FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

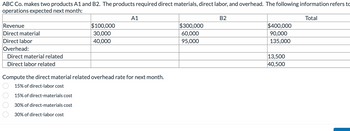

ABC Co. makes two products A1 and B2. The products required direct materials, direct labor, and

| A1 | B2 | Total | |

| Revenue | $100,000 | $300,000 | $400,000 |

| Direct material | 30,000 | 60,000 | 90,000 |

| Direct labor | 40,000 | 95,000 | 135,000 |

| Overhead: | |||

| Direct material related | 13,500 | ||

| Direct labor related |

40,500 |

Compute the direct material related overhead rate for next month.

15% of direct-labor cost

15% of direct-materials cost

30% of direct-materials cost

30% of direct-labor cost

Transcribed Image Text:ABC Co. makes two products A1 and B2. The products required direct materials, direct labor, and overhead. The following information refers to

operations expected next month:

Revenue

Direct material

Direct labor

Overhead:

Direct material related

Direct labor related

$100,000

30,000

40,000

A1

Compute the direct material related overhead rate for next month.

15% of direct-labor cost

15% of direct-materials cost

30% of direct-materials cost

30% of direct-labor cost

$300,000

60,000

95,000

B2

$400,000

90,000

135,000

13,500

40,500

Total

Expert Solution

arrow_forward

Step 1: Introducing Predetermined Overhead Rate

PREDETERMINED OVERHEAD RATE

Predetermined rate means the indirect cost rate..

Predetermined overhead rate is an allocation rate that is used to apply the estimated cost of manufacturing overhead to cost objects

Predetermined Overhead Rate is computed by dividing the estimated manufacturing overhead by the estimated activity base.

Predetermined Overhead Rate:

= Estimated Manufacturing Overhead Cost ÷ Estimated Direct Labour Hour

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION: AT THE BEGINNING OF THE YEAR, RANGLE COMPANY EXPECTED TO INCUR $54,000 OF OVERHEAD COSTS IN PRODUCING 6,000 UNITS OF PRODUCT. THE DIRECT MATERIAL COST IS $20 PER UNIT OF PRODUCT. DIRECT LABOR COST IS $30 PER UNIT. DURING JANUARY, 600 UNITS WERE PRODUCED. REQUIRED: THE TOTAL COST OF THE UNITS MADE IN JANUARY WAS:arrow_forwardThe Ordon Company manufactures products in two departments: Mixing and Packaging. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $888,000, and estimated direct labor hours are 370,000. In October, the company incurred 45,000 direct labor hours. Read the requirements LOADING... . Requirement 1. Compute the predetermined overhead allocation rate. Round to two decimal places. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter the amounts to compute the allocation rate. Predetermined OH ÷ = allocation rate ÷ = Requirement 2. Determine the amount of overhead allocated in October. Begin by selecting the formula to allocate overhead costs. Allocated mfg. × = overhead…arrow_forwardManufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month, manufacturing overhead was $321,600. During that time, the company produced 14,600 units of the M-008 and 2,200 units of the M-123. The direct costs of production were as follows. Direct materials Direct labor M-008 M-123 $116,800 $ 88,000 116,800 44,000 Management determined that overhead costs are caused by three cost drivers. These drivers and their costs for last year were as follows. Cost Driver Number of machine-hours Number of production runs Number of inspections. Total overhead Total $204,800 160,800 Costs $156, 600 70,000 95,000 $321,600 Activity Level M-898 M-123 2,000 8,000 20 30 20 20 Total 10,000 40 50 Required: a. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? b. How much of the overhead will be assigned to each product if direct…arrow_forward

- Steeler Towel Company estimates its overhead to be $483,000. It expects to have 138,000 direct labor hours costing $4,830,000 in labor and utilizing 11,500 machine hours. Calculate the predetermined overhead rate using: Round your answers to two decimal places. A. Direct labor hours $fill in the blank 1 per direct labor hour B. Direct labor dollars $fill in the blank 2 per direct labor dollar C. Machine hours $fill in the blank 3 per machine hourarrow_forwardCompany XYZ uses labor hours to allocate its manufacturing overhead. The direct labor cost rate is $8 per direct labor hour. The company estimates that the number of labor hours to be used next month is 600,000 labor hours. The estimated variable overhead is estimated to be quarter of the direct labor cost rate. The estimated fixed overhead costs are $50,000. Calculate the predetermined overhead rate. а. 4.08 b. 8.08 С. 5.08 d. 2.08 е. None of the given answersarrow_forwardAngler Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Assembly 248,888 DLH Finishing 154,000 DLH 68,000 MH 448,800 MH $440,000 Direct labor hours Machine hours Overhead costs Assume that Angler Industries allocates overhead using a plantvide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 1 direct labor hour and 3.90 machine hours in the Assembly Department, and 4.00 direct labor hours and 0.6 machine hours in the Finishing Department? Multiple Chaises O O O $21.50 $17.60 $2.00. $18.10 $ 677,680 $13.20.arrow_forward

- A Company estimates its overhead to be $375,000 It expects to have 125,000 direct labor hours costing $1,500,000 in labor It expects to utilize 15,000 machine hours Calculate the predetermined overhead rate using: Direct labor hours Direct labor dollars Machine hours Predetermined overhead allocation rate= estimated manufacturing overhead cost/ allocation basearrow_forwardApplying Factory Overhead Salinger Company estimates that total factory overhead costs will be $90,000 for the year. Direct labor hours are estimated to be 15,000. a. For Salinger Company, determine the predetermined factory overhead rate using direct labor hours as the activity base. If required, round your answer to two decimal places. $4 per direct labor hour b. During May, Salinger Company accumulated 660 hours of direct labor costs on Job 200 and 620 hours on Job 305. Determine the amount of factory overhead applied to Jobs 200 and 305 in May. $4 c. Prepare the journal entry to apply factory overhead to both jobs in May according to the predetermined overhead rate. If an amount box does not require an entry, leave it blank. 88arrow_forwardA Mark uses 1,100 units of the component IMC2 every month to manufacture one of its products. The unit costs incurred to manufacture the component are as follows. Direct materials $58.89 Direct labor 39.08 Overhead 126.50 Total $224.47 Overhead costs include variable material handling costs of $6.50, which are applied to products on the basis of direct material costs. The remainder of the overhead costs are applied on the basis of direct labor dollars and consist of 60% variable costs and 40% fixed costs. A vendor has offered to supply the IMC2 component at a price of $250 per unit. (a) Prepare the incremental analysis for the decision to make or buy IMC2. (Round answers to 2 decimal places, e.g. 12.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Make IMC2 (per unit) Buy IMC2 (per unit) Net Income Increase (Decrease)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education