Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

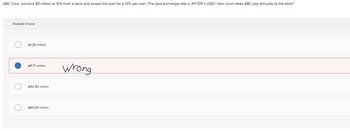

Transcribed Image Text:ABC Corp. borrows $5 million at 10% from a bank and swaps this loan for a 12% yen loan. The spot exchange rate is JPY105 = USD1. How much does ABC pay annually to the bank?

Multiple Choice

¥1.26 million

¥5.71 million

Wrong

¥52.50 million

¥63.00 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A U.S. bank converted $6 million to Swiss francs to make a Swiss franc loan to a valued corporate customer when the exchange rate was 1.153 francs per dollar. The borrower agreed to repay the principal plus 5.2 percent interest in one year. The borrower repaid Swiss francs at loan maturity and when the loan was repaid the exchange rate was 1.423 francs per dollar. What was the bank's dollar rate of return? (Do not round intermediate calculations. Round your answers to 3 decimal places. (e.g., 32.165))arrow_forwardTB SA Qu. 06-69 If you had borrowed $1,000,000.... Use the information below to answer the following question. Exchange Rate $ 1.60 €1.00 $1.58 € 1.00 So ( $/ €) F360 ($/C) Interest Rate is ic APR 28 4% If you had borrowed $1,000,000, traded them for euro at the spot rate, and invested those euros in Europe, how many euros will you receive in one year?arrow_forwardNewstar Co. expects to pay 500,000 euro in one year. Assume the annual interest rate of borrowing or lending euro is 1% and the annual interest rate of borrowing or lending U.S. dollar is 2%. The spot rate of euro is $1.12 per euro. How much guaranteed amount of U.S. dollar does the company expect to pay after hedging the euro payable transaction in the international money market? (pick the closest answer) A. 565,545 USD. B. 554,510 USD. C. 562,786 USD. D. 576,912 USD.arrow_forward

- An American rm owes SFr 6, 000, 000.00 payable in one year. The current spot it$1.3750/SFr. A Swiss bank is paying 1.50% on deposits or will lend at 6.50% AU.S. bank is paying 4.50% or will lend at 8.00%. The rm would like to hedge this exposurewith money market hedging. How much do they need to borrow todayarrow_forwardA bank in London, Ontario has a buying rate of CHF 1 = C$1.3547. If the exchange rate is CHF 1 = C$1.3841, calculate the rate of commission that the bank charges.arrow_forwardLooking for help on Journal Entry 7 ( interest expense and foreign exhange loss) and Journal Entry 8 (not payable and foreign exhange loss).arrow_forward

- Company A and B has been offered the following rates per annum on a £10 million 5 - year loan. Company A Fixed (%) Floating (%) LIBOR + 1.2 B LIBOR + 0.3 Company A requires a floating rate loan, whereas company B requires a fixed rate loan. In which market does company A have a comparative advantage? Design a swap that will give a bank, acting as an intermediary 0.5% p.a. and that will appear equally attractive to both companies. Explain how to achieve this, using diagrams and text.arrow_forwardCompany A and B has been offered the following rates per annum on a £10 million 5 - year loan. Company Fixed (%) Floating (%) A 5 LIBOR + 1.2 B 6 LIBOR + 0.3 Company A requires a floating rate loan, whereas company B requires a fixed rate loan. In which market does company A have a comparative advantage? Design a swap that will give a bank, acting as an intermediary 0.5% p.a. and that will appear equally attractive to both companies. Explain how to achieve this, using diagrams and text. (15 Marks) (Please answer without use of excel)arrow_forwardEUROCREDIT LOAN:A Swiss sporting goods company borrows in yen in the Eurocredit market at a rate of 4.94 percent from Bank of America using a three-month rollover loan. Bank of America assigns a default risk premium of 1.93 percent on the loan, and the country risk is an additional 0.76 percent. The bank can borrow funds in the Euromarket at the three-month LIBOR rate of 0.30 percent. What is Bank of America’s gross profit margin on this loan?arrow_forward

- KF1. Exquisite Jewelers has purchased 100 pounds of silver from Silver Mines Ltd. at US$8,000 per pound payable in one year. The current spot exchange rate is 1.6295 (C$/US$) and the one year forward rate, quoted by the company’s bank, is 1.6312. The Financial Controller at Fine Jewelers suggests that the spot rate in one year will be 1.6224. Interest rates in Canada are currently 3.9 percent for one year and 3.7 percent in the United States. Required: a) Outline, with calculations, three alternative actions available to Golden Jewelers to handle its foreign exchange exposure. b) Advise the company which alternative they should take, providing the reason for your recommendationarrow_forwardA UK company owes an American company $100,000 due to be paid in three months. The company wishes to avoid exchange rate risk, so borrows enough in sterling now and converts it immediately to dollars which are invested to bring in the required amount in three months' time. The following information is available: Spot rate $/£ 1.7755 - 1.7765 3-month interest rates: Sterling 3.250% US dollar 2.425% How much will the UK company have to borrow now to clear the debt in three months? A. £54,958 B. £54,989 £56,744 D. £56,775 C.arrow_forwardA bank in London, Ontario charges 2.50% commission to buy and sell currencies. Assume that the current exchange rate is US$1 = C$1.3599. a. How many Canadian dollars will you receive from the bank if you sell US$1,340? Round to the nearest cent b. How much commission will you pay the bank for this transaction? Round to the nearest centarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education