Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please send me answer of this question within 10 min i will give you like sure.send me typed answer only

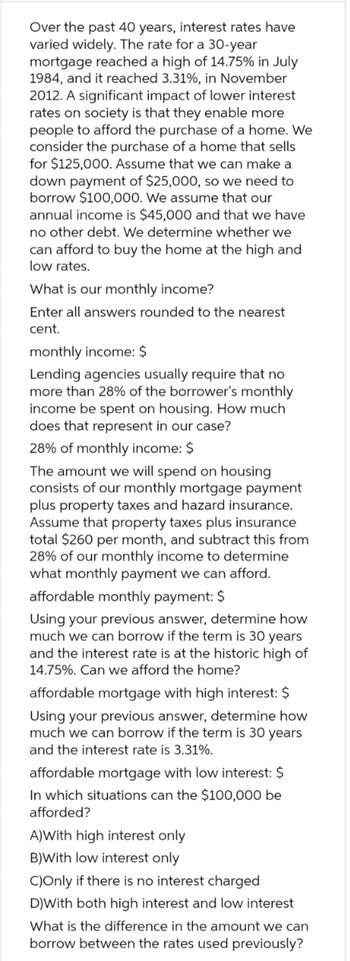

Transcribed Image Text:Over the past 40 years, interest rates have

varied widely. The rate for a 30-year

mortgage reached a high of 14.75% in July

1984, and it reached 3.31%, in November

2012. A significant impact of lower interest

rates on society is that they enable more

people to afford the purchase of a home. We

consider the purchase of a home that sells

for $125,000. Assume that we can make a

down payment of $25,000, so we need to

borrow $100,000. We assume that our

annual income is $45,000 and that we have

no other debt. We determine whether we

can afford to buy the home at the high and

low rates.

What is our monthly income?

Enter all answers rounded to the nearest

cent.

monthly income: $

Lending agencies usually require that no

more than 28% of the borrower's monthly

income be spent on housing. How much

does that represent in our case?

28% of monthly income: $

The amount we will spend on housing

consists of our monthly mortgage payment

plus property taxes and hazard insurance.

Assume that property taxes plus insurance

total $260 per month, and subtract this from

28% of our monthly income to determine

what monthly payment we can afford.

affordable monthly payment: $

Using your previous answer, determine how

much we can borrow if the term is 30 years

and the interest rate is at the historic high of

14.75%. Can we afford the home?

affordable mortgage with high interest: $

Using your previous answer, determine how

much we can borrow if the term is 30 years

and the interest rate is 3.31%.

affordable mortgage with low interest: $

In which situations can the $100,000 be

afforded?

A)With high interest only

B)With low interest only

C)Only if there is no interest charged

D)With both high interest and low interest

What is the difference in the amount we can

borrow between the rates used previously?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Edit View History Bookmarks Profiles Tab Window Help t Fridays - Become a w x sp MyPath - Home Gradebook / ACC 202: Manage X M Question 7 - Chapter 11 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Maps News Translate M SmartBook 2.0 M SmartBook 2.0 Homework i t Perez Company is considering an investment of $28,245 that provides net cash flows of $9,300 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A What is the internal rate of return of this investment? Present value factor Internal rate of return FI Required B @ 2 F2 # 3 APR…arrow_forwardChrome File Edit View History Bookmarks People Window Help 52% !), Wed 3:48 PM d : The Charge Flas Sigma Chi-Initi My Questions l l (7) YouTube | Bb] Syllabus-ROST G where to find sc X x Х Χ Chapter 1 Home ← → C https://newconnect.mheducation.com/flow/connect.html?returnUrl=https%3A%2F%2Fconnect.mheducation.com%2Fpaamweb%2Findex.html%.··d-☆ . Chapter 1 Homework - Graded Saved Help Save & Exit Submit Check my work 4 Required: Use only the appropriate accounts to prepare an income statement. 7 points COWBOY LAW FIRM Income Statement For the Period Ended December 31 eBook etained earnings Hint ervice revenue Ask Expenses Salaries expense Print References Total expenses Mc Graw Hill KPrev4 of 11 Next>arrow_forward- Homework A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co... E User Management,.. H https://outlook.offi.. O FES Protection Plan System 7- North C.. 用Re mework Exercises i Soved Help Save & Exit Submit Check my work Required: Record the following transactions of Fashion Park in a general journal, Fashion Park must charge 6 percent sales tax on all sales. The company uses the perpetual inventory system. (Round your intermediate calculations and final answers to the nearest whole dollar value.) DATE TRANSACTIONS 20X1 Sold merchandise for cash, $2,540 plus sales tax. The cost of merchandise sold was $1,540. The customer purchasing merchandise for cash on April 2 returhed $270 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $170. Sold merchandise on credit to Jordan Clark; issued Sales Slip 908 for $1,090 plus tax, terms n/30. The cost of the merchandise sold was…arrow_forward

- Please watch the following video, then answer the prompt below: https://youtu.be/nfkqCv3Rd_g: copy and paste it to view After watching, answer the question below: Describe the Time Value of Money.arrow_forwardAnswered: The fo x b Details | bartleby x b My Questions |b x Post Altendee -2 x FA Midterm Exan X -> File | C:/Users/Wendy/Downloads/FA%20Midterm%20Exam.pdf ME6 Which of the following entries records the payment of an account payable? a) Debit Accounts Payable, credit Cash b) Debit Cash, credit Accounts Payable c) Debit Expense, credit Cash d) Debit Cash, credit Expense ME7 The process of initially recording a business transaction is called: a) Sliding b) Posting c) Journalizing d) Transposing ME8 Which of the following entries for goods sold by cash is correct? a) Cash Dr, AR Cr b) AR Dr, Revenue Cr c) Fees Earned, debit; Cash credit d) Cash, debit; Bank Cr ME9 The verification that the sum of the debits and the sum of the credits in the ledger are equal is called: a) A journal b) A ledger c) Posting Type here to searcharrow_forwardNeed help with answering the questiins. Thank youarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education