FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

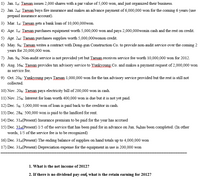

Transcribed Image Text:1) Jan. 1st. Taesan issues 2,000 shares with a par value of 5,000 won, and just organized their business.

2) Jan. 2ad: Taesan buys fire insurance and makes an advance payment of 6,000,000 won for the coming 6 years (use

prepaid insurance account).

3) Mar. 1st: Taesan gets a bank loan of 10,000,000won.

4) Apr. 1st: Taesa purchases equipment worth 5,000,000 won and pays 2,000,000wonin cash and the rest on credit.

5) Apr. 2nd: Taesan purchases supplies worth 5,000,000wonon credit.

6) May. 9h: Taesan writes a contract with Dong-gun Construction Co. to provide non-audit service over the coming 2

years for 20,000,000 won.

7) Jun. 9h: Non-audit service is not provided yet but Taesan receives service fee worth 10,000,000 won for 2012.

8) Aug. 16th: Taesan provides tax advisory service to Yunkyoung Co. and makes a payment request of 2,000,000 won

as service fee.

9) Oct. 20a: Yunkvoung pays Taesan 1,000,000 won for the tax advisory service provided but the rest is still not

collected.

10) Nov. 20th: Taesan pays electricity bill of 200,000 won in cash.

11) Nov. 25a: Interest for loan worth 400,000 won is due but it is not yet paid.

12) Dec. 5th: 5,000,000 won of loan is paid back to the creditor in cash.

13) Dec. 28h. 500,000 won is paid to the landlord for rent.

14) Dec. 31:(Present) Insurance premium to be paid for the year has accrued

15) Dec. 31(Present) 1/5 of the service that has been paid for in advance on Jun. 9ahas been completed. (In other

words, 1/5 of the service fee is to be recognized)

16) Dec. 31(Present) The ending balance of supplies on hand totals up to 4,000,000 won

17) Dec. 31:(Present) Depreciation expense for the equipment in use is 200,000 won

1. What is the net income of 2012?

2. If there is no dividend pay-out, what is the retain earning for 2012?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q) Tanya sells mutual funds for Pacific Financial Services Ltd. On mutual fund sales, Pacific Financial Services charges a "front-end load" or gross commission rate of 6%. Tanya is paid on a graduated commission structure. She receives 40% of the gross commission on the first $100,000 worth of mutual funds she sells in a month, and 60% of the gross commission on all additional sales in the same month. What are her earnings for a month in which she sells $180,000 worth of mutual funds? 20arrow_forward3. on June 50, Di María's Company sold a car to De Paul's Company on June 30,2022. De Paul's Company signs 1 a $800,000, 4%, 9-month note. What entry will Di María's Company make on March 30,2023? A Cash 824,000 B Cash Notes Receivable Interest Revenue • C Cash D Cash Notes Receivable Notes Receivable Notes Receivable Interest Receivable Interest Revenue 824,000 800,000 24,000 824,000 800,000 800,000 824,000 800,000 16,000 8,000arrow_forwardDée Trader opens a brokerage account and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. The interest rate on the loan is 8%Dée Trader opens a brokerage account and purchases 300 shares of Internet Dreams at $40 per share. She borrows $4,000 from her broker to help pay for the purchase. The interest rate on the loan is 8%. Required: a. What is the margin in Dée’s account when she first purchases the stock? b. If the share price falls to $30 per share by the end of the year, what is the remaining margin in her account? c. If the maintenance margin requirement is 30%, will she receive a margin call? multiple choice Yes No Correct d. What is the rate of return on her investment? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.)arrow_forward

- Subject:- accountingarrow_forwardOn May 15, 2022, Powell Incorporated obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $478,700. The interest rate charged by the bank was 6.75%. The bank made the loan on a discount basis. Exercise 7-7 (Algo) Part a - Journal entry a-3. Record the journal entry to show the effect of signing the note and the receipt of the cash proceeds on May 15, 2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardOn October 1, 2023 PT. Leci borrowed $500,000 from Pineapple Bank by signing a 10-month, 6% note. If on December 31 PT. Leci makes adjusting entries, then on August 1, 2024 what is the amount of interest expense recorded by PT. Lychee when paying off the notes? a. 17.500 b. 21 000 c. 9.000 d. 30.000 e. 7.500arrow_forward

- 10arrow_forwardThe following is a December 31, 2024, post-closing trial balance for Almway Corporation. Account Title Cash Investment in equity securities Accounts receivable Inventory Prepaid insurance (for the next 9 months) Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Patent (net) Accounts payable Notes payable Interest payable Bonds Payable Common stock Retained earnings Totals Debits $ 47,000 112,000 61,000 201,000 8,000 92,000 421,000 111,000 11,000 $ 1,064,000 Credits $ 101,000 61,000 77,000 133,000 21,000 241,000 303,000 127,000 $ 1,064,000 Additional information: 1. The investment in equity securities account includes an investment in common stock of another corporation of $31,000 which management intends to hold for at least three years. The balance of these investments is intended to be sold in the coming year. 2. The land account includes land which cost $26,000 that the company has not used and is currently listed for sale. 3. The cash…arrow_forwardOn September 1, Year 1, West Company borrowed $30,000 from Valley Bank. West agreed to pay interest annually at the rate of 5% per year. The note issued by West carried an 18-month term. West Company has a calendar year-end. What is the amount of interest expense that will be reported on West's income statement for Year 1? Multiple Choice $500 $375 $-0- $150arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education