Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

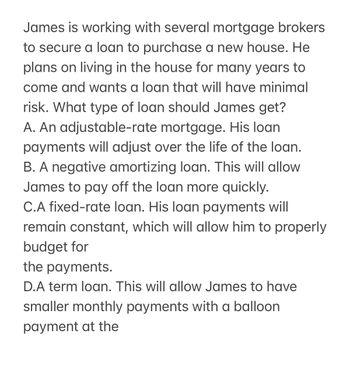

Transcribed Image Text:James is working with several mortgage brokers

to secure a loan to purchase a new house. He

plans on living in the house for many years to

come and wants a loan that will have minimal

risk. What type of loan should James get?

A. An adjustable-rate mortgage. His loan

payments will adjust over the life of the loan.

B. A negative amortizing loan. This will allow

James to pay off the loan more quickly.

C.A fixed-rate loan. His loan payments will

remain constant, which will allow him to properly

budget for

the payments.

D.A term loan. This will allow James to have

smaller monthly payments with a balloon

payment at the

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- You were planning to purchase a house this month with a mortgage and just learned that the Fed is conducting open market purchase. Your situation is flexible in terms of the timing of the purchase; right now or later. It is assumed that everything else stays constant. What'd be the best strategy for your purchase? Explain using economic theory, not as a personal finance advisorarrow_forwardAccording to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,578.50 per month, with a balance of $217,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. MORTGAGE REFINANCING WORKSHEET STEP 1. Current monthly mortgage payment...…arrow_forwardHannah is exploring savings options from several different banks and has settled on one of the financial products offered by Bank A. Calculate the effective annual interest rate for Hannah given that the nominal annual interest rate is 3% p.a. Note that the nominal interest rate is compounded monthly. Additionally, Bank B is offering the same product with an effective interest rate of 5.5% p.a. Given this, would Hannah be better off saving with Bank A or Bank B? Justify your answer.arrow_forward

- According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,578.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $90; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. (a) What is your currently monthly mortgage (in $)? $ (b) Using…arrow_forward6) Stephanie suggests to George that they can reduce the amount of interest they pay over the life of the loan by simply making his monthly repayments at the start of each month rather than at the end. Is Stephanie correct? Explain why/why not using calculations to prove your response.please Show formula, variables, calculations and a concluding statement in your response.arrow_forwardAccording to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,658.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. (attached is chart) (a): What is your currently monthly mortgage (in…arrow_forward

- Ten years ago Jim took a mortgage loan of $200,000 to be repaid in 20 equal annual installments of $30,197.34. The bank has told him that they would accept $145,000 today as payment in full for the remainder of the loan. What is the balance on this loan? If we assume that Jim has the money, what interest rate must he earn on alternative investments in order not to accept the bank offer?arrow_forwardThis is a Debt Coverage Ratio or DCR question for part a and a CAP rate question for part b]. Wendy is going to purchase a commercial building and is working with a commercial lender at her local bank. The bank has some loan parameters that Wendy must follow. Understanding the rules will allow her to calculate her cash, income, and payment projections. The bank requires a 1.4 debt coverage ratio for her project. Wendy needs to calculate her net operating income or NOI first. The debt coverage ratio is based on this number. Then she will apply for a 20 year loan at 5% with annual payments. Information on the property includes: Gross rents- $780,000 Vacancy 5% Salaries $85,000 Other Fixed Expenses $125,000 Variable Expenses 20% of gross rents. NOI=_________________ Use the NOI and Debt Coverage requirement to calculate the answer. What is the largest annual payment the bank will allow? If Wendy had to buy the property at a 6% CAP (capitalization) rate, what is the asking price?arrow_forwardAccording to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,558.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. A guided mortgage refinancing worksheet. The first line states "Step 1.…arrow_forward

- According to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,678.50 per month, with a balance of $218,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.75% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $570. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage a) What is your currently monthly mortgage (in $)? $ (b) Using this…arrow_forwardSuppose that you need $30,000 for your last year of college. You could go to a private lending institution and apply for a signature student loan; rates range from 7% to 14%. However, your Aunt Sally is willing to loan you the money from her retirement savings, with no repayment until after graduation. All she asks is that in the meantime you pay her each month the amount of interest that she would otherwise get on her savings (since she needs that to live on), which is 4%.What is your monthly payment to her, and how much interest will you pay her over the year (9 months)?(Fill in the blanks below and give your answers as whole numbers.)The amount of interest per month you would pay Aunt Sally is $__(1)__ .The total interest you will pay her over the year (9 months)is $__(2)__ .arrow_forwardAccording to money.CNN.com, with mortgage rates near 35-year lows, you may be able to cut your payments sharply by refinancing your loan. To qualify for the best rates, you need a credit score of 740 or higher and usually at least 20% equity. Even if you have to settle for a higher rate, a new loan may save you money. The main consideration is whether you will live in your home long enough to offset the refinance closing costs. Your current mortgage payment is $1,658.50 per month, with a balance of $219,800. Suppose you have a chance to refinance at a certain bank with a 30-year, 5.5% mortgage. The closing costs of the loan are application fee, $80; credit report, $165; title insurance, 0.4% of the amount financed; title search, $360; and attorney's fees, $560. You plan to live in your home for at least four more years. Use the Mortgage Refinancing Worksheet to see if it makes sense to refinance your mortgage. Using this table, what is your new monthly mortgage payment (in $) if you…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education