Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

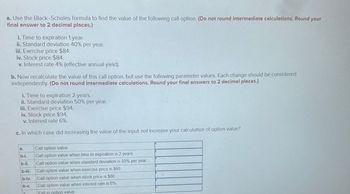

Transcribed Image Text:a. Use the Black-Scholes formula to find the value of the following call option. (Do not round intermediate calculations. Round your

final answer to 2 decimal places.)

i. Time to expiration 1 year.

ii. Standard deviation 40% per year.

iii. Exercise price $84.

iv. Stock price $84.

v. Interest rate 4% (effective annual yield).

b. Now recalculate the value of this call option, but use the following parameter values. Each change should be considered

independently. (Do not round intermediate calculations. Round your final answers to 2 decimal places.)

i. Time to expiration 2 years.

ii. Standard deviation 50% per year.

iii. Exercise price $94.

iv. Stock price $94.

v. Interest rate 6%.

c. In which case did increasing the value of the input not increase your calculation of option value?

a.

Call option value

b-i.

Call option value when time to expiration is 2 years.

b-ii.

Call option value when standard deviation is 50% per year.

b-iii.

Call option value when exercise price is $60.

b-iv.

b-v.

C

Call option value when stock price is $60

Call option value when interest rate is 6%.

Fall in option value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give typing answer with explanation and conclusion You are considering purchasing a put on a stock with a current price of $33. The exercise price is $35, and the price of the corresponding call option is $3.25. According to the put-call parity theorem, if the risk-free rate of interest is 4% and there are 90 days until expiration, the value of the put should be:arrow_forwardConsider a call option on one share of BP with a strike price of $70 and exercise time 1 quarter (3 months). Suppose the current stock price for BP is S(0) = $65 per share. Suppose further that A(0) = $100, A(1) = $102 and two possible prices for S(1) are S $74 with probability 0.5, S(1) = $66 with probability 0.5. Evaluate the expected returns E(Ks) and E(Kc) for the stock and the option.arrow_forwardThe current price of a stock is $21. In 1 year, the price will be either $26 or $16. The annual risk-free rate is 5%. Find the price of a call option on the stock that has a strike price of $22 and that expires in 1 year. (Hint: Use daily compounding.) Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Black-Scholes Model Use the Black-Scholes model to find the price for a call option with the following inputs: (1) current stock price is $32, (2) strike price is $37, (3) time to expiration is 3 months, (4) annualized risk-free rate is 7%, and (5) variance of stock return is 0.16. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward(B). An investor must choose between two options. The first option (A) offers AED 10m for AED 2m a year for 5 years. The second option (B) offers AED 11m of AED 1m a year for four years and AED 7m in year 5. (a). Compare the present value of each option by assuming a range of the required rate of return of the investor, say 8%, 9%, 10%, 11%, and 12%. What is your advice?arrow_forward2. What are the prices of a call option and a put option with the following characteristics? Stock price = $74Exercise price = $72Risk-free rate = 2.7% per year, compounded continuouslyMaturity = 4 monthsStandard deviation = 52% per year 3. Draw the payoff picture at expiration for a long position in a call option that has a premium of $1.25 and a strike price of $30. 4. Draw the payoff picture for a short position in the call option given in Problem 2.5. Draw the payoff picture at expiration for a long position in a put option that has a premium of $3.50 and a strike price of $80. 6. Draw the payoff picture for a short position in the put option given in Problem 4.please let me have it by mornin. Thank you.arrow_forward

- What is the value of a put option if the underlying stock price is $47, the strike price is $40, the underlying stock volatility is 52 percent, and the risk-free rate is 5.5 percent? Assume the option has 150 days to expiration. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places.) X Answer is complete but not entirely correct. Value of a put option $ 7.00arrow_forwardThe following information is given: Time to expiration 1 year. Standard deviation 40% per year. Exercise price $72. Stock price $72. Risk free rate 4% a year. Use the Black–Scholes formula to find the value of the calloption. What is the value of the put option with the same exercise price and time to expiration? What is the value of the call option if time to expiration is 3 years? What is the value of the call option if the standard deviation is 20%? What is the value of the call option if the exercise price is $90? What is the value of the call option if the current stock price is $50? What is the value of the call option if the risk-free rate is 8%?arrow_forwardFind the implied volatility (to 2 decimals, for example, �=8.23% ) of a Put option with a time to expiration of 11 months and a price of $6.13 The stock is currently trading at $47. The riskless rate is 2% per annum, and the strike/exercise price of the option is $50. Hint: compute the Put price using the same formula as in exercise 4 , as a function of the volatility �. Then use Solver to change the volatility cell in order to obtain a price of $6.13 \table[[�1=,-0.0614997,,So =,47],[�2=,,4,�=,50],[,,,�=,2%arrow_forward

- Find the PUT option price using the following data: S0 = $215 X = $220 Risk-free Int Rate = 5% Two possibilities of ST at expiration: $200 or $250 Expiration: 2 years from todayarrow_forwardA power call option pays off (max(ST-X, 0))2 at time T, where ST is the stock price at time T and X is the exercise price. A stock price is currently $54. It is known that at the end of one year it will be either $60 or $50. The risk-free rate of interest with continuous compounding is 8% per annum. Calculate the value of a one year power call option with an exercise price of $55. a. What is the delta of the power call option? (sample answer: 1.55 or 0.55)b. What is the risk neutral probability of up movement? (sample answer: 55.50%)c. What is the value of the power option? (sample answer: $15.50)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education