FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

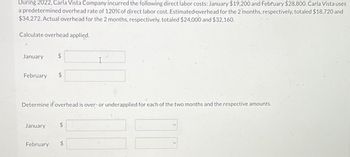

Transcribed Image Text:During 2022, Carla Vista Company incurred the following direct labor costs: January $19,200 and February $28,800. Carla Vista uses

a predetermined overhead rate of 120% of direct labor cost. Estimated-overhead for the 2 months, respectively, totaled $18,720 and

$34,272. Actual overhead for the 2 months, respectively, totaled $24,000 and $32,160.

Calculate overhead applied.

January

February

$

Determine if overhead is over- or underapplied for each of the two months and the respective amounts.

January $

February

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Emley Company incurred direct materials costs of $750,000 during the year. Manufacturing overhead applied was $700,000 and is applied based on direct labor costs. The predetermined overhead rate is 70%. How much are Emley Company's total manufacturing costs for the year?arrow_forwardCavy Company estimates that the factory overhead for the following year will be $2,034,500. The company has decided that the basis for applying factory overhead should be machine hours, which is estimated to be 31,300 hours. The machine hours for the month of April for all of the jobs were 2,830. If the actual factory overhead for April totaled $180,455, determine the over- or underapplied amount for the month. Enter the amount as a positive number.arrow_forwardCavy Company estimates that total factory overhead costs for the following year will be $994,000. The company has decided that the basis for applying factory overhead should be machine hours, which are estimated to be 35,500 hours. Compute the predetermined factory overhead rate.fill in the blank 1 of 1$ per machine hourarrow_forward

- A company bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the company estimated the labor-hours for the upcoming year at 75,000 labor-hours. The estimated variable manufacturing overhead was $10.70 per labor-hour and the estimated total fixed manufacturing overhead was $1,237,500. The actual labor-hours for the year turned out to be 78,100 labor-hours. Compute the company's predetermined overhead rate for the recently completed year. (Round your answer to2 decimal places.) Predetermined overhead rate per labor-hourarrow_forwardAt the beginning of the year, Custom Manufacturing set its predetermined overhead rate using the following estimates: overhead costs, $520,000, and direct materials costs, $200,000.At year-end, the company reports that actual overhead costs for the year are $528,700 and actual direct materials costs for the year are $200,000. 1. Determine the predetermined overhead rate using estimated direct materials costs 2. Enter the actual overhead costs incurred and the amount of overhead cost applied to jobs during the year using the predetermined overhead rate. Determine whether overhead is over- or underapplied (and the amount) for the year. 3. Prepare the entry to close any over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Enter the actual overhead costs incurred and the amount of overhead cost applied to jobs during the year using the predetermined overhead rate. Determine whether overhead…arrow_forwardA manufacturing company applies overhead based on direct labor hours. At the beginning of the year, it was estimated that overhead costs would be $450,000 and direct labor hours would be 90,000. Actual overhead costs incurred were $459,000 and actual direct labor hours were 95,000. What is the amount of overapplied or underapplied overhead at the end of the year? A. $16,000 overapplied B. $16,000 underapplied C. $9,000 overapplied D. $9,000 underappliedarrow_forward

- Longobardi Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the Corporation estimated the labor-hours for the upcoming year at 49,200 labor-hours. The estimated variable manufacturing overhead was $6.38 per labor-hour and the estimated total fixed manufacturing overhead was $1,383,504. The actual labor-hours for the year turned out to be 46,400 labor-hours. The predetermined overhead rate for the recently completed year was closest to:arrow_forwardOnline A company uses direct labor-hours for its predetermined overhead rate. The company estimated direct labor-hours would be 25,000 hours and the total estimated manufacturing overhead would be $500,000. At the end of the year, actual direct labor-hours for the year were 23,000 hours and the actual manufacturing overhead for the year was $490,000. Overhead at the end of the year was: (Do not round your intermediate calculations.) Multiple Choicearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education