equipment**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

4. **Accounts Payable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

5. **Common Stock**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

6. **Service Revenue**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

7. **Salaries and Wages Expense**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

---

**Explanation:**

This table represents an interactive worksheet used to understand and analyze T-accounts for various financial accounts by filling out corresponding debit and credit transactions.

- Each row represents a financial account: Cash, Accounts Receivable, Equipment, Accounts Payable, Common Stock, Service](https://content.bartleby.com/qna-images/question/0d1f03dc-16fb-4834-9136-6d6472c9ed62/86d70346-3cfc-438c-9ef5-5cbc93ea06fb/gg6f2ix_thumbnail.jpeg)

Transcribed Image Text:**Title: Understanding T-Accounts and Month-End Balances**

**Objective:**

Learn how to post transactions to T-accounts and determine month-end balances.

---

**Instructions:**

Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of information presented in the question.)

---

**T-Accounts:**

1. **Cash**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- [Dropdown for transaction selection]

- [Input field for amount]

2. **Accounts Receivable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

3. **Equipment**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

4. **Accounts Payable**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

5. **Common Stock**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

6. **Service Revenue**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

7. **Salaries and Wages Expense**

- Debit side:

- [Dropdown for transaction selection]

- [Input field for amount]

- Credit side:

- [Dropdown for transaction selection]

- [Input field for amount]

---

**Explanation:**

This table represents an interactive worksheet used to understand and analyze T-accounts for various financial accounts by filling out corresponding debit and credit transactions.

- Each row represents a financial account: Cash, Accounts Receivable, Equipment, Accounts Payable, Common Stock, Service

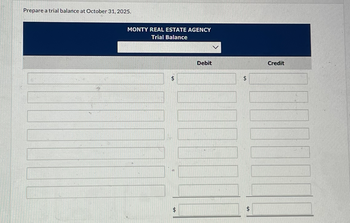

Transcribed Image Text:### Monty Real Estate Agency - Transactions and Journal Entries for October

Below are the recorded financial transactions for Monty Real Estate Agency during the month of October, along with their respective journal entries.

#### October Transactions:

1. **Oct. 1**

- Stockholders invest $30,000 in exchange for common stock of the corporation.

2. **Oct. 2**

- Hired an administrative assistant at an annual salary of $31,080.

3. **Oct. 3**

- Purchased office furniture for $3,700 on account.

4. **Oct. 6**

- Sold a house and lot for E.C. Roads; commissions due from Roads, $10,090 (not paid by Roads at this time).

5. **Oct. 10**

- Received $220 as a commission for acting as rental agent renting an apartment.

6. **Oct. 27**

- Paid $630 on account for the office furniture purchased on October 3.

7. **Oct. 30**

- Paid the administrative assistant $2,590 in salary for October.

#### Journal Entries:

| Date | Account Titles and Explanation | Debit | Credit |

|-----------|-----------------------------------------|---------|---------|

| Oct. 1 | **Cash** | 30,000 | |

| | **Common Stock** | | 30,000 |

| Oct. 2 | No entry | | |

| Oct. 3 | **Equipment** | 3,700 | |

| | **Accounts Payable** | | 3,700 |

| Oct. 6 | **Accounts Receivable** | 10,090 | |

| | **Service Revenue** | | 10,090 |

| Oct. 10 | **Cash** | 220 | |

| | **Service Revenue** | | 220 |

| Oct. 27 | **Accounts Payable** | 630 | |

| | **Cash** | | 630 |

| Oct. 30 | **Salaries and Wages Expense** | 2,590 | |

| | **Cash** | | 2,590 |

### Explanation of Entries

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Prepare a trial balance at October 31, 2025.

MONTY REAL ESTATE AGENCY

Trial Balance

A

$

Debit

$

$

Credit

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:Prepare a trial balance at October 31, 2025.

MONTY REAL ESTATE AGENCY

Trial Balance

A

$

Debit

$

$

Credit

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forwardThe following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $4,390 from a local bank on a note due in six months. b. Received $5,080 cash from investors and issued common stock to them. c. Purchased $1,900 in equipment, paying $650 cash and promising the rest on a note due in one year. d. Paid $750 cash for supplies. e. Bought and received $1,150 of supplies on account. Required: Post the effects to the appropriate T-accounts and determine ending account balances. Show a beginni Debit Beginning Balance Ending Balance Debit F Cash Equipment Credit Credit Debit Beginning Balance Ending Balance Debit Supplies Accounts Payablearrow_forwardJuly 1 July 1 July 3 July 5 July 12 July 18 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Common Stock Retained Earnings Maintenance and Repairs Expense Supplies Expense Depreciation Expense 14,400 5520 1080 2160 9600 350 2400 6480 744C 1440Carrow_forward

- prepare journal entries and T-accountarrow_forwardYou are the bookkeeper for Harley Inc., a newly formed corporation. Harley had the following transactions for their business: * Four shareholders contributed $40,000 ($10,000 each) in exchange for Harley common stock. * Harley purchased inventory for $5,000. Harley received an invoice for the inventory that is due in 30 days. What are the effects on Harley's accounting equation? A B D Based on the two transactions, Assets increased by $40,000, Liabilities decreased by $5,000 and Shareholder Equity increased by $45,000. Based on the two transactions, Assets increased by $45,000, Liabilities increased by $5,000 and Shareholder Equity increased by $40,000. C Based on the two transactions, Assets increased by $15,000, Liabilities increased by $5,000 and Shareholder Equity increased by $10,000. Based on the two transactions, Assets increased by $35,000, Liabilities decreased by $5,000 and Shareholder Equity increased by $40,000.arrow_forwardE2-13 (Algo) Recording Journal Entries LO2-4 Jameson Corporation was organized on May 1. The following events occurred during the first month. a. Received $72,000 cash from the five investors who organized Jameson Corporation. Each investor received 110 shares of $10 par value common stock. b. Ordered store fixtures costing $11,000. c. Borrowed $10,000 cash and signed a note due in two years. d. Purchased $18,000 of equipment, paying $1,100 in cash and signing a six-month note for the balance. e. Lent $1,500 to an employee who signed a note to repay the loan in three months. f. Received and paid for the store fixtures ordered in (b). Required: Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 2 3 4 5 6 Record the receipt of $72,000 cash from five investors who each received 110 shares of $10 par value common stock. Note: Enter…arrow_forward

- This information relates to McCall Real Estate Agency. Oct. 1 Stockholders invest $31,020 in exchange for common stock of the corporation. 2 Hires an administrative assistant at an annual salary of $42,960. 3 Buys office furniture for $4,110, on account. 6 Sells a house and lot for E. C. Roads; commissions due from Roads, $11,340 (not paid by Roads at this time). 10 Receives cash of $215 as commission for acting as rental agent renting an apartment. 27 Pays $730 on account for the office furniture purchased on October 3. 30 Pays the administrative assistant $3,580 in salary for October. Prepare the debit–credit analysis for each transactionarrow_forwardE3-7 This information relates to Crofoot Real Estate Agency. Stockholders invest $30,000 in exchange for common stock of the corporation. Hires an administrative assistant at an annual salary of $36,000. 3 Buys office furniture for $3,800, on account. Sells a house and lot for M.E. Graves; commissions due from Graves, $10,800 (not paid by Graves at this time). Oct. 1 6. 10 Receives cash of $140 as commission for acting as rental agent renting an apartment. 27 Pays $700 on account for the office furniture purchased on October 3. 30 Pays the administrative assistant $3,000 in salary for October. Instructions Prepare the debit-credit analysis for each transaction, as illustrated on pages 121-126.arrow_forwardLabel each transaction as an Operating Activity, Investing activity, or Financing Activity and if it is an inflow or (outflow). 1. Drake issued 10,000 shares of common stock for $40,000 2. Drake collected $80,000 from customers on Accounts Receivables 3. Drake Paid $5,000 in interest payments on their bonds 4. Drake purchased a new copy machine and paid cash of $35,000 5. Drake sold their old copy machine for $2,000 cash 6. Drake paid a $4,500 dividend to shareholders 7. Drake borrowed $40,000 cash from the bank on December 28,2019 (payments begin 1/28/20) 8. Drake purchased a patent for $15,000 cash 9. Drake paid $65,000 cash in wages during 2019 10. Drake paid 2018 taxes due in the amount of $10,500 on April 15, 2019 Indicate the total net cashflow (Inflow-Outflow) from above for each classification: Operating Investing Financingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education