Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

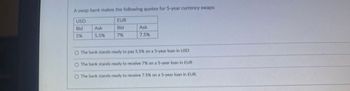

Transcribed Image Text:A swap bank makes the following quotes for 5-year currency swaps:

USD

EUR

Bid

Ask

Bid

Ask

5%

5.5%

7%

7.5%

O The bank stands ready to pay 5.5% on a 5-year loan in USD

O The bank stands ready to receive 7% on a 5-year loan in EUR

O The bank stands ready to receive 7.5% on a 5-year loan in EUR.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The $/£ spot rate is $1.60/£1. The UK interest rate is 4% and the US interest rate is 9%. Calculate the one year forward rate using the covered interest parity formula. State if the pound is at a forward discount or at a forward premium, and why.arrow_forwardMarket conditions are as follows; Exchange rate is USD 1 = JPY 130.00. USD market interest rate is 10% p.a. during the contract period, and JPY market interest rate is 6% p.a. during the contract period. The scheduled 'currency coupon' swap contract is as follows; the assumed principle amount is USD 100 million (JPY 13,000 million). Swap contract period is 2 years. You will pay 6.3 % in USD currency at the end of each year, and receive 6% in JPY currency at the end of each year. Calculate the NPV in JPY currency, using the original exchange rate of USD 1 = JPY 130.00.arrow_forwardIn September 2020, swap dealers were quoting a rate for five-year euro interest-rate swaps of 4.5% against Euribor (the short-term) interest rate for euro loans). Euribor at the time was 4.1%. Suppose that A arranges with a dealer to swap a €10 million five-year fixed- rate loan for an equivalent floating-rate loan in euros, answer the following: (Leave no cells blank - be certain to enter "0" wherever required.) a. Assume the swap is fairly priced. What is the value of this swap at the time that it is entered into? Swap value b. Suppose that immediately after A has entered into the swap, the long-term interest rate rises by 1%. Who gains and who loses? Dealer gains; A loses O A gains; Dealer loses c. What is now the value of the swap to A for each €1,000 of par value? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Swap valuearrow_forward

- Newstar Co. expects to pay 500,000 euro in one year. Assume the annual interest rate of borrowing or lending euro is 1% and the annual interest rate of borrowing or lending U.S. dollar is 2%. The spot rate of euro is $1.12 per euro. How much guaranteed amount of U.S. dollar does the company expect to pay after hedging the euro payable transaction in the international money market? (pick the closest answer) A. 565,545 USD. B. 554,510 USD. C. 562,786 USD. D. 576,912 USD.arrow_forwardSuppose that the current EUR/GBP exchange rate is £0.86 per euro. The current 6-month interest rates are: GBP 4%, EUR 6%. There are three 6-month forward contracts available, with the following exchange rates: Contract A B C EUR/GBP 0.86 0.85 0.90 You expect to incur an expense of €50,000 in six months. Can you identify any relevant risk in terms of the EUR/GBP exchange rate? Would you use any of the available forward contracts to hedge against this risk? Explain and provide an example.arrow_forwardCompany A and B has been offered the following rates per annum on a £10 million 5 - year loan. Company Fixed (%) Floating (%) A 5 LIBOR + 1.2 B 6 LIBOR + 0.3 Company A requires a floating rate loan, whereas company B requires a fixed rate loan. In which market does company A have a comparative advantage? Design a swap that will give a bank, acting as an intermediary 0.5% p.a. and that will appear equally attractive to both companies. Explain how to achieve this, using diagrams and text. (15 Marks) (Please answer without use of excel)arrow_forward

- EUROCREDIT LOAN:A Swiss sporting goods company borrows in yen in the Eurocredit market at a rate of 4.94 percent from Bank of America using a three-month rollover loan. Bank of America assigns a default risk premium of 1.93 percent on the loan, and the country risk is an additional 0.76 percent. The bank can borrow funds in the Euromarket at the three-month LIBOR rate of 0.30 percent. What is Bank of America’s gross profit margin on this loan?arrow_forwardAssume the time from acceptance to maturity on a $2,280,000 banker’s acceptance is 90 days. Further assume that the importing bank’s acceptance commission is 1.25 percent and that the market rate for 90-day B/As is 7 percent. Determine the amount the exporter will receive if he holds the B/A until maturity and also the amount the exporter will receive if he discounts the B/A with the importer’s bank.arrow_forwardYou enter into a futures contract to buy €125,000 at $1.53 per euro. The spot exchange rate when you enter the contract is $1.63. Your initial performance bond is $6,100 and your maintenance level is $2,400. At what settle price will you get a demand for additional funds to be posted to your account? 1.6596 1.7596 1.8896 1.5004 1.5596 1.6004arrow_forward

- This is required dataarrow_forwardCompany A wants to borrow US Dollar (USD) at a floating rate of interest and Company B want to borrow Australian Dollar (AUD) at a fixed rate of interest. They have been quoted the following rates by Bank C. USD AUD Company A LIBOR +0.5% 5.0% Company B LIBOR+1.0% 6.5% Develop an interest rate swap that will net the bank 50 basis point spread and will appear equally attractive to Company A and Company B. Explain your answer.arrow_forwardAnswer a) and b) Problem 3: Interest Swap Companies A and B have been offered the following rates per annum on a $50 million five-year loan: Company A Company B Floating LIBOR +0.7% LIBOR +1.0% Fixed 6.0% 7.5% Company A requires a floating-rate loan and company B requires a fixed-rate loan. a) Design a swap that will net a bank, acting as an intermediary, 30 basis points (0.3%) per annum and that is equally attractive to the two companies. Illustrate the swap with a diagram. b) Determine the effective financing costs for A and B.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education