FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

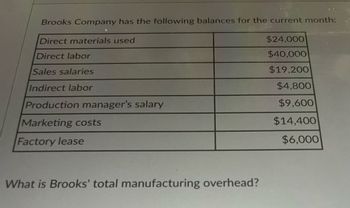

Transcribed Image Text:Brooks Company has the following balances for the current month:

Direct materials used

$24,000

Direct labor

$40,000

Sales salaries

$19,200

Indirect labor

$4,800

Production manager's salary

$9,600

Marketing costs

$14,400

Factory lease

$6,000

What is Brooks' total manufacturing overhead?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that total factory overhead costs would be $329,900 and direct labor hours would be 43,500. Actual manufacturing overhead costs incurred were $308,200, and actual direct labor hours were 51,900. What is the predetermined factory overhead rate per direct labor hour? a. $6.07 b. $11.38 c. $7.58 d. $9.10arrow_forwardNova Company's total overhead cost at various levels of activity are presented below Total Overhead Machine- Month Hours Cost April May June 52,000 42,000 62,000 72,000 $203,860 $181,060 $226,660 $249,460 July Assume that the total overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 42,000 machine-hour level of activity is: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost S 50,400 67,000 63.660 181,060 Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements Required: 1. Estimate how much of the $249,460 of overhead cost in July was maintenance cost. (Hint: To do this, it may be helpful to first determine how much of the $249,460 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs!) (Do not round intermediate calculations.) Maintenance cost in July 2. Using the high-low method,…arrow_forwardOriole Corporation accumulates the following data relative to jobs started and finished during the month of June 2022. Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Actual $4.10 11,400 $165,000 15,000 $192.130 Standard $4.00 11.000 $160,650 15,300 $192,780 44,340 $75,378 $2.80 $1.70 Overhead is applied on the basis of standard machine hours. 2.80 hours of machine time are required for each direct labor hour. The jobs were sold for $462.000. Selling and administrative expenses were $41.200. Assume that the amount of raw materials purchased equaled the amount used.arrow_forward

- Berry Company applies overhead on the basis of direct labor hours. Given the following data, calculate overhead applied and the under- or over-application of overhead for the period: Estimated annual overhead cost $450,000 Actual annual overhead cost $445,000 Estimated direct labor hours 90,000 Actual direct labor hours 88,000arrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that total factory overhead costs would be $466,920 and direct labor hours would be 46,692. Actual factory overhead costs incurred were $496,253, and actual direct labor hours were 51,693. What is the amount of overapplied or underapplied manufacturing overhead at the end of the year? O $516,930 overapplied Ob. $50,010 underapplied Oc. $20,677 overapplied Od. $20,677 underappliedarrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $353,700 and direct labor hours would be 47,300. Actual manufacturing overhead costs incurred were $319,500, and actual direct labor hours were 52,400. The journal entry to apply the factory overhead costs for the year would include a Oa. debit to Factory Overhead for $391,952 Ob. credit to Factory Overhead for $391,952 Oc. debit to Factory Overhead for $319,500 Od. credit to Factory Overhead for $353,700arrow_forward

- Focarrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $360,000 and direct labor hours would be 30,000. Actual factory overhead costs incurred were $377,200, and actual direct labor hours were 36,000. What is the amount of overapplied or underapplied manufacturing overhead at the end of the year? Pick one a. $54,800 underapplied b. $6,000 overapplied c. $54,800 overapplied d. $6,000 underapplied A manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $360,000 and direct labor hours would be 30,000. Actual manufacturing overhead costs incurred were $377,200, and actual direct labor hours were 36,000. The entry to apply the factory overhead costs for the year would include a a. credit to Factory Overhead for $432,000 b. debit to Factory…arrow_forwardAquaria, Co. reported the following accounting data. Sales quantity Sales Direct material Direct labor Manufacturing overhead Selling and Admin. Expenses Total fixed costs per month are $66,000 $12,000 $13,800 $1,800 1,000 $66.00 per unit $12.00 $4.00 $3.00 per unit $7.20 per unit $1,800 per month $12,000 per montharrow_forward

- Crane Corporation accumulates the following data relative to jobs started and finished during the month of June 2022 Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor, hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Actual $2.20 11.200 $169,500 15,000 $214,452 Standard $2 10,400 $161,120 15,200 $209,760 41.500 $3.10 $1.50 Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The jobs were sold for $458,000. Selling and administrative expenses were $35,700. Assume that the amount of raw materials purchased equaled the amount used.arrow_forwardCrosshill Company's total overhead costs at various levels of activity are presented below: Month April May June July Machine-Hours 70,000 60,000 80,000 90,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 60,000-machine-hour level of activity in May is as follows: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost Total Overhead Cost $200,200 $177,300 $223,100 $246,000 $ 48,000 21,000 108,300 $177,300 The company wants to break down the maintenance cost into its variable and fixed cost elements. Maintenance cost in July Required: 1. Estimate how much of the $246,000 of overhead cost in July was maintenance cost. (Hint: To do this, first betermine how much of the $246,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the "Variable cost per unit" to 2 decimal places.)arrow_forwardThe following are Margin Company's production costs for December: Direct Materials $ 105,000 Direct Labor 95,000 Factory Overhead 9,000 What amount of costs should be traced to specific products in the production process?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education