Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

i keep trying to do this and it says the answer i’m getting is wrong, i really need help

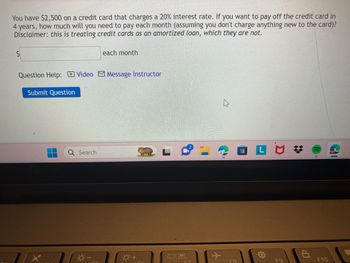

Transcribed Image Text:You have $2,500 on a credit card that charges a 20% interest rate. If you want to pay off the credit card in

4 years, how much will you need to pay each month (assuming you don't charge anything new to the card)?

Disclaimer: this is treating credit cards as an amortized loan, which they are not.

S

Question Help: Video Message instructor

Submit Question

each month

Q Search

0:- +

Y

F8

O

F9

F10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I have problems in understanding the concept of "risk aversion" Which of the following is correct? i. A more risk averse person would require less return to face the face same risk as a less risk averse person i. No, he would require more return because his aversion is higher ii. They both would require the same return, because in the final analysis, risk aversion, does not matter. iv. Risk aversion is morally wrong, so forget about the concept, nothing to understand!arrow_forwardI still don't understand and the answer to project X, Y and Z isn't correct. I got a different answer.arrow_forwardIt keeps coming back incorrect and I can not figure out whYarrow_forward

- still comes up as wrong- that's what i was getting.arrow_forwardIm having an issue with this problem. Thank you!arrow_forwardEmployees are more likely to apply their personal values to their behaviour when: those values conflict with the organization's values. the values are abstract. someone reminds them of those values. All of the answers are correct. None of the answers apply.arrow_forward

- A Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forwardAll qualified plans must have fiduciaries who must act in the best interests of the plan participants and their beneficiaries. Which of the following is a breach of fiduciary responsibilities? Select one: a. Making a bad investment based on professional advice and conducting appropriate due diligence. b. Making sure the plan investments are diversified. c. Making decisions in the interest of the plan sponsor. d. Paying for educational seminars that are reasonable in cost and substantiate attendance in a high percentage of presentation sessions.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education