FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

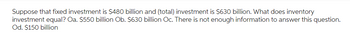

Transcribed Image Text:Suppose that fixed investment is $480 billion and (total) investment is $630 billion. What does inventory

investment equal? Oa. $550 billion Ob. $630 billion Oc. There is not enough information to answer this question.

Od. $150 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which U.S. GAAP principle or rule would apply if the net realizable value of acompany’s inventory is below its original cost?a. Lower-of-cost-or-market ruleb. Consistency principlec. Disclosure principled. Historical cost principlearrow_forward4. The purchase of inventory items on account using the perpetual inventory method a. Has no effect on the current ratio but decreases working capital. b. Has no effect on working capital but decreases the current ratio. c. Decreases working capital and the current ratio. d. Has no effect on working capital nor the current ratio. 5. The cost of inventories shall be measured using a. Either FIFO, average method or LIFO b. Average method c. Either FIFO or average method d. FIFOarrow_forwardThe following information for Tuell Company is available: 1. Assume Tuell uses the LIFO cost flow assumption. what is the correct inventory value in each of the preceding situations under U.S. GAAP? 2. Assume Tuell Uses the average cost inventorγcost flow asstrmption. what is the correct inventory value in each of the preceding situations under U .S. GAAP? 3. Assume that Tuell uses the average cost inventory cost flow assumption. What is the correct inventor)' value rn each of the preceding situations if Tuell uses IFRS?arrow_forward

- The original cost of an item of inventory is above its replacement cost. The item s replacement cost is below its net realizable value but is higher than its net realizable value minus a normal profit. Under the lower of cost or market method, the inventory item should be valued at: a. Net realizable value. b. Original cost. c. Replacement cost. d. Net realizable value less normal profit margin.arrow_forwardIf the profit margin is 0.1142, asset turnover is 0.5619 and financial leverage is 1.2937, what is the return on asset? Multiple Choice 0.1142 0.7269 0.0830 0.0642arrow_forwardH7. For the same transactions, why does the weighted-average cost method provide different value for ending inventory and COGS depending on whether the periodic or perpetual inventory system is used? Select one: a. Perpetual inventory calculates and assigns costs as items are sold, while periodic inventory calculates and assigns costs at the end of the period. b. Perpetual inventory calculates and assigns costs at the end of the period, while periodic inventory calculates and assigns costs as items are sold. c. Perpetual inventory counts all the purchases for the month first before calculating the average cost, while periodic calculates the average cost after every transaction. d. Perpetual inventory and periodic inventory will not provide different values using Explain also wrong options and explain with detailsarrow_forward

- Lower-of-Cost-or-Market Method On the basis of the data shown below: Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) MX62 56 $56 $58 VZ31 107 29 26 Determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.arrow_forwardAa 129.arrow_forward18.Net realizable value is a. acquisition cost plus estimated costs to complete and sell b. estimated selling price less estimated cost to complete and sell c. estimated selling price less estimated costs to complete and sell and normal profit. d. estimated selling price.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education