SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please help me with this accounting problem

Transcribed Image Text:(a4)

Your answer is incorrect.

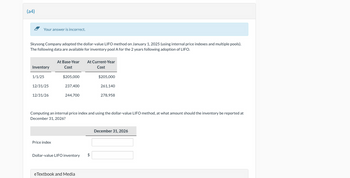

Skysong Company adopted the dollar-value LIFO method on January 1, 2025 (using internal price indexes and multiple pools).

The following data are available for inventory pool A for the 2 years following adoption of LIFO.

At Base-Year At Current-Year

Inventory

Cost

Cost

1/1/25

$205,000

$205,000

12/31/25

237,400

261,140

12/31/26

244,700

278,958

Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at

December 31, 2026?

Price index

Dollar-value LIFO inventory

$

eTextbook and Media

December 31, 2026

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardRefer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the allowance method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardOlson Company adopted the dollar-value LIFO method for inventory valuation at the beginning of 2015. The following information about the inventory at the end of each year is available from Olsons records: Required: 1. Calculate the dollar-value LIFO inventory at the end of each year. 2. Prepare the appropriate disclosures for the 2021 annual report if Olson uses current cost internally and LIFO for financial reporting.arrow_forward

- At December 31, 2019, the following information was available from Crisford Companys books: Sales for the year totaled 110,600; markdowns amounted to 1,400. Under the approximate lower of average cost or market retail method, Crisfords inventory at December 31, 2019, was: a. 30,800 b. 28.000 c. 21,560 d. 19,600arrow_forwardWhen the double-extension approach to the dollar-value LIFO inventory cost flow method is used, the inventory layer added in the current year is multiplied by an index number. How would the following be used in the calculation of this index number?arrow_forwardCrane Company adopted the dollar-value LIFO method on January 1, 2025 (using internal price indexes and multiple pools). The following data are available for inventory pool A for the 2 years following adoption of LIFO. At Base-Year At Current-Year Inventory Cost Cost 1/1/25 $190,700 $190,700 12/31/25 251,800 276,980 12/31/26 256,100 286,832 Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at December 31, 2026? Price index Dollar-value LIFO inventory A December 31, 2026arrow_forward

- Hsieh Company adopted the dollar-value LIFO method on January 1, 2020 (using internal price indexes and multiplepools). The following data are available for inventory pool A for the 2 years following adoption of LIFO:At Base- At CurrentInventory Year Cost Year Cost1/1/2020 $334,000 $334,00012/31/2020 361,000 375,44012/31/2021 412,000 449,080arrow_forward4. Ashbrook Company adopted the dollar-value LIFO method on January 1, 2020 (using internal price indexes and multiple pools). The following data are available for inventory pool A for the 2 years following adoption of LIFO. Inventory At Base-Year Cost At Current-Year Cost 1/1/20 $200,000 $200,000 12/31/20 240,000 264,000 12/31/21 256,000 286,720 Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at December 31, 2021?arrow_forwardA company adopted the dollar-value LIFO inventory method on January 1, 2024. In applying the LIFO method, the company uses internal cost indexes and the multiple-pools approach. The following data were available for Inventory Pool No. 3 for the two years following the adoption of LIFO: Year Ending Inventory Cost Index At Year-End At Base Year Cost 1/1/2024 $ 303,500 $ 303,500 1.00 12/31/2024 344,500 325,000 1.06 12/31/2025 435,540 357,000 1.22 Under the dollar-value LIFO method, the inventory on December 31, 2025, should be?arrow_forward

- What is the internal price index? What is the dollar-value LIFO inventory?arrow_forwardWildhorse Company adopted the dollar-value LIFO method on January 1, 2020 (using internal price indexes and multiple pools). The following data are available for inventory pool A for the 2 years following adoption of LIFO. Inventory At Base-Year Cost At Current-Year Cost 1/1/20 $209,300 $209,300 12/31/20 226,200 248,820 12/31/21 281,300 320,682 Computing an internal price index and using the dollar-value LIFO method, at what amount should the inventory be reported at December 31, 2021? December 31, 2021 Price Index enter the price index Dollar-value LIFO inventory $enter a dollar amount Save for Laterarrow_forwardGive me correct answer and explanation.vdarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning