FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

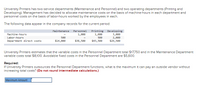

Transcribed Image Text:University Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and

Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and

personnel costs on the basis of labor-hours worked by the employees in each.

The following data appear in the company records for the current period:

Maintenance Personnel

Printing Developing

3,000

2,000

$29,500

Machine-hours

1,000

1,000

Labor-hours

500

500

Department direct costs

$14,000

$38,500

$43,500

University Printers estimates that the variable costs in the Personnel Department total $17,750 and in the Maintenance Department

variable costs total $8,100. Avoidable fixed costs in the Personnel Department are $5,600.

Required:

If University Printers outsources the Personnel Department functions, what is the maximum it can pay an outside vendor without

increasing total costs? (Do not round intermediate calculations.)

Maximum Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Memorial Services, Incorporated (MSI) has three service departments (IT, Accounting, and HR) and two production departments (West and East). The usage data for each of the service departments for the previous period follow: IT IT 05 10% Accounting HR 8% 20% 10% Allocation Service department costs IT allocation Accounting allocation HR allocation Total costs allocated 0% Accounting HR The direct costs of the service departments in the previous period were $184,650 for IT, $100,000 for Accounting, and $113,500 for HR. $ Required: Use the reciprocal method to allocate the service department costs to the production departments. (Matrix algebra is not required.) Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations. IT West East 40% 40% 60% 60% 40% 20% 0 $ Accounting 0 $ HR 0 $ West 0 $ East 0arrow_forwardPrint Company manufacturers laser printers. It has outlined the following overhead cost drivers: Overhead Costs Pool Cost Driver Overhead Cost Budgeted Level for Cost Driver Quality control Number of inspections $ 80,000 1,600 Machine operation Machine hours 157,000 1,000 Materials handling Number of batches 1,500 30 Miscellaneous overhead cost Direct labor hours 60, 000 4,000 Print Company has an order for 1,000 laser printers that has the following production requirements: Number of inspections 210 Machine hours 260 Number of batches 5 Direct labor hours 810 Using activity - based costing, applied quality control factory overhead for the 1,000 laser printers order is: Multiple Choice $12, 150. $ 9,940. $10,500. $250. $40,820.arrow_forwardRequired Information [The following information applies to the questions displayed below.] Mack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Fabricating Finishing Direct Costs $ 143,600 Total Allocated Costs 104, 200 44,700 83,500 Repair 0 0.8 Proportion of Services Used by Quality Control 0.2 8 Fabricating Finishing 0.5 0.1 Required: Compute the allocation of service department costs to producing departments using the direct method. Note: Do not round Intermediate calculations. Round your final answers to the nearest whole dollar. 0.3 0.1arrow_forward

- The Hsu Manufacturing Company has two service departments: Maintenance and Accounting. The Maintenance Department's costs of $641,850 are allocated on the basis of machine hours. The Accounting Department's costs of $212,400 are allocated on the basis of the number of employees within a specific department. The direct departmental costs for A and B are $390,000 and $590,000, respectively. Maintenance Accounting A B Machine hours 495 65 3,600 290 Number of employees 2 2 8 4 What is the Maintenance Department's cost allocated to Department B using the step method and assuming the Maintenance Department's costs are allocated first? Note: Do not round intermediate calculations.arrow_forwardCulver's Medical operates three support departments and two operating units, Surgery and ER. The support departments are allocated based on the hours used. The cost of operating the accounting (acct), administration (admin), and human resources (HR) departments is $270300, $154500, and $63000, respectively. Information on the hours used are as follows: Hours in Acct Hours in Admin Hours in HR Acct O $252768. $0. $275348. $277601. 16 8 Admin HR 48 20 4 8 Surgery ER 360 120 65 220 80 130 What are the total costs allocated to the surgery department from the supporting departments? (Do not round the intermediate calculations.)arrow_forwardABC, Inc. has the following information available regarding costs at various levels of monthly production: Production volume 8,000 12,000 Direct materials $75,000 $70,000 Direct labor 56,000 80,000 Packaging materials 22,000 30,000 Supervisors' salaries 14,000 14,000 Depreciation on plant and equipment 11,000 11,000 Maintenance 31,000 45,000 Utilities 15,000 21,000 Insurance on plant and equipment 2,600 2,600 Property taxes on plant and equipment…arrow_forward

- Davis Snowflake & Co. produces Christmas stockings in its Cutting and Sewing departments. The Maintenance and Security departments support the production of the stockings. Costs from the Maintenance Department are allocated based on machine hours, and costs from the Security Department are allocated based on asset value. Information about each department is provided in the following table: MaintenanceDepartment SecurityDepartment CuttingDepartment SewingDepartment Machine hours 800 2,000 7,600 10,400 Asset value $2,000 $1,470 $2,500 $5,500 Department cost $41,040 $18,240 $63,000 $81,000 Determine the total cost of each production department after allocating all support department costs to the production departments using the reciprocal services method. CuttingDepartment SewingDepartment Production departmentsʼ total costsarrow_forwardA company has two production departments, Cutting and Finishing and two service departments, Quality Control and Maintenance. Selected information on the four departments is given below: Cutting Finishing Quality Control Maintenance Direct cost P400,000 P240,000 P120,000 P180,000 No of inspection 4000 16,000 Machine hours 40,000 20,000 Quality control department costs are allocated on the basis of number of inspections. Maintenance department costs are allocated on the basis of number of machine hours Under the direct method, the amount of quality control costs allocated to the cutting department is O 424000 O 24000 96000 O 296000arrow_forwardMcCourt Company produces small engines for lawnmower producers. The accounts payable department at McCourt has 10 clerks who process and pay supplier invoices. The total cost of their salaries is $450,000. The work distribution for the activities that they perform is as follows: Activity Percentage of Time on Each Activity Comparing source documents 10 % Resolving discrepancies 55 % Processing payment 35 % Required: Assign the cost of labor to each of the three activities in the accounts payable department. Round your answers to the nearest dollar. Activity Cost Assignment Comparing source documents Sfill in the blank 1 Resolving discrepancies $fill in the blank 2 Processing payment Sfill in the blank 3 Comparing source documents Resolving discrepancies Processing paymentarrow_forward

- Webster Company provides the following ABC costing information: Activities Total Costs Activity-cost drivers Account inquiry hours $250,000 10,000 hours Account billing lines $125,000 5,000,000 lines Account verification accounts $50,000 50,000 accounts Correspondence letters $ 25,000 5,000 letters Total costs $450,000 The above activities are used by Departments A and B as follows: Department A Department B Account inquiry hours 1,000 hours 3,000 hours Account billing lines 200,000 lines 300,000 lines Account verification accounts 10,000 accounts 8,000 accounts Correspondence letters 1,000 letters 1,500 letters How much of the account inquiry cost will be assigned to Department A? Group of answer choices $5,000 $250,000 $75,000 $25,000arrow_forwardTasman Products has a Maintenance Department that services equipment in the company's Forming Department and Assembly Department. The cost of this servicing is charged to the operating departments based on machine-hours. Data for the Maintenance Department follow: Variable costs for lubricants Fixed costs for salaries and other Budget $ 261,000* Actual $ 215,000 $ 333,300 $ 231,500 *Budgeted at $18 per machine-hour. Data for the Forming and Assembly Departments follow: Percentage of Peak- Forming Department Assembly Department Total Machine-Hours Period Capacity Required Budget Actual 74% 9,700 11,700 26% 100% 4,800 3,800 14,500 15,500 The amount of fixed costs in the Maintenance Department is determined by peak-period requirements. Required: 1. How much Maintenance Department cost should be charged to the Forming Department and to the Assembly Department? 2. How much, if any, of the Maintenance Department's actual costs should be treated as a spending variance and not charged to the…arrow_forwardJoe's Tire Company has two support departments, Personnel and Maintenance. The Maintenance Department costs of $80,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $20,000 are allocated based on the number of employees. Costs of Departments A and B are $40,000 and $60,000, respectively. Data on standard service hours and number of employees are as follows. How much of the cost of the Personnel Department is allocated to Department B using the direct method? Round to the nearest dollar. Personnel Department 200 Standard service hours used Number of employees O A. $8,000 O B. $60,000 O C. $12,632 D. $5,000 E. $15,000 Maintenance Department 200 10 20 CO Production Department A 240 40 Production Department B 160 120arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education