Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity.

Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs.

Your current mortgage payment is $1,558.50 per month, with a balance of $217,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570.

You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage.

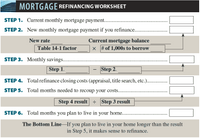

A guided mortgage refinancing worksheet.

(a)

What is your currently monthly mortgage (in $)?

$

(b)

Using this table, what is your new monthly mortgage payment (in $) if you decide to refinance? (Round your answer to the nearest cent.)

$

(c)

What is your monthly savings (in $) if you decide to refinance? (Round your answer to the nearest cent.)

$

(d)

Calculate the total refinance closing cost (in $). (Round your answer to the nearest cent.)

$

(e)

How many months would you need to recoup the refinance closing cost? (Round your answer up to the nearest month.)

months

(e)

How many months are you planning to live in your home?

months

Transcribed Image Text:**Mortgage Refinancing Worksheet**

**Step 1:** Current monthly mortgage payment ..............................

**Step 2:** New monthly mortgage payment if you refinance ................

- **New rate:** ____

- **Table 14-1 factor:** ____

- **Current mortgage balance:** ____

- **# of 1,000s to borrow:** ____

**Step 3:** Monthly savings .............................................................

- Calculation: **Step 1 result** – **Step 2 result**

**Step 4:** Total refinance closing costs (appraisal, title search, etc.) ............

**Step 5:** Total months needed to recoup your costs ...........................

- Calculation: **Step 4 result** ÷ **Step 3 result**

**Step 6:** Total months you plan to live in your home .......................

**The Bottom Line:** If you plan to live in your home longer than the result in Step 5, it makes sense to refinance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1

VIEW Step 2 Calculation of currently monthly mortgage (in $):

VIEW Step 3 Calculation of new monthly mortgage payment (in $) if you decide to refinance:

VIEW Step 4 Calculation of monthly savings (in $) if we decide to refinance:

VIEW Step 5 Calculation of total refinance closing cost (in $):

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $982,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.)arrow_forwardAccording to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,578.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $90; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. (a) What is your currently monthly mortgage (in $)? $ (b) Using…arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $983,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for four years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (d): If Darrell chooses the 2-point 9.5% loan, what will be his total outlay in points…arrow_forward

- According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,658.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. (attached is chart) (a): What is your currently monthly mortgage (in…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely.arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $986,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) I want to know how to find this out: If Darrell chooses the 4-point 9% loan, what will be his…arrow_forward

- According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,558.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. A guided mortgage refinancing worksheet. The first line states "Step 1.…arrow_forwardThe buyer of a piece of real estate is often given the option of buying down the loan. This option gives the buyer a choice of loan terms in which various combinations of interest rates and discount points are offered. The choice of how many points and what rate is optimal is often a matter of how long the buyer intends to keep the property. Darrell Frye is planning to buy an office building at a cost of $984,000. He must pay 10% down and has a choice of financing terms. He can select from a 9% 30-year loan and pay 4 discount points, a 9.25% 30-year loan and pay 3 discount points, or a 9.5% 30-year loan and pay 2 discount points. Darrell expects to hold the building for three years and then sell it. Except for the three rate and discount point combinations, all other costs of purchasing and selling are fixed and identical. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount being financed? $ (b) If Darrell chooses the 4-point 9% loan, what…arrow_forwardAccording to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,678.50 per month, with a balance of $218,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage a) What is your currently monthly mortgage (in $)? $ (b) Using this…arrow_forward

- James is working with several mortgage brokers to secure a loan to purchase a new house. He plans on living in the house for many years to come and wants a loan that will have minimal risk. What type of loan should James get? A. An adjustable-rate mortgage. His loan payments will adjust over the life of the loan. B. A negative amortizing loan. This will allow James to pay off the loan more quickly. C.A fixed-rate loan. His loan payments will remain constant, which will allow him to properly budget for the payments. D.A term loan. This will allow James to have smaller monthly payments with a balloon payment at thearrow_forwardExplain All point of question with proper Answer.arrow_forwardSuppose you are shopping for a mortgage and the lender presents you with a long menu of loan options. For each option, there is a discount point charged and an interest rate given. The amount of the point ranges anywhere from -1% to 3%. When would it be optimal for you select a loan with a point of 2%? (Assume there is no affordability constraint, ie: you have the money to buy whatever point you would like). If you have a very short holding period O Never O If you have a very long holding period O Only when the point is equal to the effective borrowing cost O Alwaysarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education