FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A

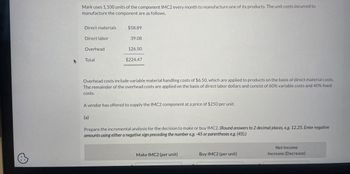

Mark uses 1,100 units of the component IMC2 every month to manufacture one of its products. The unit costs incurred to

manufacture the component are as follows.

Direct materials

$58.89

Direct labor

39.08

Overhead

126.50

Total

$224.47

Overhead costs include variable material handling costs of $6.50, which are applied to products on the basis of direct material costs.

The remainder of the overhead costs are applied on the basis of direct labor dollars and consist of 60% variable costs and 40% fixed

costs.

A vendor has offered to supply the IMC2 component at a price of $250 per unit.

(a)

Prepare the incremental analysis for the decision to make or buy IMC2. (Round answers to 2 decimal places, e.g. 12.25. Enter negative

amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Make IMC2 (per unit)

Buy IMC2 (per unit)

Net Income

Increase (Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rardin Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Direct materials 7.4 ounces Direct labor 0.3 hours Variable overhead 0.3 hours The company reported the following results concerning this product in July. Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. Required: b. Compute the materials price variance. Do not indicate whether Favorable or Unfavorable. $8.00 per ounce $16.00 per hour $7.00 per hour 2,200 units 16,420 ounces 17,900 ounces 720 hours $141,410 $12,528 $5,112arrow_forwardLinger Products uses a two-stage allocation method to assign costs to its products. The following information has been provided for March: Product 1 Product 2 Total Units 3,000 2,000 5,000 Machine hours 2,000 4,000 6,000 Direct labor hours 2,000 2,000 4,000 Direct materials $ 60,000 $ 60,000 $ 120,000 Direct labor 45,000 45,000 90,000 Manufacturing overhead Utilities (machine related) $ 3,000 Supplies (labor related) 8,000 Training (labor related) 20,000 Supervision (labor related) 17,000 Machine depreciation (machine related) 24,000 Lease on factory (machine related) 33,000 Miscellaneous (labor related) 5,000 Total manufacturing overhead $ 110,000 Required:(a) Allocate the manufacturing overhead to two cost pools: machine-related and labor-related.(b)…arrow_forwardRahularrow_forward

- Puvo, Incorporated, manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours. The company uses a standard cost system and has established the following standards for one unit of product: Standard Quantity Standard Price or Rate Standard Cost Direct materials 5.8 pounds $ 0.60 per pound $ 3.48 Direct labor 0.5 hours $ 33.50 per hour $ 16.75 Variable manufacturing overhead 0.5 hours $ 8.50 per hour $ 4.25 During March, the following activity was recorded by the company: The company produced 2,400 units during the month. A total of 19,400 pounds of material were purchased at a cost of $13,580. There was no beginning inventory of materials on hand to start the month; at the end of the month, 3,620 pounds of material remained in the warehouse. During March, 1,090 direct labor-hours were worked at a rate of $30.50 per hour. Variable manufacturing overhead costs during March totaled $14,061. The…arrow_forwardKunkel Company makes two products and uses a conventional costing system in which a single plantwide predetermined overhead rate is computed based on direct labor - hours. Data for the two products for the upcoming year follow: Mercon Wurcon Direct materials cost per unit $ 12.00 $ 9.00 Direct labor cost per unit $ 15.00 $ 17.00 Direct labor - hours per unit 0.50 3.25 Number of units produced 2,000 4,000 These products are customized to some degree for specific customers. Required: 1. The company's manufacturing overhead costs for the year are expected to be $560,000. Using the company's conventional costing system, compute the unit product costs for the two products. 2. Management is considering an activity - based costing system in which half of the overhead would continue to be allocated on the basis of direct labor - hours and half would be allocated on the basis of engineering design time. This time is expected to be distributed as follows during the upcoming year: Mercon Wurcon…arrow_forwardMemanarrow_forward

- Regent Corp. uses a standard cost system to account for the costs of its one product. Materials standards are 3 pounds of material at $14 per pound, and labor standards are 4 hours of labor at a standard wage rate of $11. During July Regent Corp. produced 3,300 units. Materials purchased and used totaled 10,100 pounds at a total cost of $142,650. Payroll totaled $146,780 for 13,150 hours worked. a. Calculate the direct materials price variance. (Do not round your intermediate calculations. Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) Price Variance b. Calculate the direct materials quantity variance. (Indicate the effect of variance by selecting "Favorable", "Unfavorable", or "None" for no effect (i.e., zero variance).) Quantity Variancearrow_forwardHutto Corp. has set the following standard direct materials and direct labor costs per unit for the product It manufactures. Direct materials (15 lbs. @ $4 per lb.) Direct labor (2 hrs. @ $15 per hr.) During May the company incurred the following actual costs to produce 8,100 units. Direct materials (125,300 lbs. @ $3.80 per lb.) Direct labor (20,400 hrs. @ $15.10 per hr.). AH = Actual Hours SH = Standard Hours AR = Actual Rate SR = Standard Rate AQ - Actual Quantity SQ - Standard Quantity = AP = Actual Price SP = Standard Price (1) Compute the direct materials price and quantity variances. (Indicate the effect of each varlance by selecting for favorable, unfavorable, and no varlance.) (2) Compute the direct labor rate variance and the direct labor efficiency variance. (Indicate the effect of each varlance by selecting for favorable, unfavorable, and no varlance. Round "Rate per hour" answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. 0 $60…arrow_forwardBullseye Company manufactures dartboards. Its standard cost information follows: Direct materials (cork board) Direct labor Standard Quantity 0.50 square feet 0.90 hour Variable manufacturing overhead (based on direct labor hours) Fixed manufacturing overhead ($21,750/87,000) Bullseye has the following actual results for the month of September: Number of units produced and sold Number of square feet of corkboard purchased and used Cost of corkboard used Number of labor hours worked Direct labor cost Variable overhead cost Fixed overhead cost 0.90 hour Standard Price (Rate) $ 1.30 per square feet $5.00 per hour $0.50 per hour 74,000 43,000 $ 47,200 80,000 $ 98,000 $ 103,880 $ 33,000 Standard Unit Cost $ 0.65 4.50 0.45 0.25 Required: 1. Calculate the fixed overhead spending variance for Bullseye. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). 2. Calculate the fixed overhead volume variance…arrow_forward

- Carla Vista Manufacturing Inc. provides you with the following data for the month of June:Prime costs were $ 196,000, conversion costs were $140, 500, andtotal manufacturing costs incurred were $265,500. Beginning and ending work in process inventories were equal. Selling and administrative costs were $ 262,100. (a)What were the total costs of direct materials used, direct labour, and manufacturing overhead? Direct material costs$Direct labour costsManufacturing overhead costsarrow_forwardAileen Co manufactures two components, L and M. Both components are manufactured on the machine ZX. The following cost information per unit of L and M is available: Direct material Direct labour Variable overhead Fixed overhead Total cost L M ($) ($) 12 18 25 15 8 7 6 46 10 55 Component L requires three hours on machine ZX and component M requires five hours. Manufacturing requirements show a need for 1,500 units of each component per week. The maximum number of machine ZX hours available per week is 10,000. An external supplier has offered to supply Aileen Co with the components for a price of $57 per component L and $55 per component M. Identify, by clicking on the relevant boxes in the table below, whether each of the following statements are true or false. would be cheaper for Aileen Co to produce all the components in-house if the hours on machine ZX were available Aileen Co should purchase 400 units of component M from the external supplier TRUE TRUE FALSE FALSEarrow_forwardTrying to find the activity based costing of the following for the allocated overheadarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education