Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

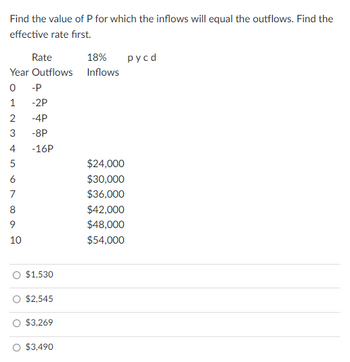

Transcribed Image Text:Find the value of P for which the inflows will equal the outflows. Find the

effective rate first.

Rate

Year Outflows

0

1

2

3

4

5

678

9

10

-P

-2P

-4P

-8P

-16P

$1,530

$2,545

$3,269

$3,490

18% pycd

Inflows

$24,000

$30,000

$36,000

$42,000

$48,000

$54,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Can you please show me the NPV formulas that I need to input for each blue shaded areaarrow_forwardDetails WACC 0 SGWN-O 1 2 3 4 5 6 7.80% Project A Project B -1225 395 402 423 432 489 512 -2146 592.5 603 634.5 648 733.5 768 1. Construct NPV profile table by using cashflows from Project A and B above. 2. Draw NPV profile 3. Compute crossover rate To receive EC your work has to be done in Excel.arrow_forwardWhich alternative should be selected using incremental rate of return analysis, if MARR = 12.0%? First cost Annual benefit Life ROR Do-nothing 0 10 yrs A B $6,500 $3,500 1,246 765 с D $7,500 $5,000 1,523 779 14.0% 17.5% 15.5% 9.0% B, because its ROR is the highest something other than C, because C costs the most initially C because C has the highest annual benefit C, because the C-B increment has a ROR of 13.70% and the A-B increment has a ROR of 9.66%arrow_forward

- solution in excelarrow_forwardwhich has a better IRR Project 1 Year Cashflows Discount Rate 10% 0 $ (750,000.00) 1 $ 250,000.00 2 $ 300,000.00 3 $ 350,000.00 4 $ 200,000.00 5 $ 100,000.00 Project 2 Year Cashflows Discount Rate 10% 0 $ (1,000,000.00) 1 $ 200,000.00 2 $ 300,000.00 3 $ 400,000.00 4 $ 500,000.00 5 $ 700,000.00arrow_forwardsolution in excelarrow_forward

- please tell me which is the best option and formulate why, thanksarrow_forwardYou are given the following cash flow information for Project A TV Inflows Year 0 PV Outflows -$150,000.00 1 Project A -$150,000.00 $80,000.00 -$25,000.00 $50,000.00 2 $80,000.00 -$30,000.00 $75,000.00 Totals 3 4 5 6 O 19.33% $75,000.00 Now assume that the project's cost of capital is 16.0 percent, but that its true reinvestment rate is 24.0 percent. Given this information, determine the project's modified internal rate of return (MIRR). Ⓒ 18.56% 5 ptsarrow_forwardJit Don't upload any image pleasearrow_forward

- A company that was to be liquidated had the following liabilities: Income Taxes Notes Payable secured by land Accounts Payable $ 15,000 120,000 48,000 Salaries Payable ($18,000 for Employee #1 and $5,000 for Employee #2) Administrative expenses for liquidation The company had the following assets: 23,000 Current Assets Land Building Saved 25,000 Book Fair Value Value $130,000 $115,000 60,000 100,000 175,000 220,000 Total liabilities with priority are calculated to be what amount? Multiple Choice О $106,650. $38,000.arrow_forwardConsider the following cash flows: C₁ Co -$45 +$41 +$41 +$41 a. Which two of the following rates are the IRRS of this project Note: You may select more than one answer. Single click th for a correct answers and double click the box with the que boxes left with a question mark will be automatically grade 2.5% 34.2% 14.3% 34.2% CA -$82 40.0%arrow_forwardNPV NPV as function of discount rate $500 $400 NPV Profile X $300 $200 Y Z $100 $0 0% 10% 20% 30% 40% 50% Project A -$100 -$200 Project B -$300 Discount rate Consider the NPV profile of projects A and B. Which of the following is true? O X=crossover rate; Y= IRR of project B; Z-IRR of project A X=crossover rate; Y= IRR of project A; Z=IRR of project B OX-IRR of project A; Y= IRR of project B; Z=crossover ratearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education