Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

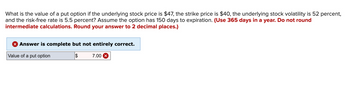

Transcribed Image Text:What is the value of a put option if the underlying stock price is $47, the strike price is $40, the underlying stock volatility is 52 percent,

and the risk-free rate is 5.5 percent? Assume the option has 150 days to expiration. (Use 365 days in a year. Do not round

intermediate calculations. Round your answer to 2 decimal places.)

X Answer is complete but not entirely correct.

Value of a put option

$

7.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the value of a call option if the underlying stock price is $112, the strike price is $105, the underlying stock volatility is 39 percent, and the risk-free rate is 6.1 percent? Assume the option has 128 days to expiration. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Call option $arrow_forwardWhat is the value of a call option if the underlying stock price is $71, the strike price is $73, the underlying stock volatility is 35 percent, and the risk-free rate is 4.8 percent? Assume the option has 132 days to expiration. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardOnly typing....arrow_forward

- Use the Black-Scholes formula for the following stock: Time to expiration Standard deviation Exercise price Stock price Interest rate |||||||||| Value of a call option = = 6 months 56 % per year 55 = 54 6% Calculate the value of a call option. (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "S" sign in your response.)arrow_forwardWhat is the value of a European put option if the underlying stock price is $36, the strike price is $29, the underlying stock volatility is 41 percent, and the risk-free rate is 4 percent? Assume the option has 150 days to expiration. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) Value of a European put option $arrow_forwardPut–Call Parity The current price of a stock is $33, and the annual risk-free rate is 6%. A call option with a strike price of $32 and with 1 year until expiration has a current value of $6.56. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option?arrow_forward

- Suppose that a call option to buy a share for $200 costs $10. What is the delta of this option today if the current stock price is $180? (ignore time value of the option) A. around 2 B. None of these answers are correct. C. around 0.5 D. close to 0 E. close to 1arrow_forwardGive typing answer with explanation and conclusion A call option has a strike price of $11, and a time to expiration of 0.8 in years. If the stock is trading for $20, N(d1) = 0.5, N(d2) = 0.12, and the risk free rate is 5.40%, what is the value of the call option?arrow_forwardGive typing answer with explanation and conclusionarrow_forward

- A put option that expires in six months with an exercise price of $65 sells for $4.45. The stock is currently priced at $61, and the risk-free rate is 3.9 percent per year, compounded continuously. What is the price of a call option with the same exercise price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) X Answer is complete but not entirely correct. Call price $ 1.68 Xarrow_forwardBaghibenarrow_forwardUse the Black-Scholes formula to find the value of a call option based on the following inputs. (Round your final answer to 2 decimal places. Do not round intermediate calculations.) Stock price Exercise price Interest rate Dividend yield Time to expiration Standard deviation of stock's returns Call value GA $ $ $ 48 60 0.07 0.04 0.50 0.26arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning